/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

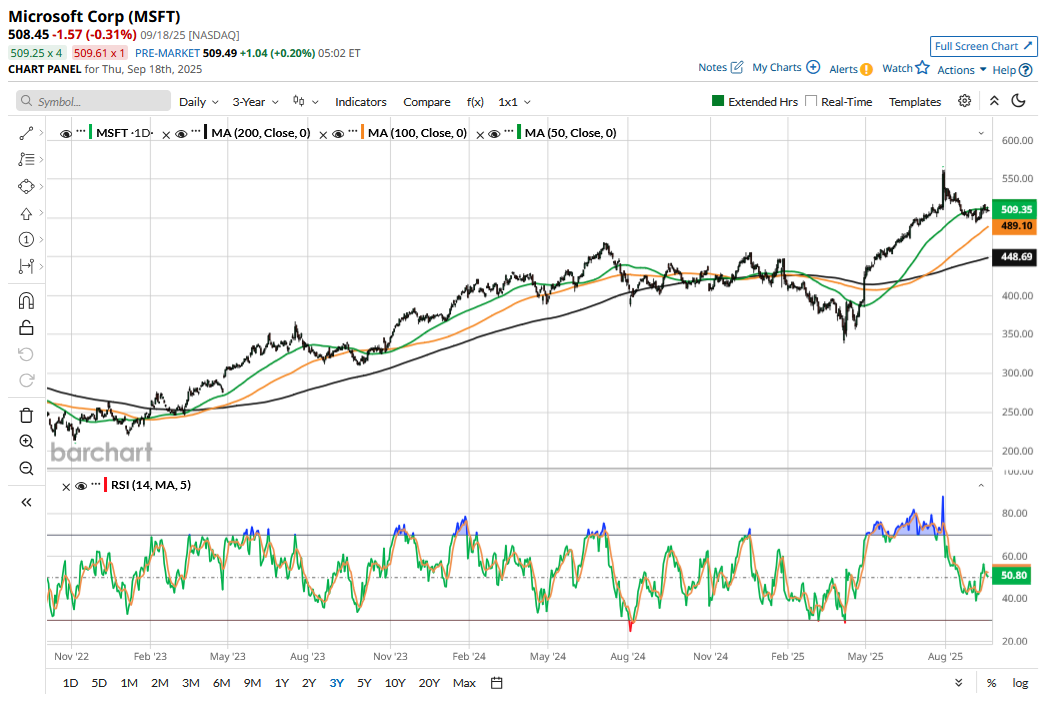

Following its fiscal Q4 2025 earnings release in July, Microsoft (MSFT) joined Nvidia (NVDA) in the $4 trillion club. However, MSFT stock has since come off its highs, and its market cap has plunged below $4 trillion. Meanwhile, Microsoft is getting more ambitious in its artificial intelligence (AI) initiatives and has announced fresh investments stateside as well as globally. Can Microsoft reclaim its $4 trillion market cap amid its aggressive AI pivot? Let's dive in.

Microsoft’s AI strategy is two-pronged. The company is investing organically and expanding its data center infrastructure. At the same time, the company has poured billions of dollars into OpenAI, and although not all is reportedly well between the two companies, it still remains a significant moving part of Microsoft’s overall AI strategy.

Microsoft Has Increased Capex

Microsoft is meanwhile doubling down on AI and expects the capex in the September quarter to be over $30 billion, which would be a record for the company. Here are some of the numbers and comments related to the AI business that the company provided during the fiscal Q4 2025 earnings call.

- Microsoft said that Copilot has 100 million monthly active users. AI is also fueling GitHub usage, and during the earnings call, CEO Satya Nadella said that AI projects on GitHub have jumped over 100% over the last year.

- For the first time ever, Microsoft provided a dollar number for Azure and said that the business brought in revenues of $75 billion last fiscal year that ended in June 2025. For context, Amazon Web Services (AWS) had an annualized revenue run rate of $123 billion at the end of Q2. Microsoft, along with Alphabet (GOOG) (GOOGL), has been gaining market share and closing in on Amazon’s (AMZN) lead in cloud. Microsoft expects Azure, whose revenues rose by 39% in the June quarter, to grow 37% on a constant currency basis in the September quarter, with the growth being over twice that of AWS.

