/Moderna%20Inc%20meds-by%20Ascannio%20via%20Shutterstock.jpg)

With a market cap of $10.7 billion, Moderna, Inc. (MRNA) is a biotechnology company specializing in the development of messenger RNA (mRNA) medicines. The company offers a broad pipeline that includes respiratory and latent virus vaccines, oncology therapeutics, and rare disease treatments, and has strategic collaborations with major global partners.

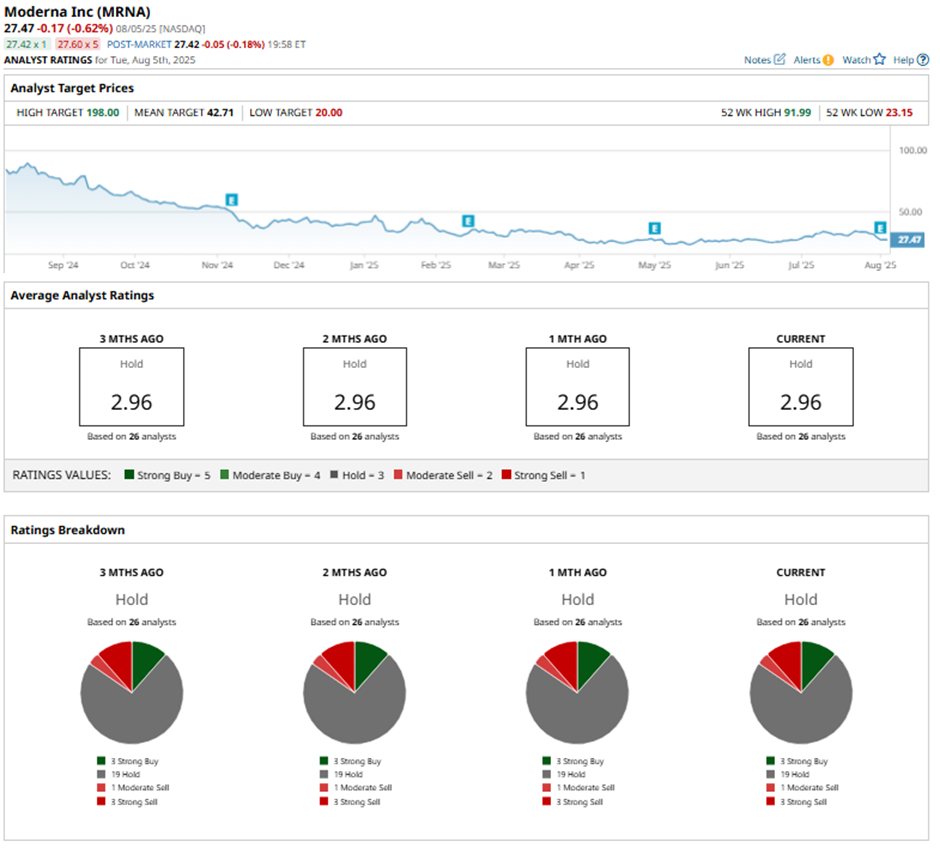

Shares of the Cambridge, Massachusetts-based company have significantly underperformed the broader market over the past 52 weeks. MRNA stock has tumbled 67.2% over this time frame, while the broader S&P 500 Index ($SPX) has gained 21.5%. Moreover, Moderna's shares have plunged 33.9% on a YTD basis, compared to SPX's 7.1% rise.

Looking closer, the biotechnology company stock has also lagged behind the Health Care Select Sector SPDR Fund's (XLV) 9.8% decrease over the past 52 weeks.

Despite reporting a better-than-expected Q2 2025 loss of $2.13 per share and revenue of $142 million, Moderna shares dipped 6.6% on Aug. 1 due to trimmed 2025 revenue guidance of $1.5 billion - $2.2 billion. The revision stemmed from deferred UK COVID vaccine deliveries and highlighted broader concerns, including a 41% year-over-year revenue drop, slumping COVID demand, slower-than-expected RSV rollout, and regulatory delays. Additionally, the company faces mounting pressure to cut costs, targeting a $400 million reduction in 2025, after pandemic-era profits faded.

For the fiscal year ending in December 2025, analysts expect Moderna’s loss per share to decline 13.6% year-over-year to $10.08. However, the company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

Among the 26 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings, 19 “Holds,” one “Moderate Sell,” and three “Strong Sells.”

On Aug. 4, BofA analyst Tim Anderson lowered Moderna’s price target to $24 and maintained an “Underperform” rating.

As of writing, the stock is trading below the mean price target of $42.71. The Street-high price target of $198 implies a significant potential upside from the current price levels.