/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

Tesla (TSLA) reported its second-quarter earnings yesterday, July 23, providing a sobering dose of reality. Elon Musk, the visionary CEO known for his bold promises and ambitions, issued a rare cautionary statement. On the Q2 earnings call, he stated that the company is expecting a "few rough quarters" ahead. TSLA is down 9% at the time of writing on Thursday, July 24, and 24.9% year-to-date.

Despite its recent struggles and controversies, Tesla has mostly thrived on forward-thinking hype. This message from Musk has made investors question whether Tesla remains a good investment. Let us look at its quarterly results to find out.

Core Business Is Struggling, but Ambitions Remain Intact

Tesla’s Q2 results arrived with a thud. Total revenue fell 12% year on year to $22.5 billion, driven by a 13.5% drop in vehicle deliveries to 384,122. GAAP gross margins fell further, to 17.2%, well below the 18% posted a year ago and far below the 25% range reported during the EV boom years. Adjusted net income fell 23% from the prior year as the company faced continued pressure from price cuts, rising input costs, and ongoing investments in new technologies such as Full Self-Driving (FSD) and Optimus, a humanoid robot.

While Tesla’s ambitions appear enticing, the underlying trends in its quarterly numbers indicate a company under pressure. Its core automotive revenue fell 16% YoY. While energy generation and storage typically compensated for declines in automotive revenue in previous quarters, they failed to do so in Q2, falling by 7%. However, the services and other segments’ revenue increased by 17%. Free cash flow, while positive, fell 89% year on year, owing primarily to aggressive capital expenditures and R&D expenses.

Despite the disappointing results, management highlighted the company’s progress in robotaxis, Optimus humanoid robots, AI development, and affordable EVs. Tesla’s robotaxi service with full self-driving (FSD) capability is now available in Austin, Texas. Musk stated that Tesla intends to reach half of the U.S. population by the end of 2025, subject to approval from state and federal authorities in California, Nevada, Arizona, Florida, and elsewhere.

Aside from the robotaxi, Tesla is rapidly moving forward with another ambitious project, Optimus, a humanoid robot. Musk revealed that the next prototype, Optimus 3, will debut by the end of the year, with production ramping up in 2026 with a goal of 1 million units per year within five years. Musk emphasized that Tesla’s expertise in real-world AI provides an unrivaled advantage. He even made a bold comparison: “Tesla is much better than Google [at AI]. By far.”

The Quarters Ahead Will Be Filled With Headwinds

The second half of 2025 is not without challenges. New legislation in the U.S. will end the $7,500 Inflation Reduction Act (IRA) EV credit by the end of the third quarter and eliminate emissions penalties, which Musk has warned could reduce vehicle demand and revenue. Tesla has offered incentives and warned that delivery guarantees may not be available after mid-August.

Tariffs are also a concern, as Tesla reported a $300 million increase in tariffs this quarter, with the majority of the impact falling on its automotive and energy divisions. Management stated that as production cycles catch up, cost increases are expected to rise in the coming quarters.

Nonetheless, the company is sticking to its aggressive investment strategy. This year, it plans to invest $9 billion in capital expenditures, with a focus on Cybertruck expansion, AI infrastructure, and factory retooling. Musk concluded the call by reiterating his vision that if Tesla executes on autonomy (vehicles and robots) and scales its energy division, it will become the most valuable company in the world.

What Is Wall Street Saying About Tesla Stock?

Following Tesla’s Q2 earnings, the Street is largely bearish on the stock. Notably, Wells Fargo analyst Colin Langan has maintained a “Sell” rating and a price target of $120. He listed a growing number of challenges that could jeopardize the company’s performance in the coming quarters. Langan believes that, while Q2 numbers were not worse, the lack of updated delivery guidance and warnings about macroeconomic pressures, such as tariffs and the expiration of key incentives such as the IRA, have raised red flags.

Separately, Needham analyst Chris Pierce has maintained a “Hold” rating for Tesla. Pierce believes Tesla’s advancements in autonomy and robotics and plans for a lower-cost vehicle provide compelling future growth opportunities. However, these are offset by weaker near-term demand and an increasing inventory of unsold vehicles. Pierce also pointed out that Tesla’s valuation remains high. Tesla currently trades at a premium valuation of 191x forward earnings. Barclays and Bank of America Securities also maintained their Hold ratings on Tesla.

