/NVIDIA%20Corp%20logo%20outside%20building-by%20BING-JHEN_HONG%20via%20iStock.jpg)

Analysts from investment firm Morgan Stanley recently met with executives from Nvidia (NVDA). Led by Joseph Moore, the analysts left the meeting with a favorable outlook. In a note, Moore wrote that the revenue growth witnessed at Nvidia so far has been due to the migration of CPU workloads to GPU within existing application workloads.

Although the hype around Nvidia has been around artificial intelligence (AI), most of the transformative AI use cases are yet to come. More AI applications are just beginning to emerge, putting the firm at the center of the next wave of growth. Moore has an “Overweight” rating and $210 price target on NVDA stock.

What's more, Nvidia's management doesn't seem to be overly concerned about the recent Advanced Micro Devices (AMD) and OpenAI deal, which could give OpenAI a 10% stake in AMD. Moore believes that, although many competitors build chips, none provide the full-stack approach and flexibility of Nvidia GPUs.

About Nvidia Stock

Based in Santa Clara, California, Nvidia continues to spearhead advancements in AI and computing technology in 2025. The company recently achieved a remarkable $4 trillion market capitalization, fueled by escalating demand for its AI chips and supercomputers. Nvidia has successfully escalated production of its Blackwell AI supercomputers, resulting in billions of dollars in sales in the first quarter of 2025 alone.

Nvidia remains a dominant player in the AI chip market, introducing innovations like the GeForce RTX 50 Series GPUs with significant AI capabilities. The company has also secured a massive $100 billion partnership with OpenAI, emphasizing its pivotal role in powering the next generation of AI data centers and technologies. These strategic moves solidify the firm's leadership and expand its influence globally in the AI landscape. Currently, Nvidia's market capitalization is $4.44 trillion.

