/Applied%20Materials%20Inc_%20mobile%20and%20computer%20logo-by%20vieimage%20via%20Shutterstock.jpg)

Applied Materials (AMAT) is a global leader in materials engineering solutions for the semiconductor and advanced display industries. The company designs, manufactures, and services equipment essential for fabricating chips and displays used in electronics, AI systems, and next-generation technologies. Their innovations drive progress in power, performance, and sustainability within the tech sector, making them integral to modern digital infrastructure.

Founded in 1967, it is headquartered in Santa Clara, California.

Applied Materials Outshines Market

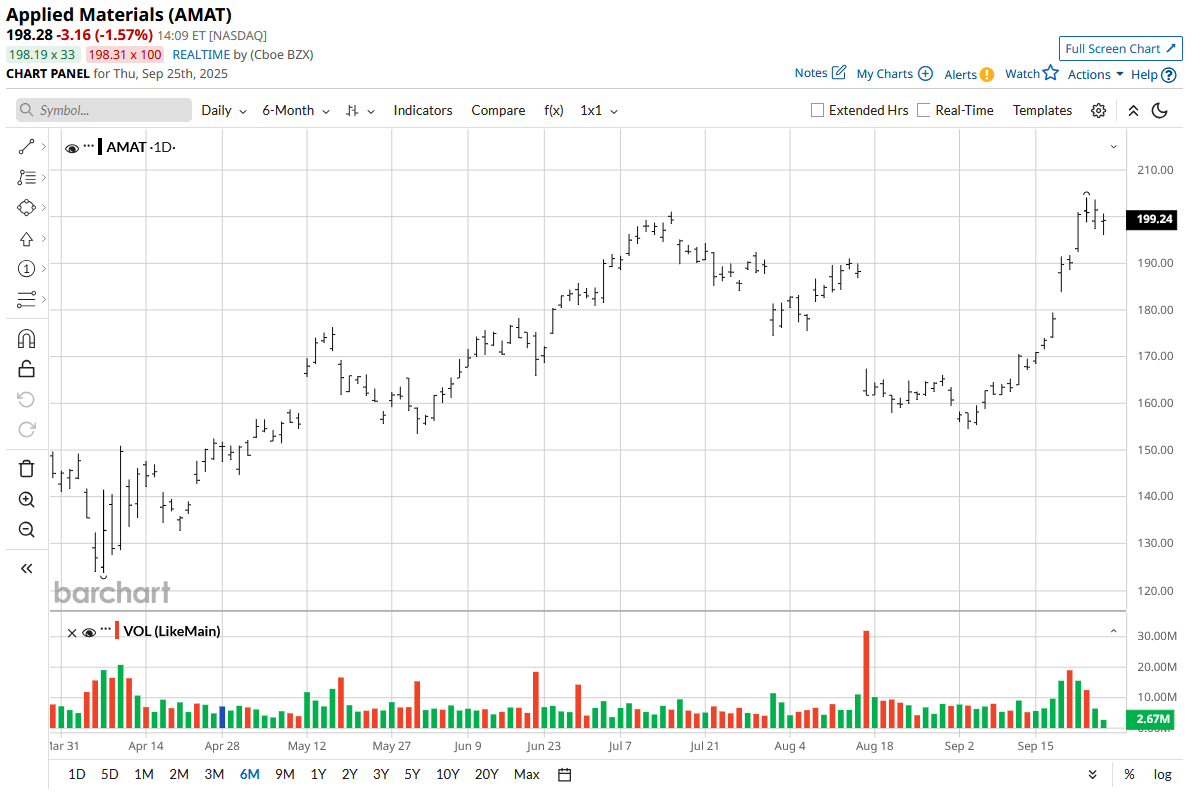

Applied Materials has delivered an impressive rally, gaining about 5.2% over the past five days and surging 23.2% in the last month. For the past six months, the stock has been up 29.9%, and its year-to-date (YTD) return stands at approximately 22%. Over the past 52 weeks, the gains have been modest at about 1.5%, reflecting a recovery from prior underperformance.

In comparison, the S&P 500 ($SPX) is up about 13% YTD. Applied Materials is now outperforming its benchmark index in the short and medium term, driven by strong semiconductor industry demand.

Applied Materials Posts Solid Results

Applied Materials reported robust Q3 2025 results on Aug. 14, with earnings per share of $2.48, surpassing the consensus expectation of $2.35. Revenue reached $7.3 billion, up 8% year-on-year (YoY) and exceeding analyst estimates of $7.21 billion. This performance was fueled by strong demand in semiconductor systems and services, alongside growth in AI-related segments.

Key financial highlights include a gross margin improvement to 48.9%, an operating margin of 31.5%, and a net profit of $1.78 billion. Operating cash flow stood at $2.6 billion, 36% of revenue, while supporting $1.4 billion in shareholder returns through buybacks and dividends. As of the end of Q3, Applied Materials reported $5.38 billion in cash and $1.63 billion in short-term investments, bringing total liquidity to approximately $7 billion.

For Q4 2025, management guided revenue to $6.7 billion, plus or minus $500 million, and non-GAAP EPS to $2.11, plus or minus $0.20. This outlook reflects expected near-term headwinds from capacity digestion in China and fluctuating leading-edge demand, but the company remains bullish on medium-term growth, supported by AI and advanced chip manufacturing trends.

Applied Materials Upgraded by Analyst

Morgan Stanley has upgraded Applied Materials to “Overweight” from “Equal Weight,” increasing its price target to $209 from $172, which signals a 4% upside over the current market price. The upgrade is based on greater confidence in the semiconductor equipment sector.

