/MSCI%20Inc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Valued at a market cap of $41.3 billion, MSCI Inc. (MSCI) is a financial services company that provides decision-support tools and products for the global investment community. The New York-based company’s offerings include benchmark indices, portfolio risk and performance analytics, Environmental, Social, Governance (ESG) research and ratings, and climate finance solutions. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Tuesday, Oct. 28.

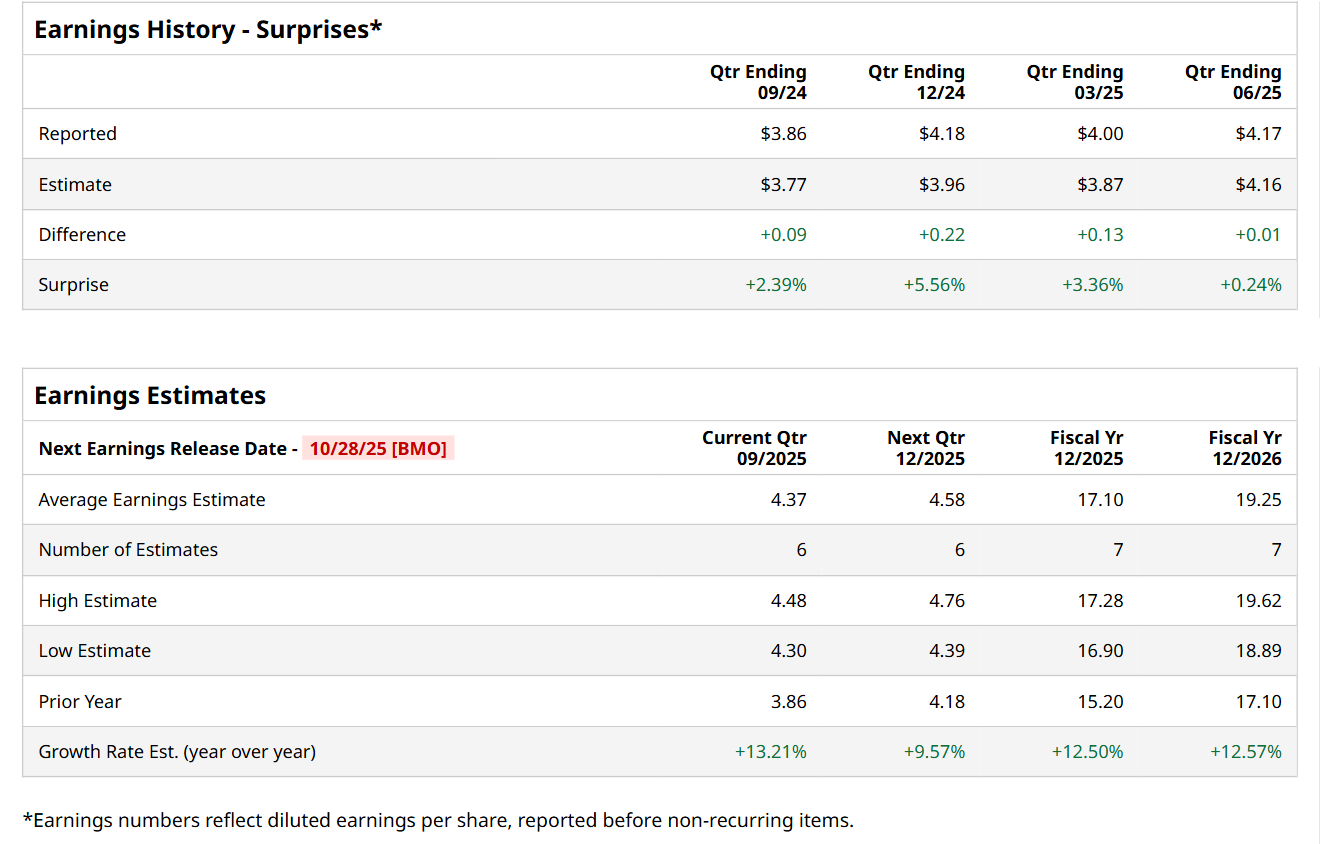

Ahead of this event, analysts expect this financial services company to report a profit of $4.37 per share, up 13.2% from $3.86 per share in the year-ago quarter. The company has a solid trajectory of consistently beating Wall Street’s bottom-line estimates in each of the last four quarters. In Q2, MSCI’s EPS of $4.17 exceeded the forecasted figure by a penny.

For fiscal 2025, analysts expect MSCI to report a profit of $17.10 per share, up 12.5% from $15.20 per share in fiscal 2024. Furthermore, its EPS is expected to grow 12.6% year-over-year to $19.25 in fiscal 2026.