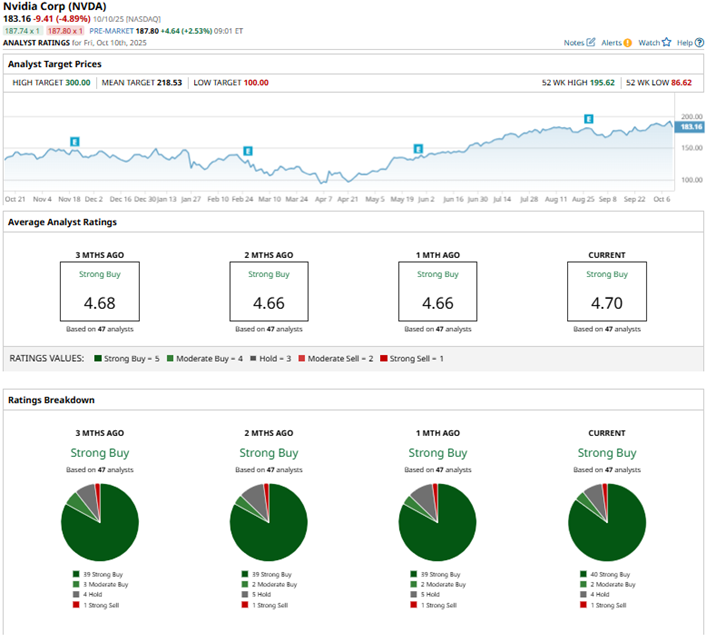

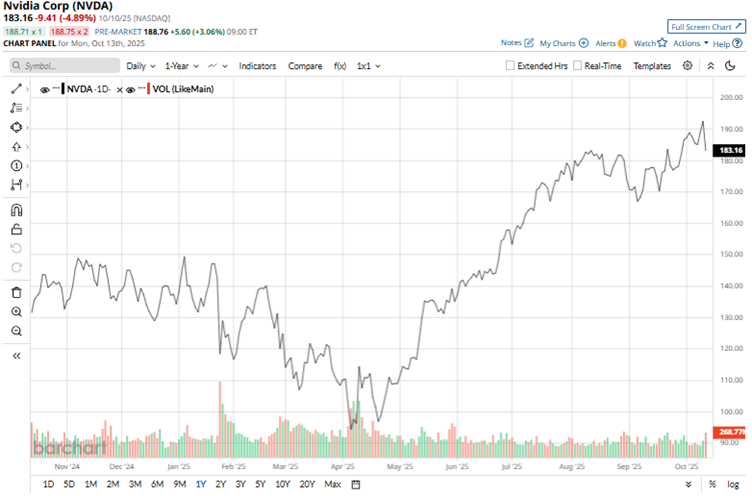

Over the past 52 weeks, NVDA stock has gained 26%, underscoring robust sentiment surrounding its operations, while it is up 35% year-to-date (YTD). Shares reached a 52-week high of $195.62 on Oct. 10, but they are currently down 7% from that level. Despite posting a high, NVDA stock also declined 4.9% intraday on Oct. 10.

NVDA stock is trading at a premium valuation. Its price sits at 43.44 times forward earnings, well above the industry average.

Nvidia's Q2 Results Were Better Than Expected

On Aug. 27, Nvidia reported solid growth in its second-quarter results for fiscal 2026, which ended on July 27. Revenue increased 56% year-over-year (YOY) to $46.7 billion. This figure was higher than the $46.1 billion that Wall Street analysts were expecting.

Nvidia's data center revenue was $41.1 billion during the quarter, up 56% from the prior year’s period. Recently, the company announced the launch of the Nvidia RTX Pro 6000 Blackwell Server Edition GPU, which would be available on renowned servers that Disney (DIS), Taiwan Semiconductor (TSM), and others have already adopted. The company also announced that its Blackwell platform achieved the “highest performance at scale on every MLPerf Training benchmark.”

Nvidia’s margins are still expanding robustly. Non-GAAP operating income increased 51% YOY to $30.17 billion, while non-GAAP EPS was $1.05, up 54% YOY. The adjusted EPS figure was also higher than the $1 expected by Wall Street analysts.

During the quarter, the company sold no H20 chips to its China-based customers. However, it benefited from a $180 million release of previously reserved H20 inventory, from approximately $650 million in unrestricted H20 sales to a non-China customer. Excluding this benefit, Nvidia's non-GAAP EPS would have been $1.04.

For the third quarter, Nvidia expects revenue of $54 billion, give or take 2%. The company has not assumed any H20 shipments in the outlook.

Wall Street analysts are optimistic about Nvidia’s future earnings. They expect EPS to climb by 50% YOY to $1.17 for Q3 fiscal 2026. For the current fiscal year, EPS is projected to surge 44% annually to $4.22, followed by 40% growth to $5.91 in the next fiscal year.

What Do Analysts Think About NVDA Stock?

Apart from Morgan Stanley’s bullish sentiment, other Wall Street analysts are also optimistic about Nvidia’s prospects. Recently, analysts at Mizuho maintained an “Outperform” rating and raised the price target from $205 to $225. This reflects Mizuho's continued confidence in the company’s position as an AI leader, while analysts expect the company to record more than $300 billion in AI data center revenue by 2028.

Analysts at Cantor Fitzgerald also raised the price target from $240 to $300, while maintaining an “Overweight” rating. The revised outlook follows Nvidia CEO Jensen Huang outlining the company’s AI infrastructure buildout.

Analysts at KeyBanc also reiterated an “Overweight” rating on shares, while maintaining a $250 price target. KeyBanc analysts believe that hyperscaler demand and the expansion of GB200/300 products will be favorable for NVDA stock going forward.

Nvidia has been in the spotlight on Wall Street for some time now, with analysts awarding it a consensus “Strong Buy” rating overall. Of the 47 analysts rating the stock, a majority of 40 analysts rate it a “Strong Buy,” two analysts suggest a “Moderate Buy,” four analysts play it safe with a “Hold” rating, and one analyst has a “Strong Sell” rating. The consensus price target of $222 represents 23% potential upside from current levels. Meanwhile, the Street-high price target of $320 indicates potential upside of 77% from here.