/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

It can be safely said that the superclub of Nvidia (NVDA), Microsoft (MSFT), Meta (META), Amazon (AMZN), Tesla (TSLA), Alphabet (GOOGL) (GOOG), and Apple (AAPL), called the “Magnificent Seven” or “Mag 7,” has attracted the bulk of the investor money in the AI megatrend. This can be gauged from the fact that the Roundhill Magnificent Seven ETF (MAGS) has outperformed the S&P 500 ($SPX) on a year-to-date (YTD) basis, with its shares up 19.8% against the index's rise of 14.1%.

However, there is a clamor for including another stock in this powerful cohort.

Enter Broadcom

Founded in 1991, Broadcom (AVGO) is a major player in infrastructure semiconductor solutions and enterprise infrastructure software. Its product lines include networking chips (Ethernet, switching, PHY), connectivity/wireless chips (Wi-Fi, Bluetooth, RF front ends), broadband/cable/access communications chips, storage/controllers, ASICs, and software acquired via its enterprise infrastructure arm (including virtualization, networking, and security).

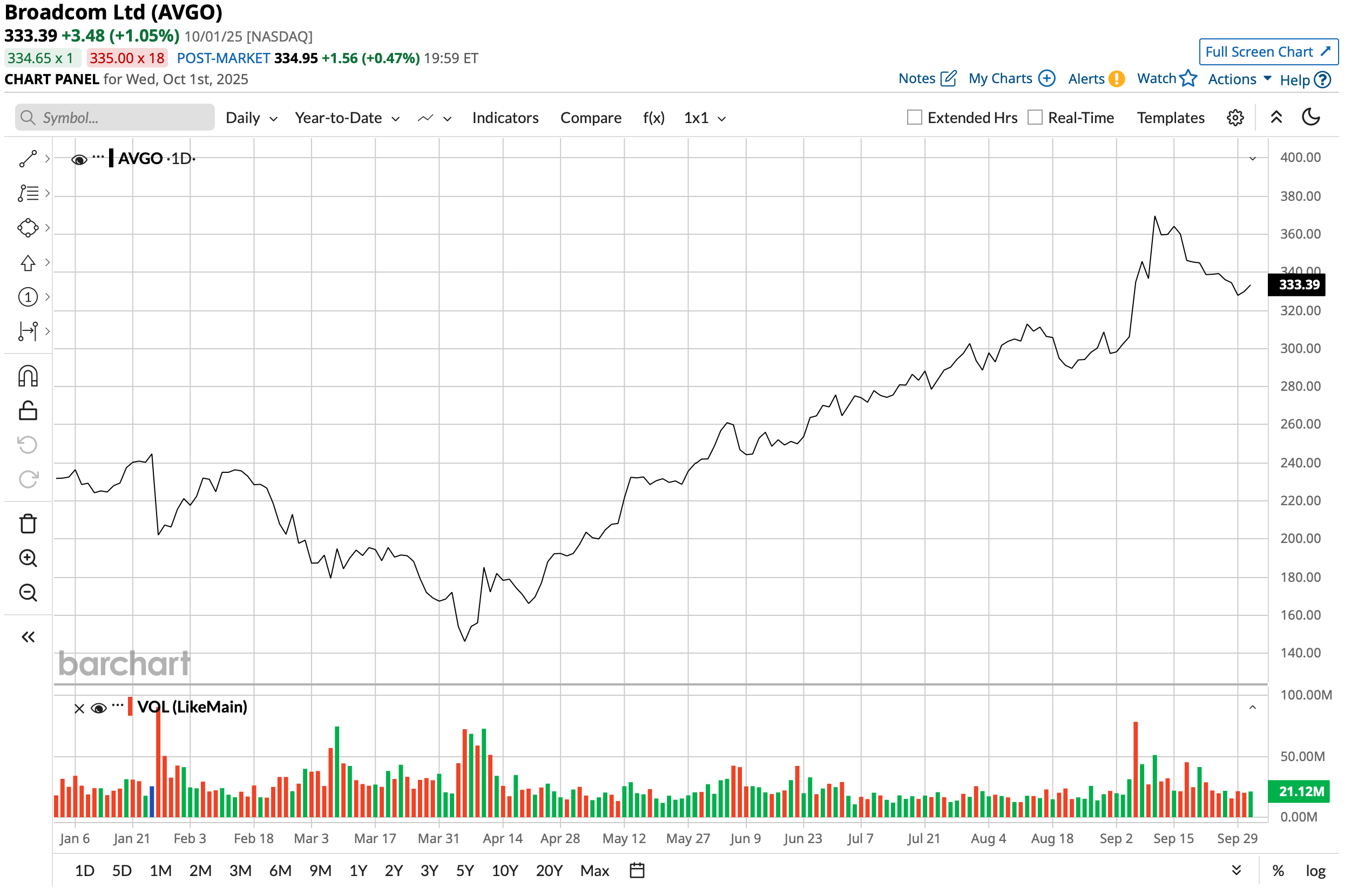

Shares of Broadcom have outperformed all the “Mag 7” stocks this year, with a return of 43.8%. And Broadcom is certainly not a small company, commanding a market cap of about $1.6 trillion, making its outperformance all the more remarkable. Meanwhile, AVGO stock also offers a modest dividend yield of 0.72%. It may not be much, but Broadcom has been raising dividends consecutively over the past 14 years, and with a payout ratio of 37.52%, there remains headroom for further growth.

However, there are more fundamentally solid reasons to add AVGO stock to one's portfolio. What are they? Let's analyze.

Growth & Robustness: Defining Features of Broadcom's Financials

Over the past 10 years, Broadcom's revenue and earnings have grown at impressive CAGRs of 24.73% and 33.35%, respectively, reflecting strong demand for the company's offerings.

Moreover, its long-term track record is complemented by its consistent outpacing of the Street estimates, which was the case in the most recent quarter as well.

In Q3 2025, Broadcom reported revenues of $15.9 billion, which denoted an annual growth of 22%. Both the key revenue segments—Semiconductor Solutions and Infrastructure Software—continued to witness strong growth. While the Semiconductor Solutions segment grew by 26% from the previous year to $9.2 billion, the Infrastructure Software segment saw a year-over-year (YOY) growth of 17% to $6.8 billion.

Earnings of $1.69 per share represented an increase of 36.3% from the prior year, as it exceeded the Street's expectations of an EPS of $1.66. Notably, not only did this mark the ninth consecutive quarter of earnings beat from Broadcom, but it was also the ninth straight quarter of YoY earnings growth as well.

