Valued at a market cap of $90.3 billion, Mondelez International, Inc. (MDLZ) is a global snacking leader based in Chicago, known for iconic brands like Oreo, Cadbury, Toblerone, and Ritz. With a strong presence in over 150 countries, Mondelez continues to expand through innovation, regional partnerships, and investments in fast-growing markets like India.

Shares of this confectionery company have lagged behind the broader market over the past 52 weeks. MDLZ has declined 2.9% over this time frame, while the broader S&P 500 Index ($SPX) has surged 17%. However, on a YTD basis, the stock is up 9%, outpacing SPX’s 8.1% upstick.

Narrowing the focus, MDLZ has outperformed the First Trust Nasdaq Food & Beverage ETF’s (FTXG) 7.6% loss over the past 52 weeks and 2.4% fall on a YTD basis.

On July 29, Mondelez International released its Q2 2025 earnings, posting revenue of $8.98 billion, up 7.7% year-over-year, and adjusted EPS of $0.73, both of which beat Wall Street estimates. The strong results were driven largely by international markets, particularly Europe, where revenues surged 18.7% due to significant price increases, despite modest volume declines.

However, the company saw overall sales volumes fall by approximately 1.5%, with North America showing a sharper 2.4% drop, as consumers remained cautious amid inflation and pricing pressures. Despite reaffirming its full-year guidance of ~5% organic net revenue growth and returning $2.9 billion to shareholders, investor sentiment turned negative, sending its shares down 6.6% in the following trading session.

For the current fiscal year, ending in December, analysts expect MDLZ’s EPS to decline 9.8% year over year to $3.03. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

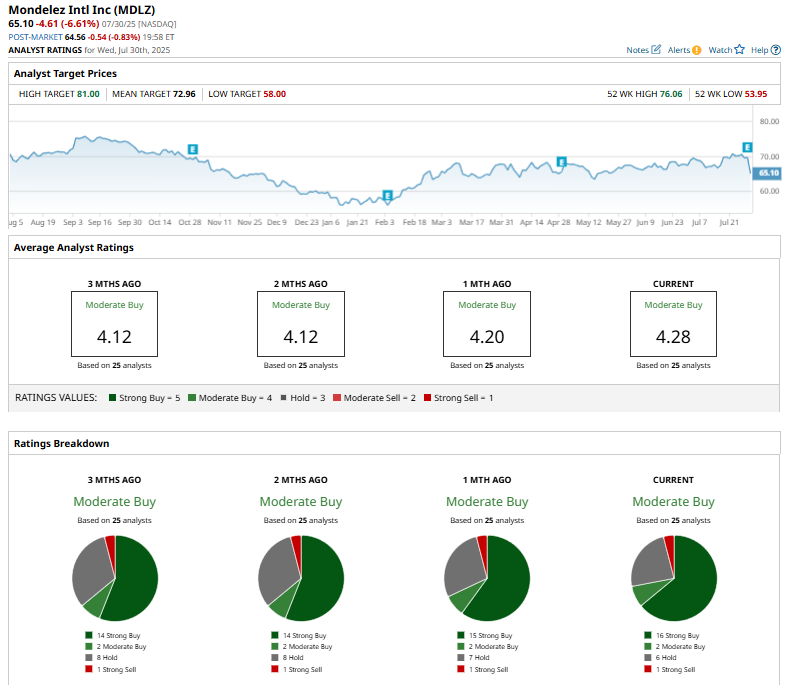

Among the 25 analysts covering the stock, the consensus rating is a “Moderate Buy” which is based on 16 “Strong Buy,” two “Moderate Buy,” six “Hold,” and one “Strong Sell” rating.

This configuration is slightly more bullish than it was a month ago, with 15 analysts recommending a “Strong Buy” rating.

On July 30, Bernstein analyst Alexia Howard reaffirmed an "Outperform" rating on Mondelez International and raised the stock’s price target from $79 to $88, signaling increased confidence in the company’s growth outlook amid current market conditions.

The mean price target of $72.96 represents a 12.1% potential upside from MDLZ’s current price levels, while the Street-high price target of $81 suggests an upside potential of 24.4%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.