Earlier this summer, a worrying but bluntly unsurprising headline caught the attention of investors everywhere: a growing number of young Americans have given up pursuing homeownership, believing that an all-out global war will have a greater likelihood of materializing. However, a critical shift in monetary policy just might force a rethink of this dire condition.

According to a survey by Clever Real Estate, 21% of respondents from the Generation Z demographic believe that World War III erupting is a more likely future event over the next five years than them buying a home. What's more, almost the same share of respondents believe they're more likely to win the lottery or become homeless in that timeframe.

However, the Federal Reserve recently presented an interesting wrinkle. On Sept. 17, the central bank cut its benchmark interest rate by 25 basis points to 4.00%-4.25%, delivering what many experts thought was a near-certainty. It was the first rate cut since December of last year. More importantly, policymakers signaled that further easing may follow.

Obviously, the move carries significance for the housing market, particularly for prospective buyers and refinancers. Essentially, a dovish monetary policy helps ease the burden of borrowing, which has kept many would-be buyers on the sidelines. Still, speculators targeting homebuilders and related subsectors should be prepared for an eventful journey.

Several economists have sounded the warning regarding the possibility of stagflation. While financing pressures may have been eased, inflation remains stubbornly elevated and the labor market has previously been adjusted negatively. As such, bullish investors do need to approach homebuilders and other players within the broader real estate ecosystem cautiously.

Still, it's also possible that the optimists may have a slight edge. Initial jobless claims declined by 14,000 from the previous week to 218,000 in the third week of September. This figure bodes well compared to estimates anticipating 235,000.

Overall, economic circumstances might not be as bad as advertised — and that could play a key role in how the housing market pans out.

The Direxion ETF: For those investors who are truly gung-ho about a potential recovery in real estate and its surrounding ecosystem, financial services provider Direxion offers an ultra-leveraged exchange-traded fund. Basically, this financial vehicle provides an easy-to-understand alternative to exotic products. Called the Direxion Daily Homebuilders & Supplies Bull 3X Shares (NYSE: NAIL), the fund tracks 300% of the performance of the Dow Jones U.S. Select Home Construction Index.

Why bother considering a 3X-leveraged fund? At the core, the NAIL ETF provides convenience for speculators. Rather than attempting to trade the options market — which can feature its own unique complexities — NAIL provides extreme leverage baked into each unit, which can be bought and sold, much like any other publicly traded security.

Another important aspect that's taken for granted is that Direxion ETFs are debit-based transactions. Unlike other exotic trades, these funds are relatively straightforward. All positions start from a cash outflow position because the buyer is paying a debit upfront to acquire the fund's units. Should a market loss occur, the red ink is limited to the total principle of the trade.

However, prospective participants should be cognizant of the risks involved. Primarily, ultra-leveraged funds are far more volatile than non-leveraged counterparts tracking benchmark indices like the S&P 500. Moreover, leveraged Direxion ETFs are designed for exposure lasting no longer than one day. Holding onto these vehicles for longer than recommended can expose traders to positional decay stemming from the daily compounding effect.

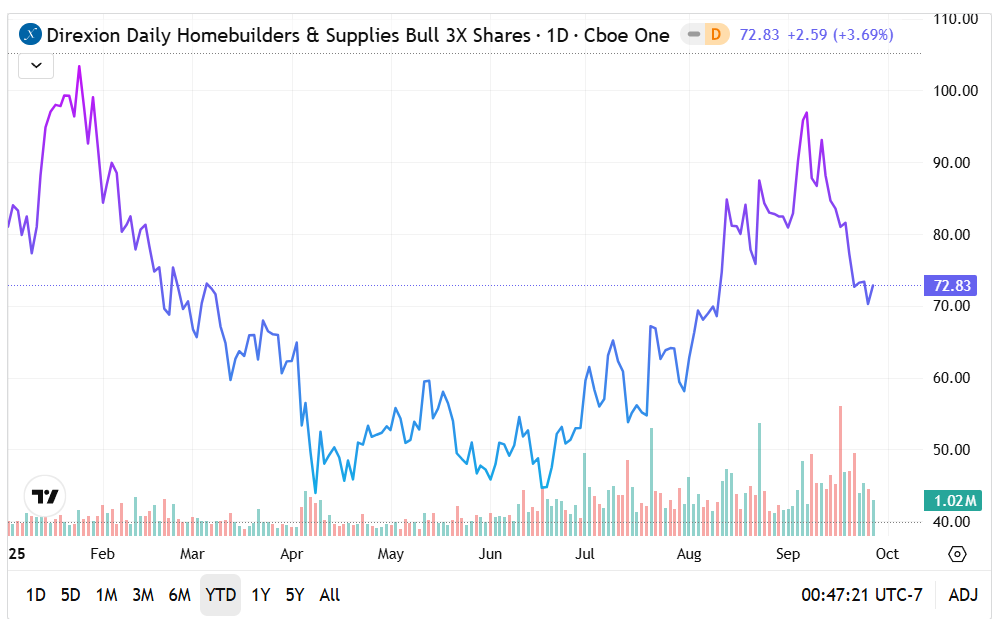

The NAIL ETF: Since the start of the year, the NAIL ETF has lost about 14% of market value. However, in the past six months, it has also gained 17%, thus reflecting potential upside.

- At the moment, the NAIL ETF is stuck in an unusual position, sandwiched between the 50-day moving average at top and the 200 DMA at bottom.

- For the first half of the year, overall volume levels have been relatively muted. However, acquisitions started to pick up in the summer months.

- More recently, buying volume has declined, coinciding with a slide in market value. However, overall levels are generally above those seen in the first half of the year.

Featured image by Oleksandr Pidvalnyi on Pixabay.