MongoDB (MDB) delivered solid second-quarter fiscal 2026 financial results last night, reflecting that its AI-powered database platform is resonating well with enterprises. MDB’s management raised its full-year outlook, signaling confidence that growth momentum will continue. Investors cheered the news, sending the stock soaring more than 30% in after-hours trading.

This marks a sharp reversal in sentiment for MongoDB stock. Until yesterday, MDB had been lagging the broader market, with shares in the red for the year. However, the latest quarterly numbers suggest that the company has sufficient firepower to capitalize on the growth of generative AI workloads and applications in the long run, indicating that the post-earnings jump could be the beginning of a long-term rally.

Atlas: The Engine Behind MongoDB’s Growth

MongoDB’s Q2 numbers indicate that its business is performing well. Revenue jumped 24% year over year to $591.4 million in Q2, while adjusted operating income came in at $87 million, giving MongoDB a healthy 15% operating margin, up from about 11% in the prior year. MDB ended the quarter with 59,900 customers, up from 50,700 in the prior-year period, a reflection of the growing adoption of its database platform among enterprises.

Powering its growth is Atlas, its multi-cloud database platform. Atlas now contributes 74% of the company’s total revenue. Growth here accelerated to 29% year-over-year, up from 26% in the prior quarter, showing that demand is strengthening. In Q2, Atlas consumption growth held steady with last year’s strong pace, reflecting durable demand.

Customer growth was equally impressive. Over the last two quarters alone, MongoDB added more than 5,000 new customers, including 2,800 in Q2, bolstered by its recent Voyage AI acquisition. Atlas customers now number 58,300, compared to 49,200 a year ago.

Notably, many of MongoDB’s new customers are building AI-powered applications, and Atlas is increasingly viewed as an essential piece of the AI infrastructure stack. Its flexible document model, ability to scale across cloud providers, and newer capabilities such as vector search position it as a natural fit for its customers.

In short, Atlas is playing a key role in powering AI workloads. With its customer base expanding, margins improving, and its platform increasingly central to the AI infrastructure stack, MongoDB looks well-positioned for long-term growth.

MDB’s Raised Guidance Signals Strong Momentum

After delivering strong Q2 financials, MongoDB lifted its full-year revenue forecast by $70 million to a range of $2.34 billion to $2.36 billion. This increase reflects continued momentum in Atlas.

While non-Atlas subscription revenue is still expected to decline, management now projects a mid–single–digit drop, compared to the earlier forecast of a high-single-digit decrease. Importantly, non-Atlas ARR is still expected to post year-over-year growth, reflecting the underlying demand from customers.

Profitability metrics have also moved higher. MongoDB raised its adjusted operating income guidance by $44 million, now targeting $321 million to $331 million, with operating margins expected to reach 14% at the high end, reflecting an improvement from the prior 12.5% forecast. Adjusted EPS is now projected between $3.64 and $3.73 for fiscal 2026, up from its previous range of $2.94 to $3.12.

Looking ahead to Q3, management expects revenue to be between $587 million and $592 million, with adjusted EPS in the $0.76 to $0.79 range. Notably, operating margin could come under pressure and dip sequentially due to a decline in high-margin non-Atlas revenue.

Should You Buy MDB Stock Now?

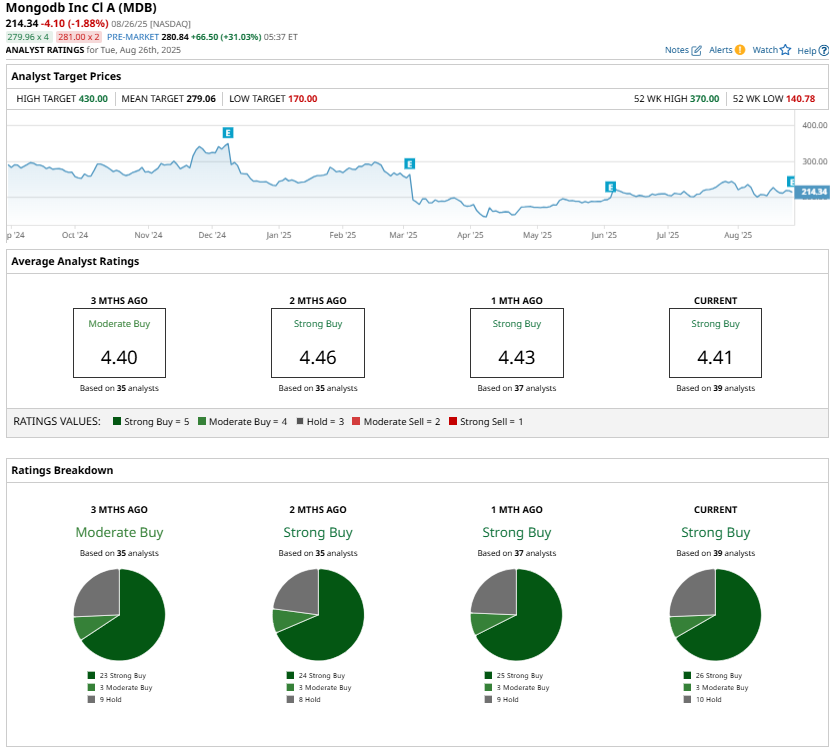

MongoDB’s strong Q2 results could mark a turning point for MDB stock, as the company demonstrates its ability to capture the surging demand for AI-driven applications while steadily improving profitability. Atlas remains the growth engine, strengthening MongoDB’s positioning as a critical layer in the enterprise AI stack. With raised guidance, accelerating customer adoption, and Wall Street maintaining a “Strong Buy” consensus rating on the stock, MDB appears to be a compelling long-term stock.

The highest price target for MongoDB stock is $430, which implies significant upside potential from current levels.