Editor's Note: The headline in this story has been updated to reflect Strategy's recent name change.

Crypto analyst Willy Woo recently proposed a unique strategy for creating a U.S. strategic reserve, which includes the nationalization of the Michael Saylor co-founded Strategy Inc. (NASDAQ:MSTR).

What Happened: In an X post on Wednesday, Woo outlined his hypothetical playbook for establishing a U.S. strategic reserve.

He suggested revaluing the gold strategic reserve to market price and selling it for cash. The next step, according to Woo, would be to nationalize Strategy Inc., especially during a bear market when mNAV is low, and pay all shareholders fair value. This would allow for bulk Bitcoin (CRYPTO: BTC) purchases without driving up the price.

Woo further explained that Strategy shareholders would then scramble to buy back their BTC exposure, driving up the price exponentially. The remaining cash could then be used to buy more BTC. Lastly, Woo proposed announcing an X-prize style competition for the US private space industry to mine near-Earth asteroids for commodities.

See Also: Vlad Tenev Says OpenAI, SpaceX Tokens Not ‘Technically’ Equity After ChatGPT Parent Questions Giveaway, Robinhood CEO Calls It ‘Seed’ For Something Bigger

Why It Matters: Strategy has been making significant strides in the cryptocurrency space. According to Tom Lee, head of research at Fundstrat Global Advisors, the company could potentially outperform Bitcoin itself as the cryptocurrency rallies. Furthermore, Strategy Inc. recently acquired an additional 10,100 Bitcoin.

Currently, Strategy is the largest corporate holder of Bitcoin with 576,230 coins in its stockpile, which are valued at $40.2 billion, according to data from Coingecko. Other large holders of the apex cryptocurrency include Marathon Digital Holdings (NASDAQ:MARA) and Riot Platforms Inc. (NASDAQ:RIOT).

Price Action: On Thursday, Strategy stock closed 0.4% higher at $403.99. Since the year began, it has shot up 35%. Bitcoin rose 0.5% to $109.483.89, according to data from Benzinga Pro.

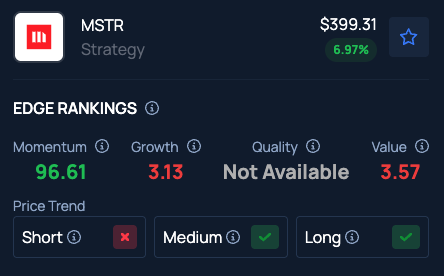

Benzinga's Edge Stock Rankings indicate Strategy has a Momentum in the 97th percentile. Here is how it ranks on other parameters.

Photo courtesy: PJ McDonnell / Shutterstock.com

Read Next:

This story was generated using Benzinga Neuro and edited by Shivdeep Dhaliwal