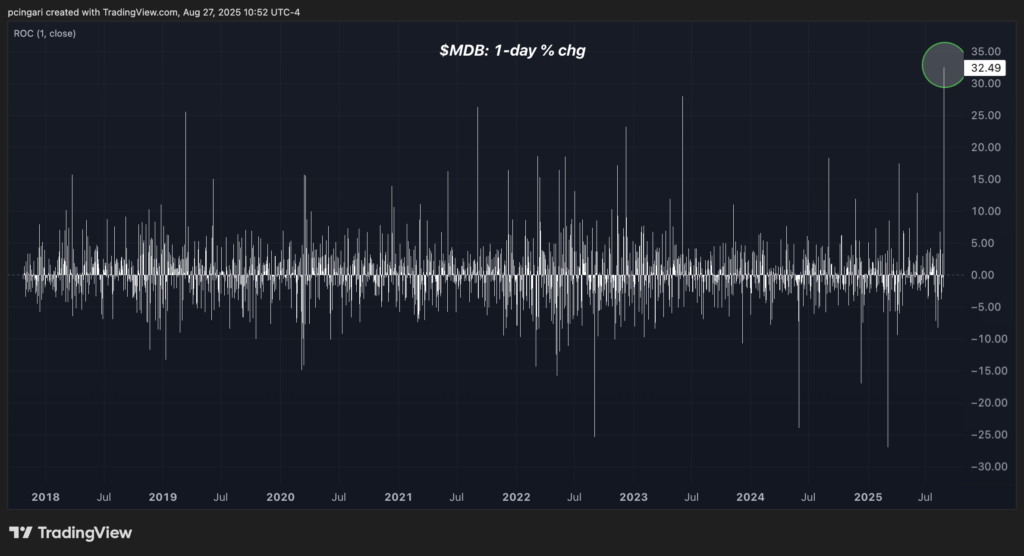

MongoDB Inc. (NASDAQ:MDB) is enjoying its biggest one-day rally since going public in 2017.

The New York-based software company saw its stock soar 32% by mid-morning Wednesday after it reported solid second-quarter earnings and raised its full-year guidance.

With revenue, margins and customer growth all topping expectations, the Street is responding with a flurry of target hikes and bullish outlooks.

A Rally Backed By Numbers

- Second-quarter revenue rose 24% year-over-year to $591.4 million, about 6.8% above consensus.

- Subscription revenue climbed to $572.3 million

- Atlas—the company's cloud database product—grew 29% year-over-year and now accounts for 74% of total revenue.

- Raised fiscal-year 2026 revenue guidance to $2.34–$2.36 billion, topping Wall Street's $2.29 billion estimate.

- Non-GAAP operating income is forecast between $321 million and $331 million (prior range: $267 million to $287 million).

- Non-GAAP EPS guidance was also lifted to $3.64–$3.73, compared with $2.94–$3.12 previously.

What Top Wall Street Analysts Are Saying

Goldman Sachs – Kash Rangan: Goldman raised its price target to $325 and maintained a Buy rating. Rangan cited a “clean beat-and-raise quarter” with Atlas growth accelerating and cost discipline surfacing in the financials.

"Atlas is now trending in the high-20's at-scale – best-in-class for consumption peers," Rangan said.

MongoDB is now executing in line with the upside thesis laid out earlier this year, Rangan says. AI startup adoption and Atlas momentum are strong signals of durable growth.

He added that MongoDB's upmarket push and architectural advantages could sustain mid-20% Atlas growth going forward.

Wedbush – Dan Ives: Calling MongoDB a “play within the AI Revolution,” Wedbush’s Ives reaffirmed an Outperform rating and $300 target.

Atlas outperformed expectations and now represents a larger portion of total revenue; multi-year deals from large customers signal long-term adoption.

While gross margins dipped slightly due to the growing Atlas mix, operating margins surged to 14.7%, well above estimates, showcasing the company's improving balance between growth and profitability.

"MDB remains included in the AI 30 list as a strong 2nd derivative play within the AI Revolution," Ives said.

Cantor: Cantor’s Thomas Blakey noted MongoDB delivered a 7% top-line beat, with Atlas up 29% and non-Atlas ARR (Annual Recurring Revenue) growing 7% year-over-year.

He said the CFO’s comments on rigorous investment reviews and a recent reorganization point to further margin expansion ahead.

"MongoDB went through a small reorganization this quarter (<2% of workforce), and management provided positive commentary around the ongoing GTM changes," Blakey said.

Blakey also pushed back on Postgres competition concerns, arguing MongoDB's integrated platform is well suited for modern AI workloads and multicloud deployments.

Citizens: Citizens’ Patrick Walravens raised its fiscal-year 2026 EPS estimate to $3.70. He maintained a Market Outperform rating with a $345 price target.

Walravens said MongoDB is rebounding on a focus on high-quality workloads and sees strong potential in the company’s position within the enterprise database market, which Gartner estimates will more than double to $226 billion by 2028.

He added that the new CFO, Mike Berry, is already making a mark on profitability.

"MongoDB has demonstrated that it is an enterprise-class database that works across a broad set of use cases," Walravens said.

Rosenblatt: Blair Abernethy lifted his price target to $305. MongoDB's beat is fueled by strong Atlas consumption and more multi-year non-Atlas license deals than expected, he adds.

MongoDB noted customer count rose 18% year-over-year to nearly 60,000. The company’s pivot toward enterprise and high-value workloads continues to pay off, he adds.

"Mongo is seeing rapid uptake of MongoDB 8.0, with performance improvements which are leading to expansion of usage and attracting AI customers," Abernethy said.

Needham: Needham analyst Mike Cikos raised its target to $325. He highlighted stronger-than-expected Atlas consumption from large U.S. customers.

Cikos said Atlas's acceleration gives management confidence to project mid-20% growth for the full year.

He highlighted rising momentum from AI-native startups and large enterprises alike, adding that go-to-market improvements are yielding more strategic wins and longer-lasting workloads.

"Go-to-market efforts to move up-market are benefiting Atlas consumption, and seem to have legs as workloads with large U.S. customers are growing for longer," Cikos said.

Guggenheim: Guggenheim’s Howard Ma described the quarter as a "beautiful print" and raised his price target from $260 to $310.

"We've gone so far as to call MongoDB a ‘swan' in our January 2025 upgrade to Buy," Ma said.

He said Atlas's 29% growth—beating even the most optimistic expectations—combined with self-serve strength and strong U.S. customer engagement, makes MongoDB a standout in the software space.

He now models 29% full-year Atlas growth and sees only modest deceleration into fiscal-year 2027.

Now Read:

Image: Shutterstock