/Morgan%20Stanley%20logo%20on%20building-by%20ginton%20via%20iStock.jpg)

The New York-based financial holding giant, Morgan Stanley (MS), offers a wide array of financial services to governments, institutions, and individuals. With a market capitalization of roughly $225.3 billion, the company’s services include capital raising, financial advisory, equity, fixed income products, alternatives, solutions, and liquidity overlay services.

Over the past year, MS stock has shown healthy performance, boasting a 52% gain, outpacing the broader S&P 500 Index ($SPX), which rose by 21.1% during the same period. In 2025, MS stock has surged by 12.4%, sailing past the broader Index’s 7.9% increase during the same stretch.

Narrowing the focus, MS has also outperformed the Financial Select Sector SPDR Fund’s (XLF) 25.2% return over the past year and 7.5% gain year-to-date (YTD).

Morgan Stanley reported its Q2 2025 earnings on July 16, delivering a mixed yet resilient performance. Net revenues came in at $16.8 billion, up 11.8% year-over-year and ahead of Wall Street's forecast of $15.9 billion, though the figure reflected a 5% decline from the prior quarter. Earnings per share of $2.13 also managed to top estimates of $1.93, despite an 18% sequential drop and represented a solid 17% increase from the year-ago period.

The strong showing was fueled by better-than-expected trading revenues, bolstered by heightened market volatility tied to tariff developments. Still, investor reaction to the investment bank’s second-quarter earnings remained muted, suggesting a degree of caution despite the upbeat headline numbers.

For the fiscal year 2025, ending in December, analysts anticipate MS to achieve EPS growth of 10.4%, reaching $8.78 on a diluted basis. Notably, Morgan Stanley has consistently beaten consensus estimates over the past four quarters.

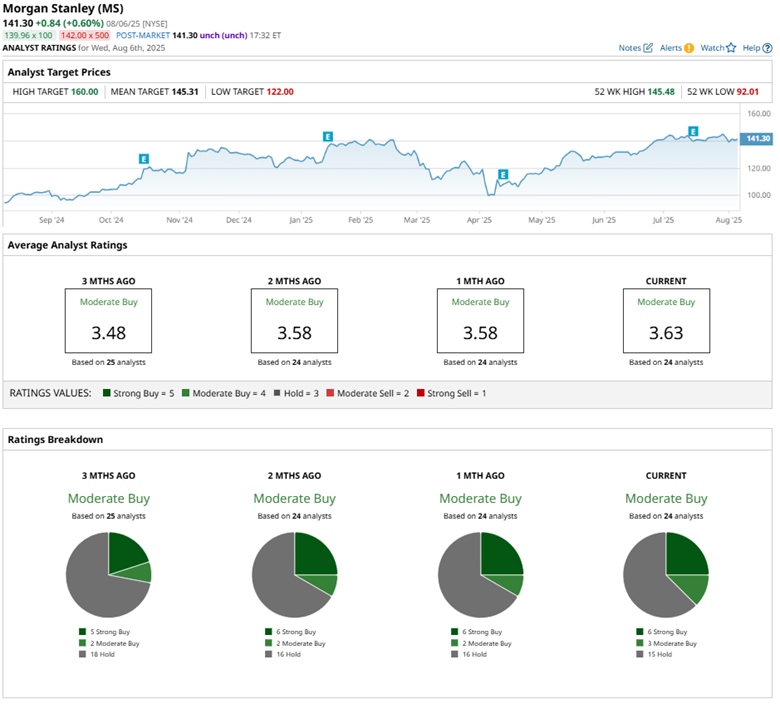

Among 24 analysts covering MS stock, the consensus rating is a "Moderate Buy," comprising six "Strong Buy" ratings, three "Moderate Buys," and 15 "Holds."

The current analyst sentiment is slightly more bullish than three months ago, when MS had a total of five "Strong Buy" ratings.

The mean price target of $145.31 represents a 2.8% premium to MS’ current price levels. Meanwhile, the Street-high price target of $160 suggests a potential upside of 13.2%.