Shares in Moderna (MRNA) rose smartly Thursday after the COVID-19 vaccine maker reported better-than-expected earnings and said it was in "active supply discussions" with the European Union.

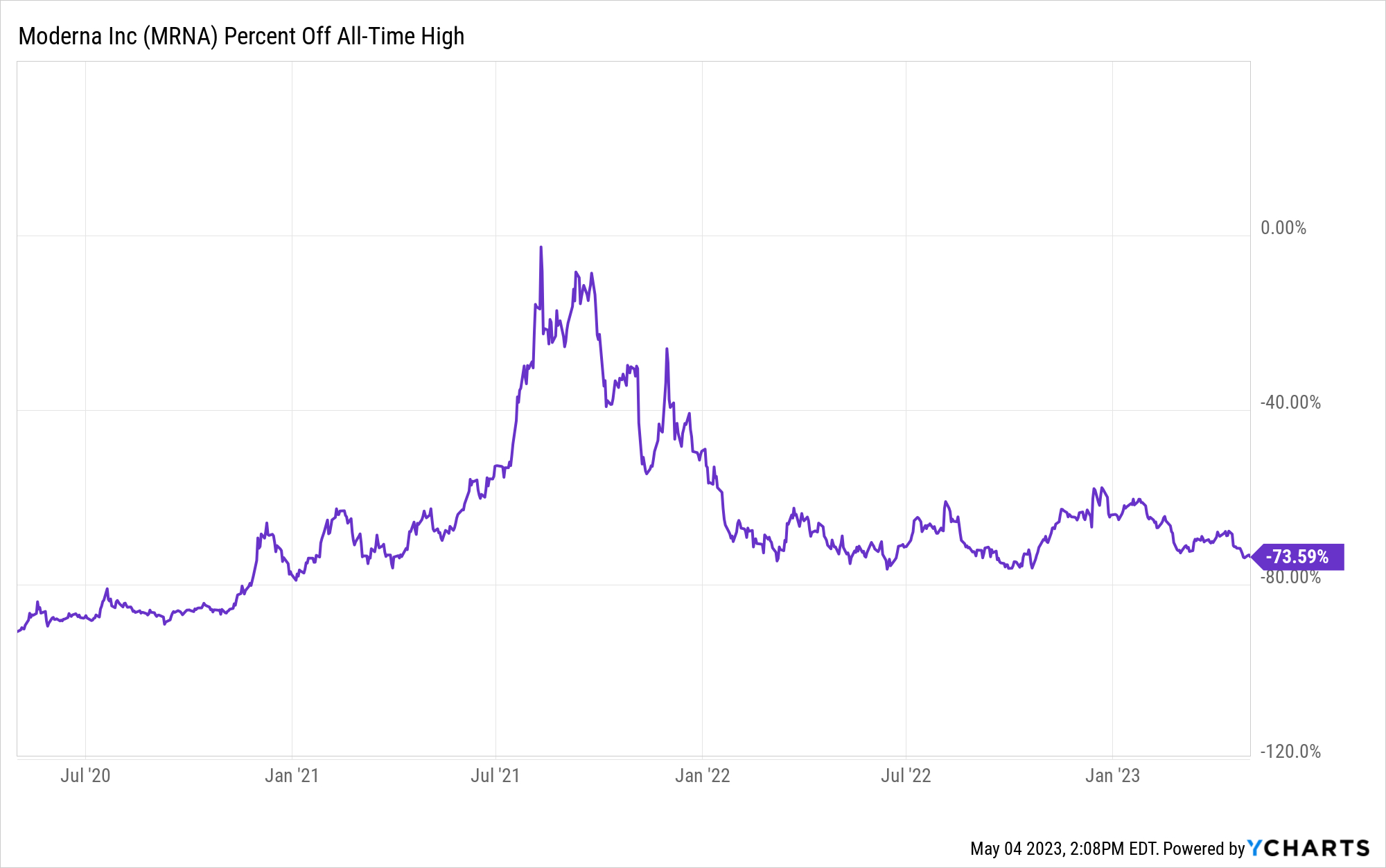

Explosive demand for the biotechnology firm's coronavirus vaccine allowed MRNA stock to generate outstanding returns during the first year-and-a-half of the pandemic. Shares peaked almost two years ago, however, as global vaccination rates rose and new COVID-19 cases tapered off. As a result, Moderna stock has lost about a quarter of its value in 2023 alone.

The company's coronavirus vaccine is its only marketable product. As such, Moderna is racing to develop and bring new drugs to market in order to find growth in the post-pandemic era.

For the first quarter ended March 31, Moderna reported net income of $79 million, or 19 cents per share. Although that represented a 98% decrease from net income of $3.7 billion, or $8.58 per share, recorded in last year's Q1, the results easily topped Wall Street estimates. Indeed, analysts surveyed by S&P Global Market Intelligence forecast Moderna to post a net loss of $1.75 a share.

Total revenue fell 69% to $1.9 billion from $6.1 billion in last year's first quarter. Analysts were looking for Moderna to report revenue of $1.2 billion. The company beat the Street's top-line forecast thanks to revenue deferred from 2022.

Moderna vaccine launches on tap

Moderna has next generation COVID-19 vaccines under development, as well as vaccinations for influenza and respiratory syncytial virus (RSV). Other areas of research include immuno-oncology, rare diseases, autoimmune diseases and cardiovascular diseases.

"Importantly, Moderna is preparing for six major vaccine launches from its respiratory franchise, with expected annual sales of $8 billion to $15 billion by 2027," notes Lee Brown, global sector lead for healthcare at research firm Third Bridge. "The company also plans to begin a Phase 3 trial of mRNA-4157, an individualized neoantigen therapy (INT) in combination with Keytruda for melanoma. mRNA-4157 has the potential to profoundly change the treatment of melanoma."

For now, however, Moderna remains a one-trick COVID-19 vaccine pony. Helpfully, it gave investors a shot of good news on that front following its earnings report.

Moderna CEO Stéphane Bancel said the company is in discussions with the European Union to supply Europe with vaccines for the fall of 2023 – a time when new coronavirus cases are expected to pick up. MRNA shareholders were deeply concerned by media reports surfacing early this week that Moderna could be shut out of the European COVID-19 vaccine market.

MRNA stock added more than 6% at one point in early intraday trading, but it still has a long way to go to reclaim anything like its all-time highs. Shares have lost almost three-quarters of their value since setting a record close in August 2021.

Although the selloff has made the valuation more attractive, Wall Street remains somewhat split on whether MRNA stock offers a good entry point. Of the 21 analysts covering the stock surveyed by S&P Global Market Intelligence, six call it a Strong Buy, five say Buy, nine have it at Hold and one says Sell. That works out to a consensus recommendation of Buy, with mixed conviction.

Analysts' price targets also reflect widely different outcomes. Although the Street's average price target of $218.88 gives MRNA stock implied upside of 60% in the next year or so, those targets range from a high of $430 a share to a low of $93. Should the Street's most bearish forecast come to pass, MRNA would fall roughly 30% from current levels.