/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

MoffettNathanson thinks Alphabet (GOOG) (GOOGL) should displace Nvidia (NVDA) as the world's most valuable company. The brokerage raised its price target on GOOGL stock to $295, suggesting 20% upside from current levels.

Analyst Michael Nathanson sees Alphabet, Google’s parent company, as the clear winner in the artificial intelligence (AI) race. He points to four key advantages: leadership in multimodal search, accelerating cloud growth, better YouTube monetization, and the emerging Waymo business.

Moreover, the analyst emphasized that Google's regulatory headaches are fading as the recent antitrust ruling was much lighter than expected. Meanwhile, concerns about ChatGPT are overblown, as early data show that AI chatbots are expanding search usage rather than replacing it. Google's Gemini AI is fast gaining traction, and prediction markets give it a 66% chance of being named best AI by year-end, compared to just 16% for ChatGPT.

Additionally, Google Cloud is crushing the competition with a projected 33% growth in 2025. Nine of the world's top 10 AI labs use Google's platform, and nearly every AI unicorn runs on Google Cloud, too.

YouTube sits on the edge of a monetization breakthrough as new AI tools will enable better brand partnerships and commerce features. Waymo also adds another long-term growth option as it expands across U.S. cities. Despite recent gains, GOOGL stock remains relatively inexpensive compared to its historical performance and peers.

The Bull Case for Alphabet Stock

Google Cloud is emerging as Alphabet's secret weapon in the AI race. CEO Thomas Kurian announced that the division now generates $50 billion in annual revenue. That puts it squarely in competition with Amazon's (AMZN) AWS and Microsoft's (MSFT) Azure.

The numbers tell a compelling story. Nine out of the top 10 AI labs use Google's cloud platform. The company processes twice as many AI tokens as other cloud providers in half the time, which is roughly four times the volume.

Google's advantage comes from owning the entire AI stack. They build their own chips called TPUs. They create their own AI models, such as Gemini, which gives Google better control over costs and performance.

Google Cloud saw 28% growth in new customers over the first half of this year. Existing customers are spending 1.5 times more when they adopt AI tools. The company's contract backlog reached $106 billion, with more than half expected to generate revenue within two years.

Kurian highlighted several growth drivers. For example, custom AI agents for specific industries are gaining traction. Alphabet also handles five billion commerce transactions through its shopping agent, and its customer service AI has seen a 10x growth in chat and voice interactions.

Google's cloud margins continue to improve as the business scales. The company benefits from years of investment in custom silicon and software optimization. While cloud adoption is still in its early stages, Google appears well-positioned to capture a larger share of enterprise AI spending.

A Strong Performance in Q2 of 2025

Alphabet delivered solid second-quarter results with revenue climbing 14% to $96.4 billion. The tech giant demonstrated strength across its core businesses, with search revenue increasing 12% and YouTube advertising growing 13%.

The Gemini AI app now has over 450 million monthly users, and daily requests have increased by 50% since the first quarter. Google processes nearly one trillion tokens monthly across all its services, a number that has doubled since May.

AI Overviews now reach over 2 billion users in more than 200 countries. These AI-powered summaries drive 10% more searches for the types of queries that they appear in. Notably, younger users like the multimodal search features that combine text with images.

Google's capital spending is expected to reach $85 billion this year, $10 billion more than original estimates. The company also requires additional servers and data centers to meet the growing demand for cloud services, and management anticipates further spending increases in 2026.

The operating margin remained steady at 32%, despite higher legal costs and depreciation expenses. Free cash flow dropped to $5.3 billion in the quarter due to the spending ramp, but the trailing 12-month figure was strong at $66.7 billion.

Alphabet ended Q2 with $95 billion in cash and securities, returning $16.1 billion to shareholders through buybacks and dividends.

Is GOOGL Stock Still Undervalued?

Analysts forecast Alphabet to increase sales from $350 billion in 2024 to $600 billion in 2029. In this period, adjusted earnings are forecast to expand from $8 per share to $17.75 per share.

Today, GOOGL stock is priced at 24.8 times forward earnings, which is higher than its 10-year average of 23.8 times. If the tech stock is priced at 20 times earnings, it should trade around $355 in early 2029, indicating an upside potential of 45% from current levels.