Meanwhile, revenue and earnings growth did not come at the expense of cash flow from operations. For Q3 2025, Broadcom's cash flow from operations was $7.2 billion, compared to about $5 billion in the corresponding period a year ago. Consequently, free cash flow increased as well to $7 billion from $4.8 billion in Q3 2024. Overall, the company ended the quarter with a healthy cash balance of $10.7 billion, which was much higher than its short-term debt levels of $1.4 billion.

For Q4, Broadcom expects revenue to be $17.4 billion, which would denote an annual rise of 24.3%. Analysts also seem convinced that Broadcom's growth story will continue, with forward revenue and earnings growth estimates of 32.93% and 24.31% being much higher than the sector medians of 7.56% and 11.38%.

Growth Story Intact and Only Getting Stronger

Broadcom is becoming increasingly vital as a company in the AI infrastructure space. The primary reasons are twofold.

Broadcom is currently strengthening its market position through two major factors. First, integrating the VMware cloud business has given a real shot in the arm to the company's AI ecosystem. This acquisition also provides a superb platform for capturing significant enterprise spending aimed at private and hybrid cloud services. Second, Broadcom's dedicated AI chip business is growing quickly, presenting promising new paths that will help the firm diversify its income streams away from relying solely on traditional semiconductor sales.

Recent corporate activity certainly backs this up.

For instance, Broadcom extended its crucial relationship with Lloyds Group (LYG), one of the UK’s largest financial players. This is a long-term partnership designed to accelerate the bank’s digital overhaul. It involves upgrading Lloyds’ infrastructure with a brand-new private cloud setup and modern mainframe solutions for digital banking. Furthermore, Walmart (WMT) recently chose Broadcom as its strategic vendor for virtualization software, planning to use the VMware Cloud Foundation to standardize its massive, globally spread-out operations. This infrastructure upgrade is expected to enhance the customer shopping experience while simultaneously improving operational efficiency and supporting the launch of new services. Finally, a little company that goes by the name of OpenAI is set to launch its first-ever custom AI chip, built collaboratively with Broadcom.

Strategically, Broadcom has announced that the VMware Cloud Foundation will transform into an AI-native platform featuring built-in AI tools. By embedding these AI capabilities directly into the software, the company will likely encourage more developer activity, making its ecosystem considerably stickier for enterprises. It goes without saying that this is a huge plus for boosting recurring revenue through subscriptions, not to mention a fantastic way to differentiate itself in the crowded enterprise cloud market.

