Thinking of moving to Florida or other Sun Belt states prone to flooding, wildfires or extreme heat? You’re not alone. According to a study published on Monday by the tech-based real estate brokerage, Redfin, Americans are flocking to the counties hardest hit by climate change. For many of these migrants, pocketbook issues like affordable housing and lower income taxes are prime motivations. But the high cost to homeowners of extreme weather may cancel out such savings.

Moving to Florida, Arizona or Texas?

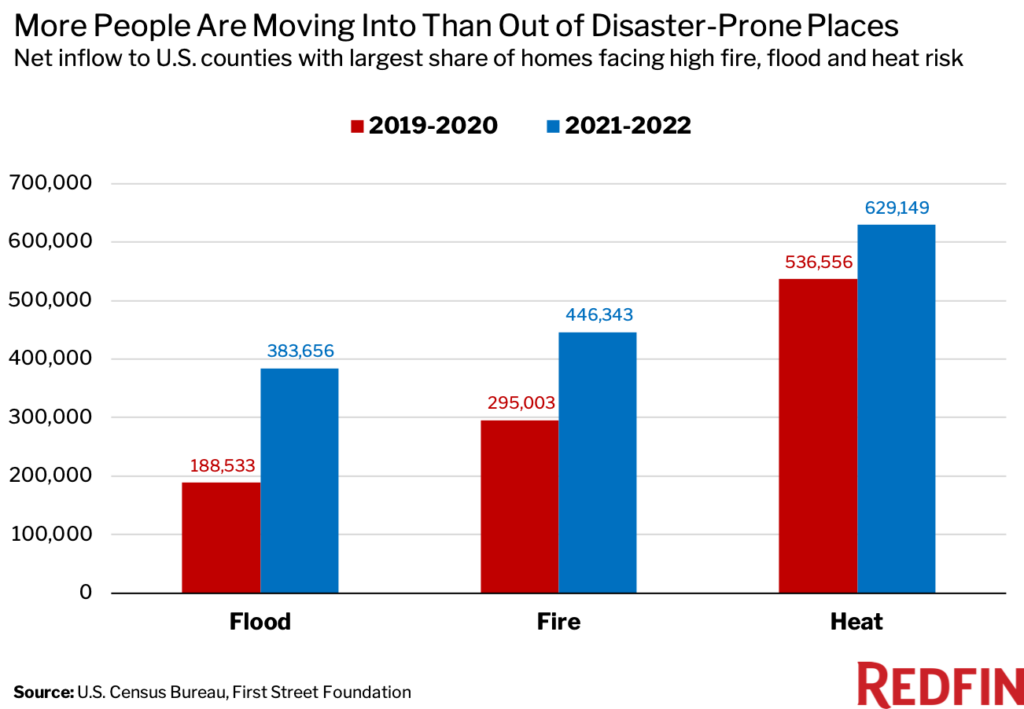

Redfin found that almost 400,000 more people moved into than out of counties with high flood risk in 2021 and 2022, representing a 103% increase over the previous two years.

The same trend held true for other disaster-prone areas. Counties with the highest risk from extreme heat saw a net 17% growth in people moving in over the past two years compared to the prior two years, and counties with the highest wildfire risk saw 51% more people move in than out.

Redfin relied on data from the U.S. Census Bureau and from First Street Foundation, which publishes climate-risk scores by location.

Part of the draw of these states is the low tax rate; both Florida and Texas have no personal income taxes. And Arizona’s tax rate is also on the low side compared to other states. Add in the growth of remote work and the draw of sunshine and beaches, and it’s understandable why so many Americans have moved to these areas, despite the risks from extreme weather.

“It’s human nature to focus on current benefits, like waterfront views or a low cost of living, over costs that could rack up in the long run, like property damage or a decrease in property value,” said Redfin Chief Economist Daryl Fairweather when commenting on the study. “It’s also human nature to discount risks that are tough to measure, like climate change.”