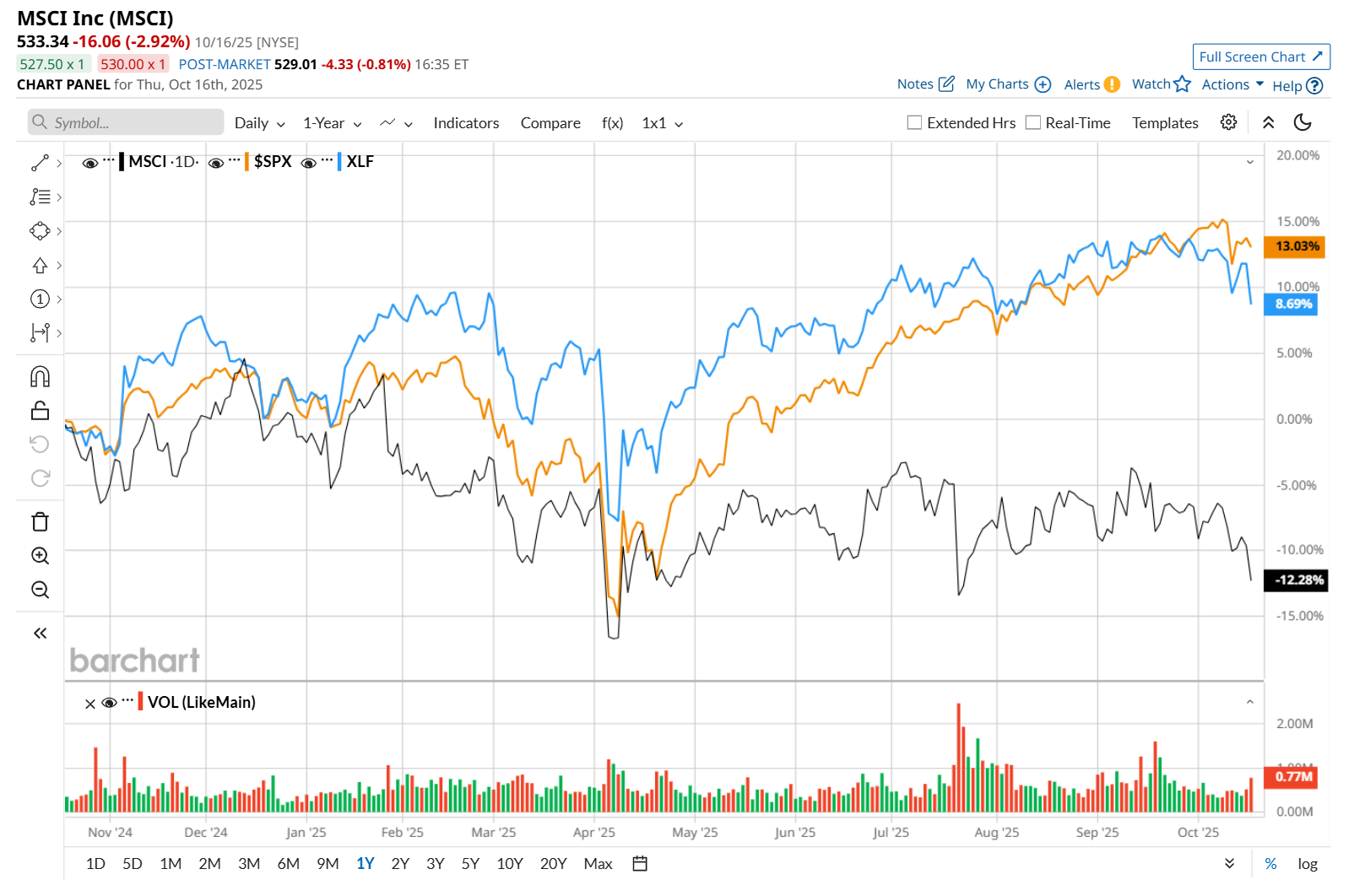

Shares of MSCI have declined 12.2% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.5% return and the Financial Select Sector SPDR Fund’s (XLF) 9% rise over the same time frame.

On Jul. 22, shares of MSCI plunged 8.9% after its mixed Q2 earnings release. While the company’s total operating revenue improved 9.1% year-over-year to $772.7 million, it missed the consensus estimates by a small margin, likely weighing on investor sentiment. Nonetheless, on the brighter side, its adjusted EPS of $4.17 advanced 14.6% from the year-ago quarter, exceeding analyst estimates by a penny.

Wall Street analysts are moderately optimistic about MSCI’s stock, with an overall "Moderate Buy" rating. Among 21 analysts covering the stock, 13 recommend "Strong Buy," three indicate “Moderate Buy," four suggest "Hold,” and one advises a "Strong Sell” rating. The mean price target for MSCI is $632.12, indicating an 18.5% potential upside from the current levels.