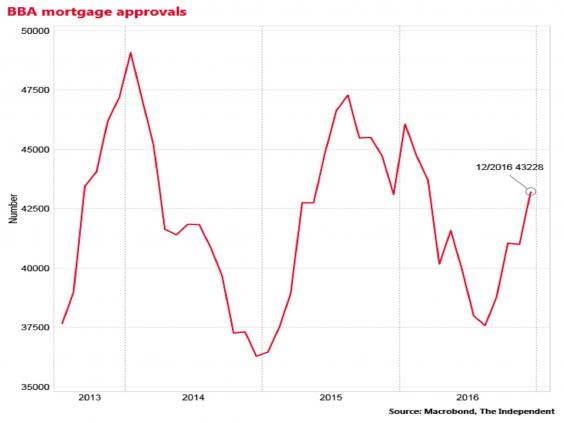

Approvals for house purchases hit a nine-month high in December, according to the latest data from the British Bankers' Association, suggesting that the national housing market is still holding up despite the Brexit vote last summer.

There were 43,228 approvals recorded in the month, up from 41,003 in November and the largest number since March 2016.

The data came as the Office for National Statistics reported that the overall economy grew by 0.6 per cent in the final quarter of 2016, beating expectations of 0.5 per cent growth and showing that - so far - there has been no negative impact from the referendum result.

Housing market robust

Some analysts said the housing market's momentum was unlikely to be maintained.

"The likely stagnation of households’ real incomes in 2017, as inflation rebounds and job gains remain weak, [will] take the edge off mortgage demand [and] a continued dearth of existing homes for sale, largely reflecting high transaction costs, will also continue to weigh on activity this year," said Samuel Tombs, UK economist at Pantheon.

According to the ONS house prices rose by 6.7 per cent in the year to November, up from 6.4 per cent in the year to October.

The latest BBA data also shows continued growth in consumer borrowing, which was up at an annual rate of 6.6 per cent in December.

"Consumers still seem pretty keen to take advantage of low interest rates, and this is something the Bank of England will likely increasingly keep an eye on," said Howard Archer, economist at IHS Global Insight.