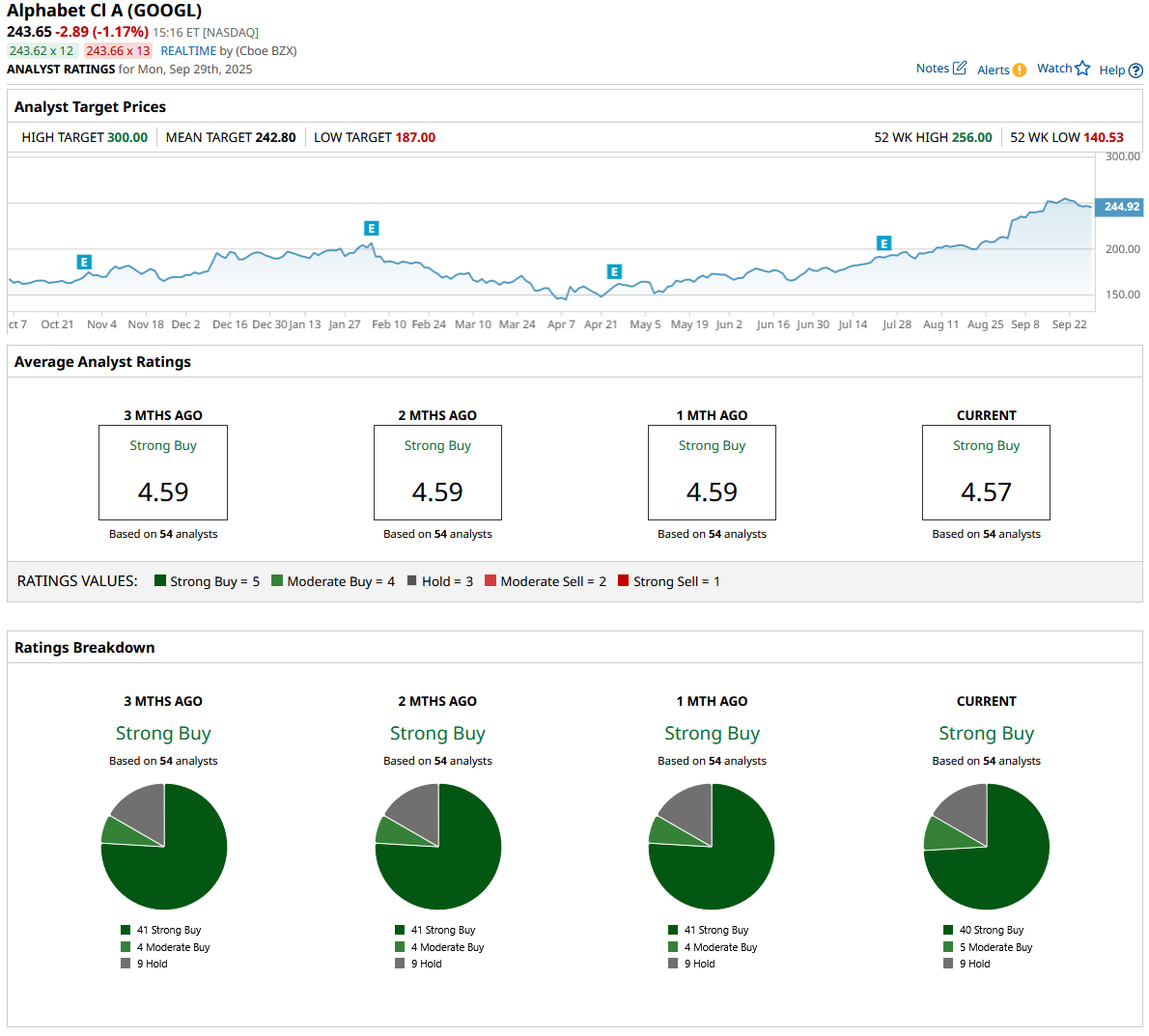

Out of the 54 analysts covering GOOGL stock, 40 recommend “Strong Buy,” five recommend “Moderate Buy,” and nine recommend “Hold.” The average GOOGL stock price target is $242.80, which is a hair below the current trading price of $243.