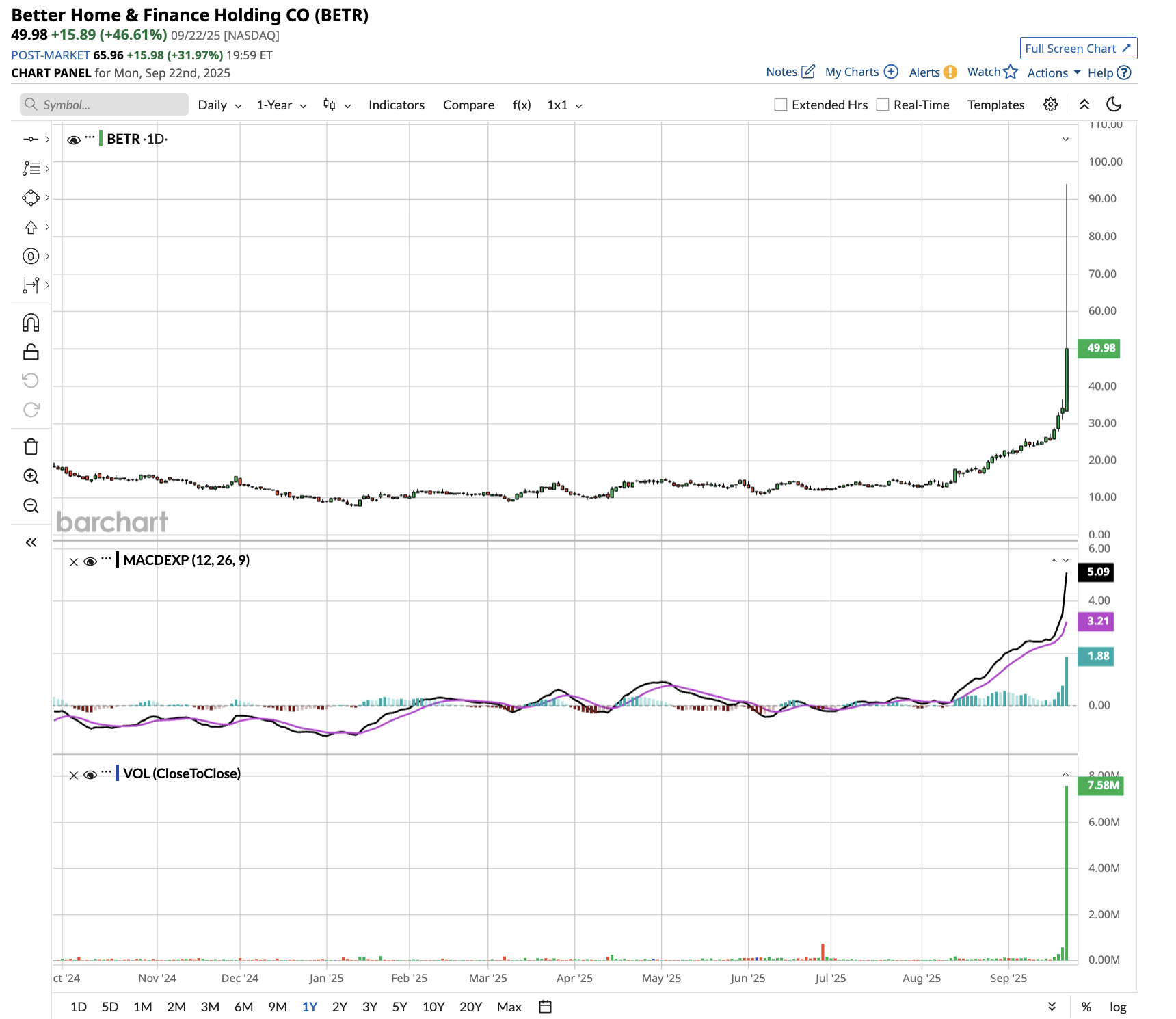

Hedge fund manager Eric Jackson has shifted his attention from Opendoor (OPEN) to Better Home & Finance Holding (BETR), calling it "the Shopify of mortgages" and predicting massive upside potential. Jackson's endorsement on X (formerly Twitter) sent Better Home shares soaring 47% on Monday, with BETR stock briefly more than doubling before settling around $50.

The founder of EMJ Capital believes Better Home is revolutionizing the $15 trillion mortgage industry by leveraging artificial intelligence (AI) and blockchain technology. He noted the valuation disparity between Better Home trading at just 1x forward sales compared to newly public Figure Technology Solutions (FIGR) at 19x, despite Better Home's faster growth rate.

Jackson predicted that Better Home could become a "350-bagger" within two years, drawing comparisons to early investments in Carvana (CVNA) and Opendoor, which generated substantial returns.

The New York-based company offers a range of loan products, including government-sponsored enterprise (GSE) conforming loans, FHA-insured loans, and VA-guaranteed loans, as well as real estate and insurance services. While Jackson's track record with Opendoor lends credibility to his latest pick, investors should exercise caution given the speculative nature of such aggressive price targets.

Is BETR Stock a Good Buy Right Now?

Better Home & Finance delivered mixed Q2 results while positioning itself for profitability within the next 12 months. The AI-powered mortgage platform increased its funded loan volume by 25% year-over-year (YoY) to $1.2 billion, while sales rose by 37% to $44.1 million, despite challenging macroeconomic conditions.

CEO Vishal Garg highlighted the company's technology advantages, including its AI assistant "Betsy," which processed 600,000 consumer interactions in Q2 and improved lead-to-lock conversion rates by over 30%, from 3.3% to 4.4%.