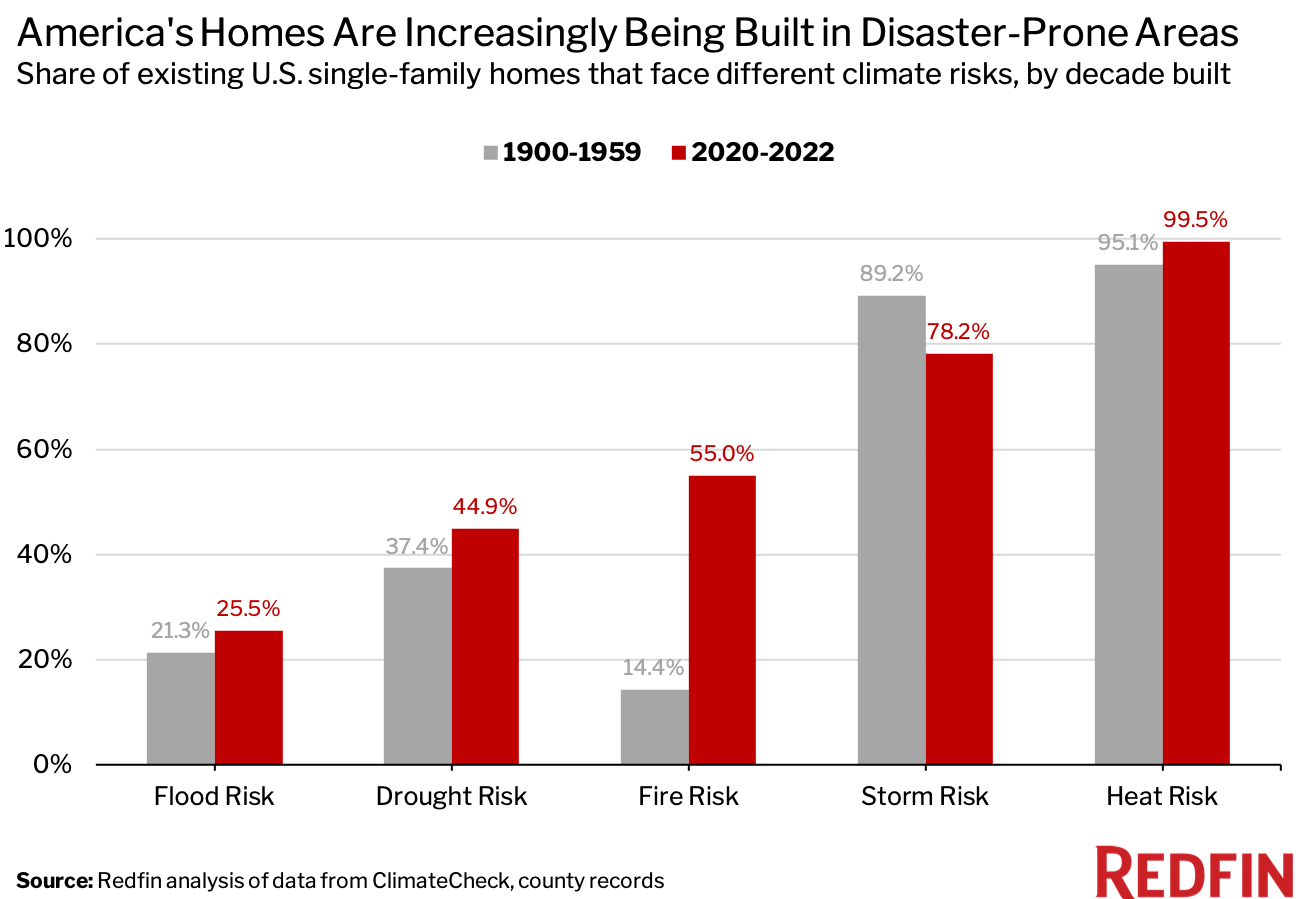

Many of these areas also provide more new and affordable housing than the places that lost population, like San Francisco or New York City. In fact, a separate Redfin study found that areas of high risk — especially from fires — tend to build more housing than safer areas do. The analysis found that more than half of homes built since 2020 face risk from fires, up from only 14% of homes built from 1900 to 1995.

The Florida real estate draw

Coastal Florida, much of which is ground zero for risks like strong winds and flooding, attracts enormous levels of in-migration in the Redfin analysis.

Florida’s Lee County received more net people than any of the other 306 high-flood risk counties Redfin studied, and a 65% increase over the prior two years. This trend continues in hot markets within Lee County, like Cape Coral and Fort Myers, despite hundreds of millions of dollars in damage to the area from the 2022 landfall of Hurricane Ian.