- Responding to a question on her previous comments on Azure growth eventually outstripping capex growth, CFO Amy Hood said that Microsoft is not focused “on trying to pick a date at which revenue growth and Capex growth will meet and cross.” She added, “I'm focused on building backlog, building business, and delivering capacity, which we are seeing has a good ROI today in terms of our ability to get that done,” while stressing that the focus is on increasing market share.

Meanwhile, Microsoft has made more AI-related announcements since the Q4 confessional, and last week, the company announced a non-binding agreement with OpenAI, paving the way for the Sam Altman-led company to restructure itself into a for-profit enterprise. Earlier this week, Microsoft committed to investing $30 billion in the U.K. over the next four years, half of it in building the country’s cloud and AI infrastructure. More recently, Microsoft announced an additional $4 billion in capex yesterday, Sept. 18, to build its second data center in Wisconsin, bringing its total investment there to over $7 billion.

Is MSFT Stock a Buy?

MSFT stock trades at a forward price-to-earnings (P/E) multiple of 33.15x, while the P/E-to-growth (PEG) multiple is 2.2x. The multiples don’t look cheap on the face of it but should be seen in context. Like fellow tech peers, Microsoft is investing heavily in AI, which will lead to higher depreciation expenses over the next couple of years, putting some pressure on profitability. As a result, the kind of outsized earnings growth that we saw between 2023 and 2024, where tech companies’ profits grew way faster than revenues due to aggressive cost cuts, might not repeat itself, at least for the next few quarters. However, eventually these investments should start paying off, and the early signs of monetization are encouraging.

Overall, while not a screaming buy (is there anything in these markets?), I continue to stay put in MSFT stock and would even consider adding more shares.

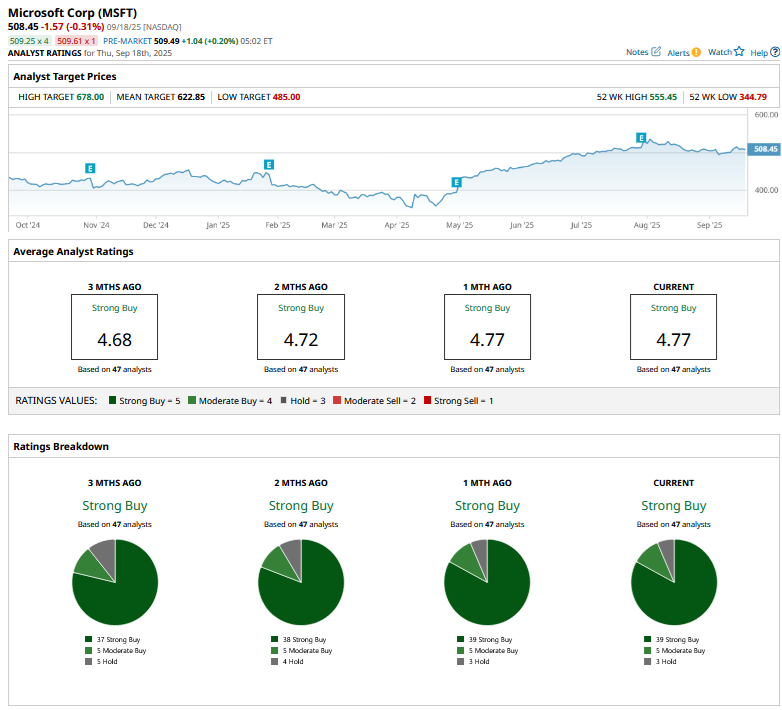

Analysts have given Microsoft a consensus rating of “Strong Buy” with a mean target price of $622.85, which is 22.5% higher than the Sept. 18 closing prices. I would share Wall Street’s sentiment and expect Microsoft to rejoin the $4 trillion market cap this year as the company advances in AI and continues to show encouraging monetization trends.