Moreover, much like Nvidia leads the GPU space, Broadcom is the unquestioned frontrunner in the application-specific integrated circuit (ASIC) market, a sector projected to hit approximately $43 billion by 2034. Broadcom's Jericho and Tomahawk ASIC families dominate the high-performance data center switching market, commanding about 70% market share, as major hyperscale operators rely heavily on Broadcom for custom silicon and switch ASICs. Areas where Broadcom operates—like 5G infrastructure, networking, and cloud data centers—all fundamentally depend on custom ASICs to manage traffic efficiently.

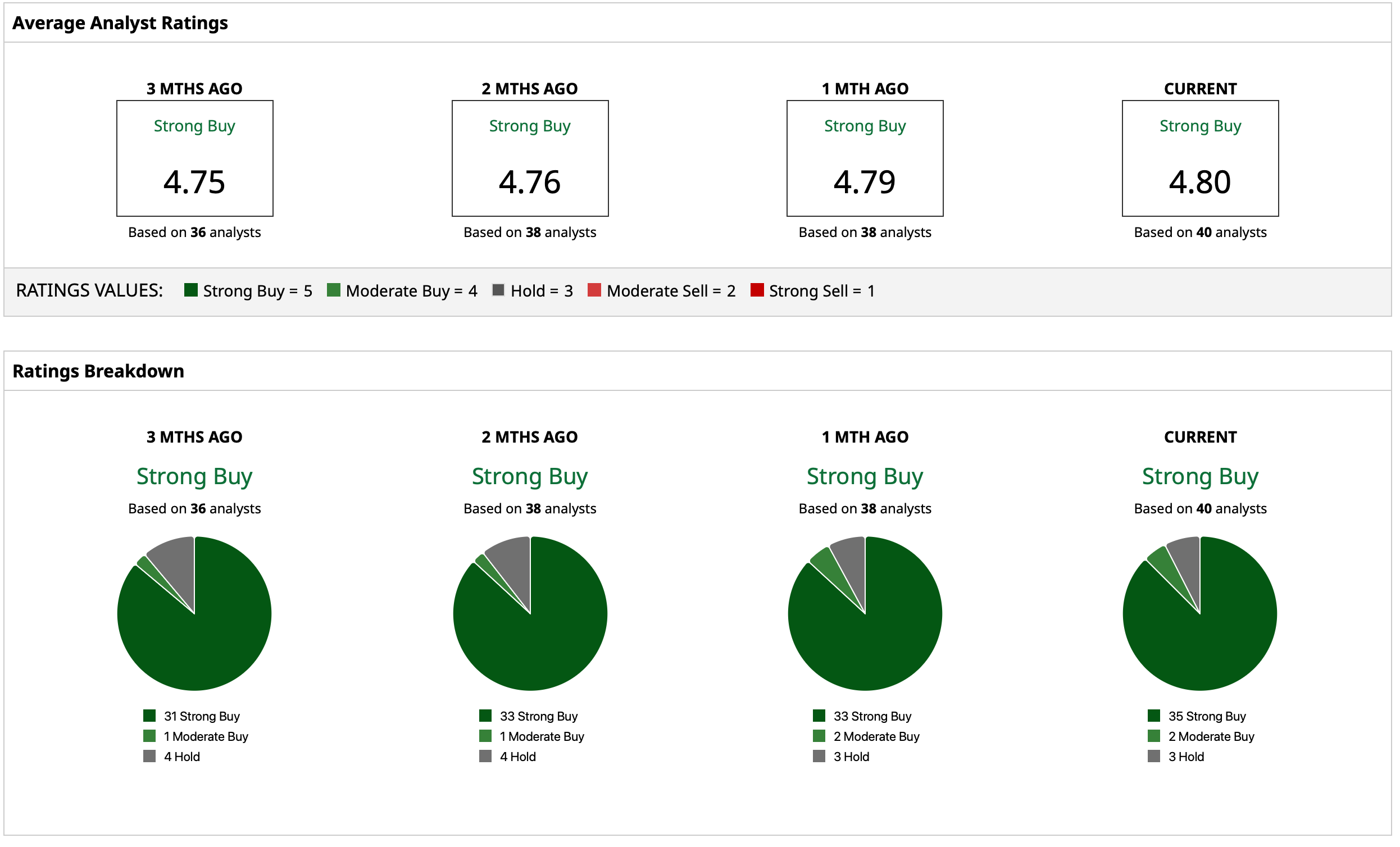

Analyst Opinion of AVGO Stock

Analysts have deemed AVGO stock a consensus “Strong Buy,” with a mean target price of $371.90. This denotes an upside potential of about 11.6% from current levels. Out of 40 analysts covering the stock, 35 have a “Strong Buy” rating, two have a “Moderate Buy” rating, and three have a “Hold” rating.