monday.com Ltd. (NASDAQ:MNDY) will release earnings results for the second quarter before the opening bell on Monday, Aug. 11.

Analysts expect the Tel Aviv, Israel-based company to report quarterly earnings at 86 cents per share, down from 94 cents per share in the year-ago period. monday.com projects to report quarterly revenue at $293.58 million, compared to $236.11 million a year earlier, according to data from Benzinga Pro.

On May 12, Monday.com reported a first-quarter revenue growth of 30% year-on-year to $282.3 million, beating the consensus of $275.8 million.

monday.com shares rose 0.3% to close at $248.04 on Friday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

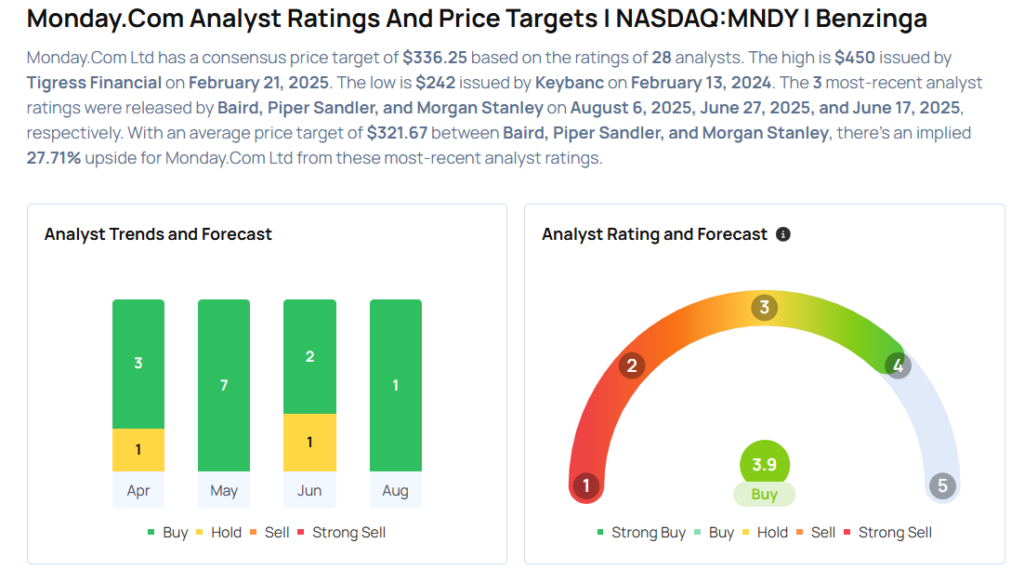

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Baird analyst Rob Oliver upgraded the stock from Neutral to Outperform and boosted the price target from $280 to $310 on Aug. 6, 2025. This analyst has an accuracy rate of 63%.

- Piper Sandler analyst Brent Bracelin reiterated an Overweight rating with a price target of $325 on June 27, 2025. This analyst has an accuracy rate of 75%.

- Morgan Stanley analyst Josh Baer initiated coverage on the stock with an Equal-Weight rating and a price target of $330 on June 17, 2025. This analyst has an accuracy rate of 69%.

- Loop Capital analyst Mark Schappel maintained a Buy rating and cut the price target from $385 to $375 on May 13, 2025. This analyst has an accuracy rate of 63%.

- Barclays analyst Raimo Lenschow maintained an Overweight rating and cut the price target from $360 to $345 on May 13, 2025. This analyst has an accuracy rate of 72%

Considering buying MNDY stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock