/Morgan%20Stanley%20logo%20on%20building-by%20ginton%20via%20iStock.jpg)

Morgan Stanley (MS) is showing huge amounts of volume in call options that expire on Friday. Is it a signal that investors are bullish on MS stock? After all, the Wall Street firm had strong Q2 earnings, implying potential upside.

MS is at $144.43 in midday trading on Wednesday, July 30. That's up from $141.59 on July 15, just before it released Q2 earnings pre-open on July 16.

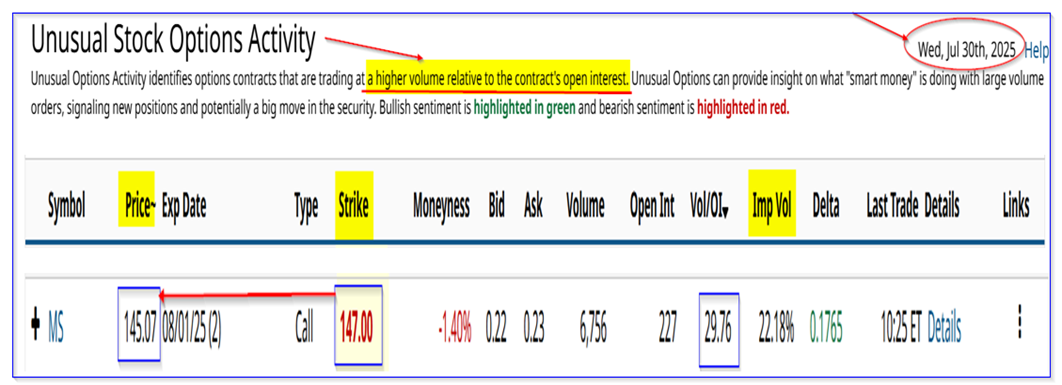

The heavy call options volume can be seen in today's Barchart Unusual Stock Options Activity Report. It shows that almost 6,800 call option contracts have traded at the $147.00 call option strike price expiring Friday, Aug. 1.

That volume is almost 30x the prior number of call options contracts previously outstanding at that strike price. This shows huge institutional interest in these options.

Moreover, this call option is just slightly over today's price, so it is “out-of-the-money” (OTM) by less than 2.0% (i.e., $147.00/$144.43 -1 = 0.0178 = +1.78% OTM). The premium paid is just 0.16% of the stock price (i.e., $0.23/$144.43).

That means that buyers of these call options believe MS stock will rise over the next two days to $177.23, or just +1.94% higher.

Does that mean investors are bullish on MS stock? Possibly, but why wouldn't an investor who buys these calls pick a later period? At least that way, they would have more time left to see the stock rise.

It's also possible that some short-sellers of these calls (especially if they already own shares in MS) believe that MS might not rise to $147.00 in the next two days. That way, they gain a very small income yield, about 0.15% over the next 2 days.

Either way, it appears that MS stock looks strong here, based on its recent Q2 earnings.

Strong Q2 Results

Morgan Stanley, which makes money from institutional securities (investment banking, and proprietary trading), wealth management, as well as investment management activities, said its Q2 revenue rose +11.8% YoY. However, the market is more concerned about its bottom line.

For example, its earnings per share (EPS) were up +17% and its return on tangible equity (ROTE) was higher at 18.2% in the quarter vs. 17.5% last year. In addition, tangible book value rose +8.4% YoY to $47.25 per share.

Most of the company's divisions posted stronger results, although investment banking revenues were down slightly (typically volatile). As a result, investors likely expect that its strong earnings will stay on track going forward.

Valuation Is High

That means that MS stock now trades for 2.34x book value (i.e., $144.43/$61.59 BV). That is higher than its historical average. For example, Morningstar reports that its historical price/book value (P/BV) ratio has been 1.62x, and Seeking Alpha reports a similar ratio with a forward P/BV ratio of 1.64x.

However, its average dividend yield has been 2.72% over the last 5 years, and today MS trades for a 2.77% yield (i.e., $4.00/$144.43 = 0.02769).

In addition, its forward P/E (price/earnings) average has been 13.02x, which is lower than today's figure. For example, analysts forecast between $8.86 earnings per share (EPS) this year and $9.58 in 2026.

That puts it on a forward P/E of 15.7x (i.e., $144.43/$9.22 next 12 months average EPS).

So, on balance, it seems that MS stock may be fully valued at today's price. Investors might not be expecting huge upside in MS stock.

Conclusion

As a result, investors should be careful about copying today's huge increase in MS call options volume. After all, there are only two days left in this contract, and it appears that much of the volume could be from institutional investors.

That implies they may be playing a very short-term trading strategy in MS stock. This may have nothing to do with Morgan Stanley's long-term outlook or even its valuation, as described above.

The bottom line is that investors should be careful about investing in out-of-the-money (OTM) call options for MS stock expiring Friday, Aug. 1.