/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

Netflix, Inc. (NFLX) completed a 10-for-1 stock split as of Nov. 17, reducing the price from over $1,100 to $107.58 as of Friday, Nov. 28. That makes it much easier to sell short out-of-the-money (OTM) put options for income.

As a result, less collateral is required to sell short one put contract. Moreover, it makes it easier to set a lower potential buy-in point. This article will show why.

Higher Values for NFLX Stock

Netflix is still worth significantly more than its present price. I discussed this in my Oct. 24 Barchart article, “Netflix Produces Strong FCF Q3 Margins - NFLX Looks 23% Too Cheap.”

At the time, NFLX was at $1,113.59 (or $113.36 post-split), and I showed that, based on its strong free cash flow (FCF), Netflix was worth $137.40 per share.

That is still +27.7% higher than today's price.

Moreover, analysts still see good upside in NFLX stock. For example, 49 analysts surveyed by Yahoo! Finance have an average price target of $134.44.

And Barchart's mean survey price is $136.68 per share.

This underlines the potential upside in NFLX stock.

One way to play this is to set a lower buy-in price by shorting out-of-the-money put options. I discussed this in my last article.

Shorting OTM Puts

On Oct. 24, I recommended selling short the $106.50 (post-split) put option that was to expire on Friday, Nov. 28. The premium received from doing this was $1.863 for a one-month short play. The strike price was about 4% or so below the trading price.

That means that the investor made a one-month yield of 1.75% (i.e., $1.863/$106.50),. That was in return for an obligation to buy 100 shares if NFLX fell to $106.50 on or before Nov. 28.

Since NFLX closed at $107.58, it remained out-of-the-money (OTM). So, the investor's collateral was not used to buy 100 shares.

At the time, that would have required securing $106,500 ( i.e., $1065 x 100) to earn $1,863 shorting the $1065 put (post split it's $106.50).

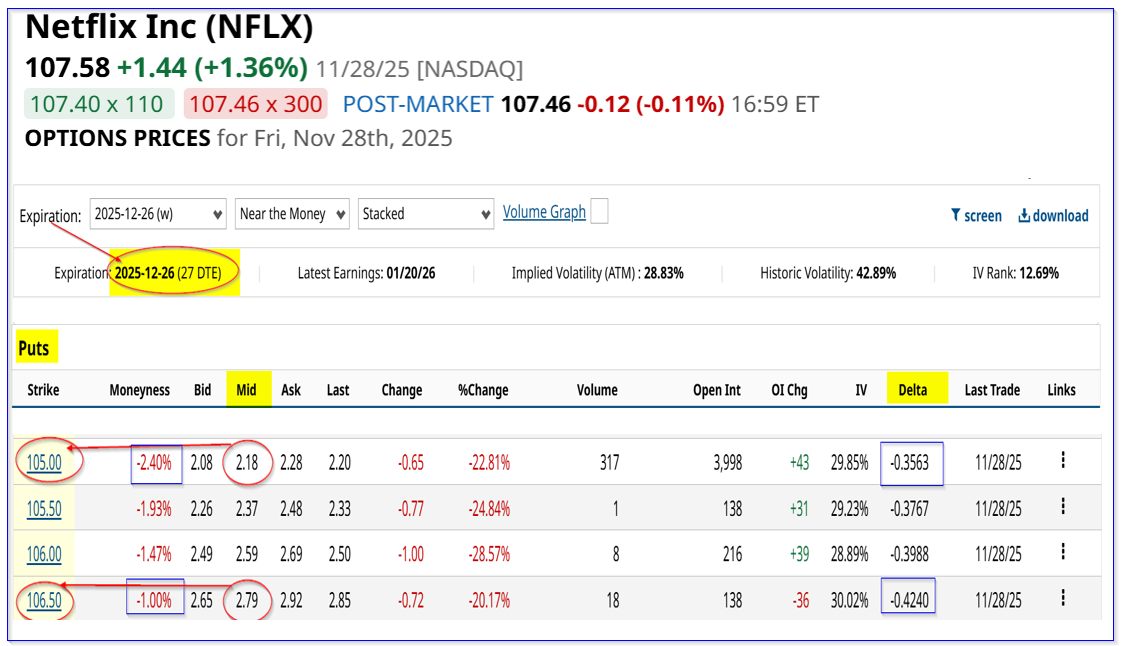

But now, it requires 10x less money to short one put. For example, a new short play expiring Dec. 26, 2025, 27 days from now, at the $106.50 strike price only requires $10,650 in cash to be secured with the brokerage firm.

This mid-point premium received is $2.79, so the one-month yield is 2.62% (i.e., $2.79/$106.50). However, that strike price is only 1% lower than the trading price.

So, it might make sense to short a further out-of-the-money (OTM) strike price. The $105.00 strike price put has a midpoint premium of $2.18.

That provides an immediate yield of 2.076% (i.e., $2.18/105.00) for one month, but the strike price is 2.40% lower than the trading price.

Moreover, the breakeven point (i.e., $105.00 - $2.18 = $102.82) is 4.42% below Friday's close of $107.58. So, it provides good downside protection.

The bottom line here is that NFLX stock looks cheap. One way to play it is short one-month away puts for a 2.1% yield at a strike price that is 2.40% lower, netting out to a 4.42% lower breakeven point.