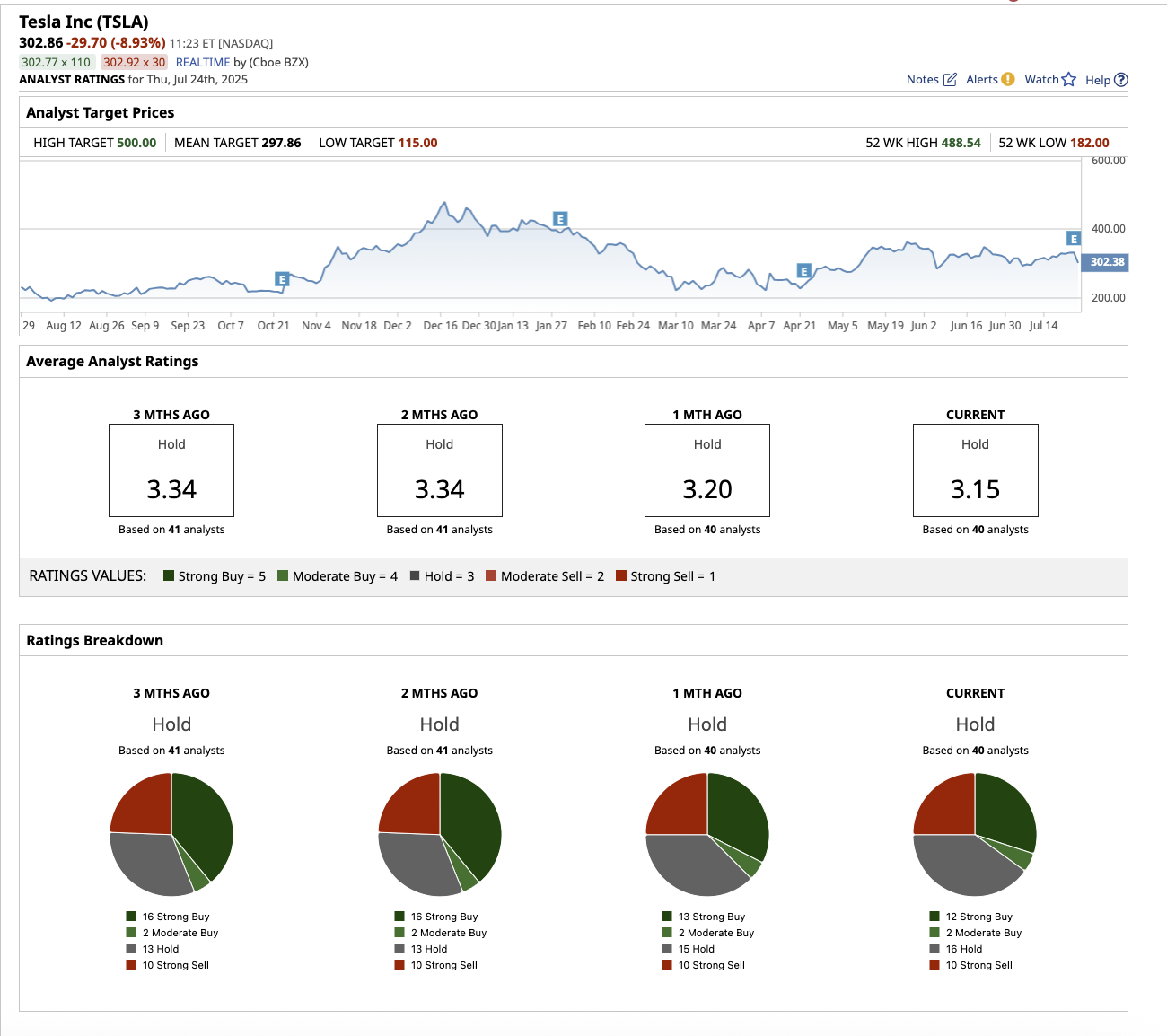

Overall, Tesla remains a “Hold" on Wall Street. Of the 40 analysts covering the stock, 12 recommend it as a “Strong Buy,” two as a “Moderate Buy,” 16 as a “Hold,” and 10 as a “Strong Sell.” Tesla has surpassed its average analyst target price of $297.86. The high price estimate of $500 implies that the stock can rise by 65% in the next 12 months.

The Key Takeaway

Tesla finds itself in a high-stakes situation. Musk’s caution is justified, given steep revenue declines, shrinking margins, policy headwinds, and the company being in a transition period. Investors who believe Musk will deliver autonomy, robotaxis, humanoid robots, cheaper EVs, AI robotics, and new energy solutions may view the current pullback as a rare buying opportunity.

However, for risk-averse investors who are unwilling to face the short-term volatility and “few rough quarters” ahead, now may be the time to reduce exposure.