The firm’s analysts, led by Shane Brett, revised their 2026 global Wafer Fab Equipment (WFE) market forecast upward to $128 billion (10% YoY growth), with most of this growth driven by robust DRAM investments. Morgan Stanley now sees Applied Materials as having the highest exposure among its peers to new DRAM projects, projecting 2026 EPS of $10.45 versus its prior $9.58 estimate.

The analysts noted that AMAT currently trades at a 25% valuation discount to Lam Research, wider than the historical average, and believe this gap should narrow as the market re-prices Applied’s sector-leading leverage to next-generation memory and logic manufacturing. They also view risks tied to China, leading-edge logic, and ICAPS (IoT, Communications, Automotive, Power, and Sensors) as largely managed, highlighting an upside risk-reward skew underpinned by a 3:1 bull-bear analyst ratio.

Overall, Morgan Stanley’s outlook suggests a strong upside for Applied Materials, driven by favorable DRAM trends, expanding WFE spending, and an attractive relative valuation.

Should You Get AMAT?

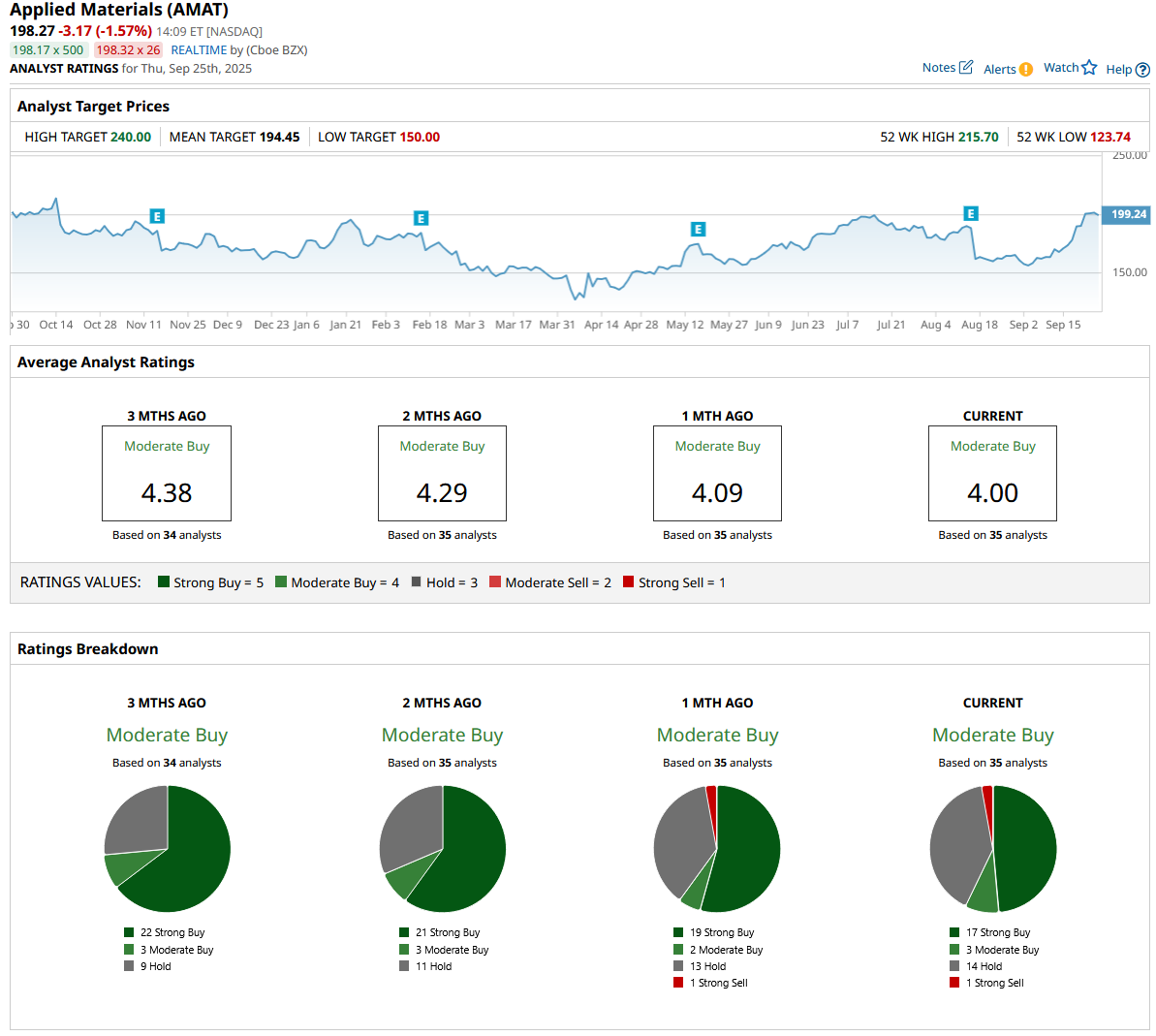

Despite analysts maintaining high ratings for Applied Materials, the average price target has not kept pace with the stock’s strong recent rally. AMAT stock holds a consensus “Moderate Buy” from Wall Street, but the mean price target of $194.45 currently points to potential downside from market levels, highlighting that recent performance has exceeded analyst forecasts and that price targets have yet to fully catch up.

Applied Materials has been reviewed by 35 analysts so far, receiving 17 “Strong Buy” ratings, three “Moderate Buy” ratings, 14 “Hold” ratings, and one “Strong Sell” rating.

.png?w=600)