“Builders in Cape Coral have not stopped — they’re just building like nothing happened,” said local Redfin real estate agent Isabel Arias-Squires. “That’s largely because there’s plenty of demand for new homes."

Climate risk in Florida is multi-faceted. In Miami-Dade, for example, porous limestone bedrock complicates efforts to guard against sea level rise when salt water can seep underneath sea walls. And on the same day that Redfin released its report, the temperature off the south coast of Florida hit what may be a world record for the hottest recorded seawater temperature, of 101.1 degrees Fahrenheit. Hot oceans are bad for corals and sea life, but may also intensify hurricanes, which are known to increase in severity as ocean surface temperatures rise.

All of these climate risks translate into higher home insurance premiums, the need for flood insurance in much of Florida, and comprehensive auto insurance. Years of insurance fraud and litigation, and insurance companies leaving the Florida market have also increased rates. The average Florida home insurance premium is estimated to be $6,000 annually, compared to a national average of $1,700.

Arizona faces extreme heat and drought

On Wednesday, Phoenix, Arizona broke its record for extreme heat, with 26 straight days of temperatures of at least 110 degrees. The city has also experienced its fourth-longest period without rainfall, extending 125 consecutive days with no precipitation.

Despite sizzling temperatures, Maricopa County, Arizona, which includes Phoenix, saw a net influx of 76,000 people during the past two years. That’s the largest growth among the 1,019 counties at high risk for heat that Redfin analyzed. And according to the U.S. Census, Maricopa County had the highest influx of new residents compared to any other U.S. county in 2022, not just those facing heat risk.

In addition to heat risk, Arizona struggles with diminishing groundwater supply, and depends heavily on the stressed Colorado River for residential water. To its credit, the state has worked hard to increase water efficiency and conservation despite a growing population, but it also recognizes limits to growth. In June, the Arizona Department of Water Resources announced that it would limit new home construction in some areas of Phoenix where it could not guarantee adequate water.

Texas counties also grow

The next-biggest net inflow to counties with high heat risk was in Collin County, TX, with 61,000 residents coming to the county. Like Florida, Texas also faces hurricanes that pose flooding and wind risk.

Louisiana shrinks

Unlike Texas or Florida, Louisiana counties facing flood risk are losing population, according to the Redfin study. Out-migration ticked up particularly in counties pounded by hurricane Ida in 2021. Over twenty home insurers in the state have either gone bankrupt or decided to leave Louisiana after five large storms hit the state in 2020. That has raised insurance premium prices and left some homeowners in the state to wonder whether they will be able to afford their homes in the future.

What is a homebuyer to do?

A house is so much more than an investment, cementing bonds to community, culture and sometimes family ties and traditions. So, the thought of having to leave a community, as so many residents did in parts of New Orleans and southern Louisiana after Hurricane Katrina, can be devastating. But getting stuck in a house that becomes uninsurable, or that loses significant value due to damage or risk, is also painful.

There are a few ways you can protect yourself when moving to these areas of the country.

- Know your risk. Research a specific home for fire, flood, wind and extreme heat risk by entering the address at Risk Factor. Search as well on the city or county where the home is located to get a sense of overall community risk. If your house is one of the few on dry land but the rest of the area is flooded, you may lose access to roads, utilities and key businesses. For flood risk, check if you are in a FEMA-designated flood zone where flood insurance is mandatory.

- Plan your exit strategy. Unless you plan to never sell your home, or to bequeath it to your family, think about how many years you will live in the home. Then research how environmental conditions may change in that time. For example, if you plan to stay for 15 years, you can use the Risk Factor tool to see projections for how risk may increase 15 years out. Making an exit strategy can help you avoid getting stuck with an uninsurable home, or one that is depreciating in value.

- Reduce your home's risk. "Harden" your home by following guidance on how to improve chances of weathering a disaster. For example, by reducing vegetation near the home that could fuel fire, installing a roof certified to withstand high winds or insulating your home against extreme heat. Some states or counties have grants, loans or tax breaks for residents to complete these kinds of projects.

- Know the insurance market in your area. Before you purchase a home, understand your options for insuring your home with general insurance and, if need be, with flood insurance. Talk to neighbors and follow local news to understand if insurance may be a problem in the community.

- Renters need insurance too. If you're planning to rent in a high-risk area, consider renters insurance and flood insurance to protect the contents of your home.