Better Home’s AI underwriting now handles 43% of locked loans, with management targeting a 75% penetration rate. These efficiency gains have reduced Better's cost to originate to approximately half the industry average.

Better operates through two primary channels. The direct-to-consumer business maintains a 13% contribution margin, with a revenue per loan of $78.86, while the higher-margin Tinman AI platform for retail loan officers generates a 40% contribution margin. The platform business funded $429 million in Q2, representing 164% sequential growth, as the company onboards loan officers from established competitors, including loanDepot and Movement Mortgage.

Home equity and HELOC products emerged as significant growth drivers, increasing 166% YoY to $240 million in Q2 volume. This positions Better for future refinancing opportunities when rates decline, creating a zero-cost customer acquisition pipeline.

Management provided its first concrete profitability timeline, targeting adjusted EBITDA breakeven by Q3 of 2026. This guidance reflects confidence in the Tinman platform's scaling potential, with over $500 million in AI platform originations expected in Q3. It also launched its software-as-a-service (SaaS) offering, enabling banks and credit unions to license Better's technology stack at an outcome-based pricing model.

Better posted a $27 million adjusted EBITDA loss in Q2, and the path to profitability depends heavily on volume growth and market conditions. The company expects continued macro headwinds and faces a $1 billion revenue headwind from losing the Ally partnership.

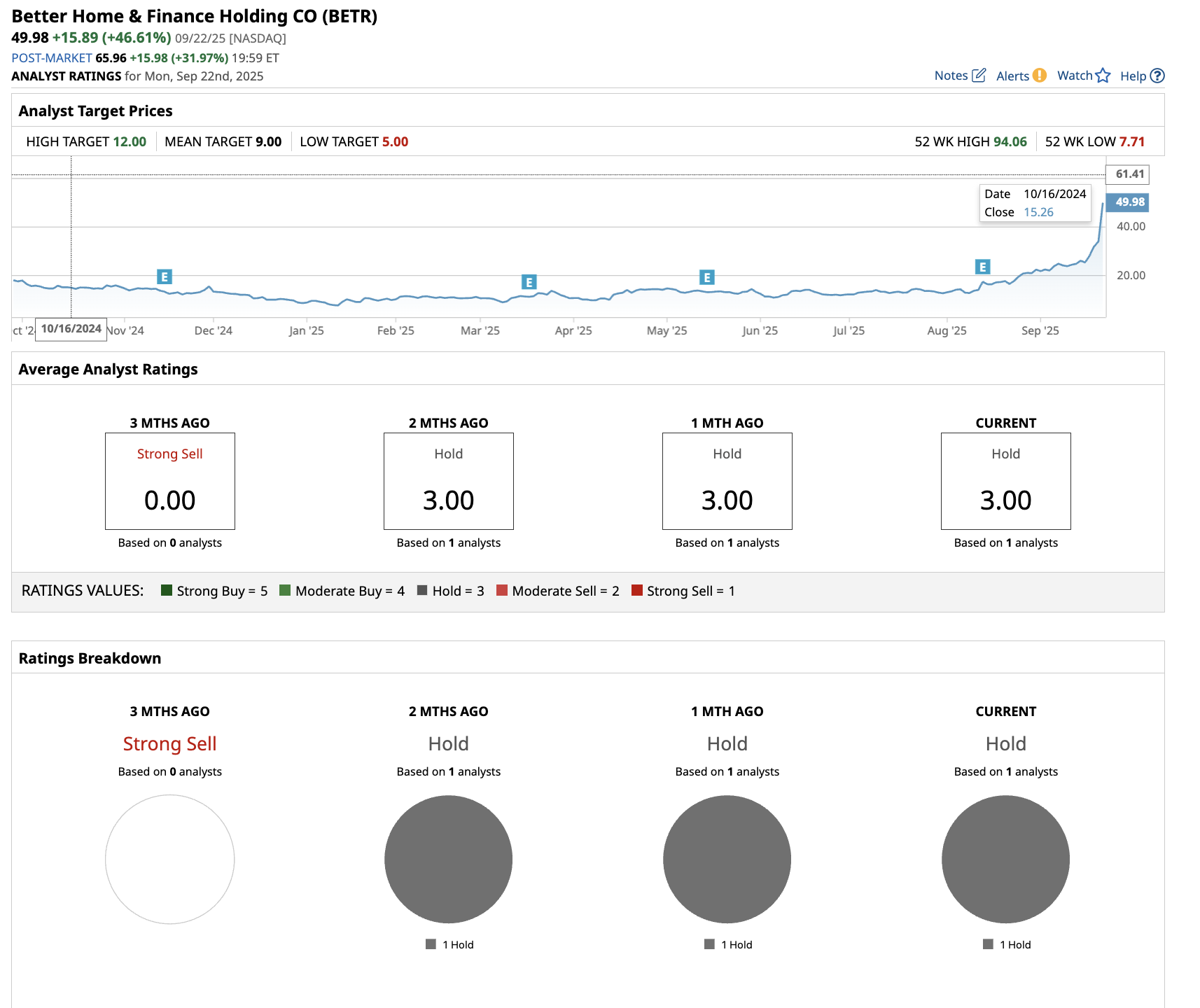

What is the BETR Stock Price Target?

Analysts tracking BETR stock forecast revenue to rise from $165.3 million in 2025 to $447.2 million in 2027. While still unprofitable, it is projected to end 2027 with adjusted earnings per share of $3.75, compared to a loss per share of $9.89 this year.

If BETR stock is priced at 25 times forward earnings, which is not too steep, it should trade around $94 in early 2027, indicating an upside potential of almost 100% from current levels. A single analyst tracking BETR stock has assigned a “Hold” rating and a price target of $9, which is significantly below the current trading price of $50.