/Moderna%20Inc%20meds-by%20Ascannio%20via%20Shutterstock.jpg)

Moderna (MRNA), with its widely used COVID-19 vaccine, rose to prominence during the global pandemic. The stock soared an eye-catching 838.4% between 2020 and 2022.

But the company is now stepping into a new era to prove that its mRNA technology can deliver beyond COVID-19. With new vaccine approvals, an expanding pipeline, and ambitious bets on cancer and artificial intelligence, the company is attempting to reinvent itself. But as coronavirus sales fade and competition grows, the question arises whether Moderna’s comeback is built on real progress or just renewed hype.

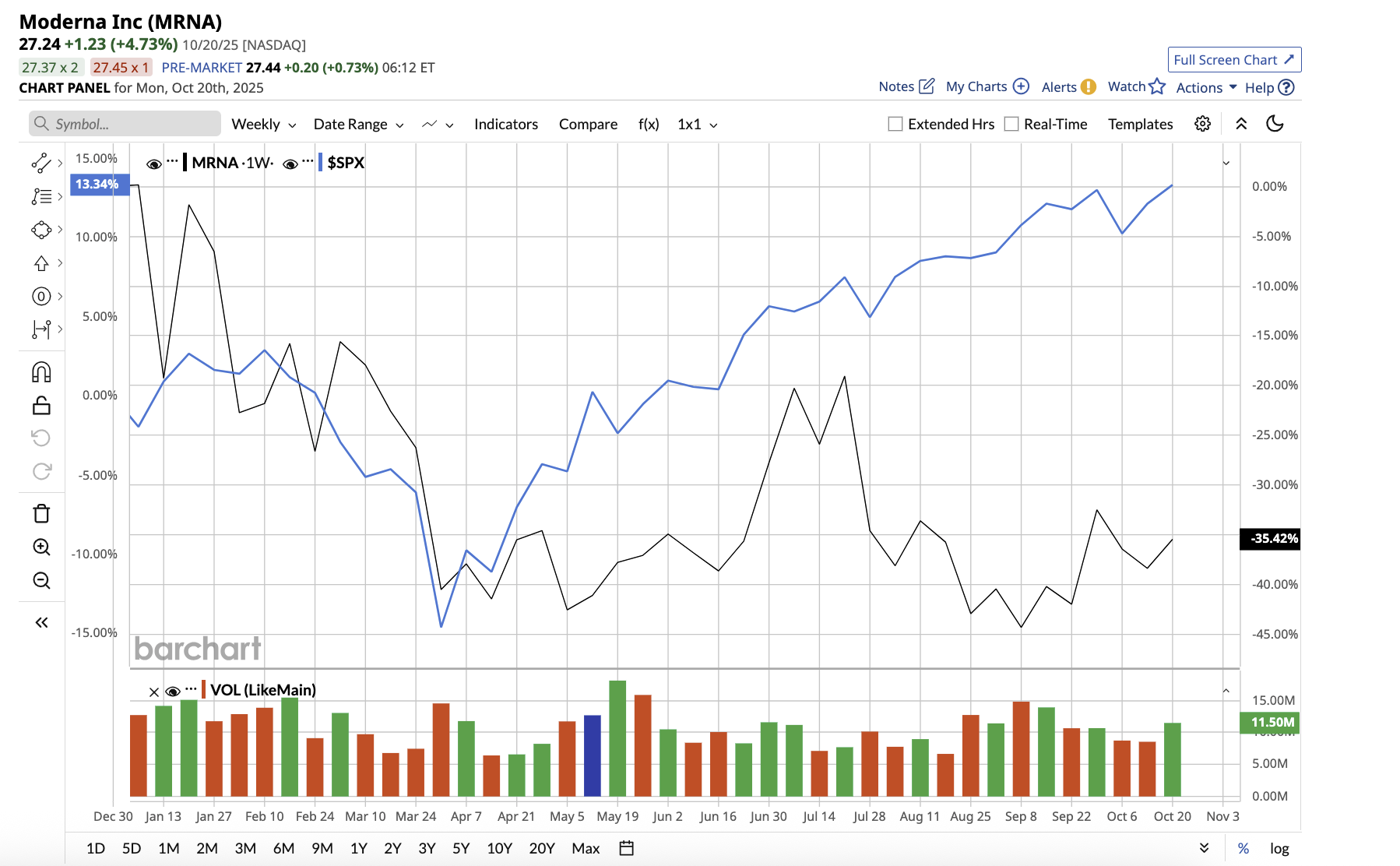

Moderna stock is down 34% year-to-date, underperforming the overall market gain of 14.6%. Let’s find out if Moderna is still worth buying or holding on to.

Financial Discipline Amid Deep Losses

Moderna’s second-quarter results showed a company still dealing with post-pandemic challenges but determined for a comeback built on discipline, cost control, and scientific execution. The company reported total revenue of just $142 million, a steep decline from its pandemic-era highs. It also posted a net loss of $825 million, though that represented a marked improvement from the $1.3 billion loss a year ago.

Despite the sharp loss, Moderna’s cash and investment reserves remain strong at $7.5 billion, providing a significant cushion as it navigates a post-COVID-19 environment. Moderna has slashed operational expenses by 40% year over year on a cash-cost basis, saving $581 million in spending compared to the same period in 2024. The company has reduced combined R&D, SG&A, and cost of sales by 35%, marking the fourth consecutive quarter of double-digit reductions in overheads.

On the commercial front, Moderna received three significant FDA approvals this year, including the next-generation COVID-19 vaccine mNEXSPIKE, mRESVIA (an RSV vaccination now approved for high-risk individuals aged 18-59), and full approval of Spikevax for children aged six months to 11 years old. These milestones show meaningful progress toward Moderna’s goal of stabilizing and expanding its vaccine portfolio in the post-pandemic era.

Moderna’s pipeline development is more important than ever. The company revealed promising Phase 3 data for its flu vaccine, which might lay the groundwork for a future flu-COVID-19 combination shot, a possible commercial differentiation in a crowded market. Aside from respiratory programs, Moderna’s non-respiratory vaccination and rare disease portfolios are continuously growing. Moderna is also deepening its oncology relationship with Merck (MRK), with a focus on customized neoantigen therapy and Intismeran (mRNA-4157).

Relentless Focus on Cost Reduction

Moderna’s ambition to build a diverse mRNA portfolio comes with significant financial costs, especially as it continues to invest in late-stage development for flu, CMV, and norovirus vaccines, as well as early stage oncology programs. To accomplish this goal, CFO James Mock laid out a multi-year strategy to lower yearly operational expenses from $11 billion in 2023 to $5 billion or less by 2027. The company intends to reach the majority of this, around $5 billion, by the end of 2025, with an additional $1 billion expected by 2027.

Moderna intends to achieve these cuts through the completion of significant Phase 3 trials, production efficiencies, procurement savings, and workforce reductions. This aggressive cost discipline reflects a hard reset for a company once geared for pandemic-scale demand. Moderna has revised its 2025 revenue guidance to a range of $1.5 billion to $2.2 billion, trimming the high end by $300 million due mainly to timing shifts in United Kingdom vaccine shipments to early 2026. Despite sustained losses, Moderna aims to have roughly $6 billion in cash and investments by the end of the year, providing a financial runway for current operations and future launches.

A Company at a Crossroads

Moderna remains a company in transition. The company is leaner, more disciplined, and strategically refocused, with a strong pipeline, but it also faces the harsh reality of a declining COVID-19 vaccination market and slow commercial adoption of new products. Long-term investors who still believe that Moderna can turn around its story might want to buy the stock on the dip now or hold on to the stock.

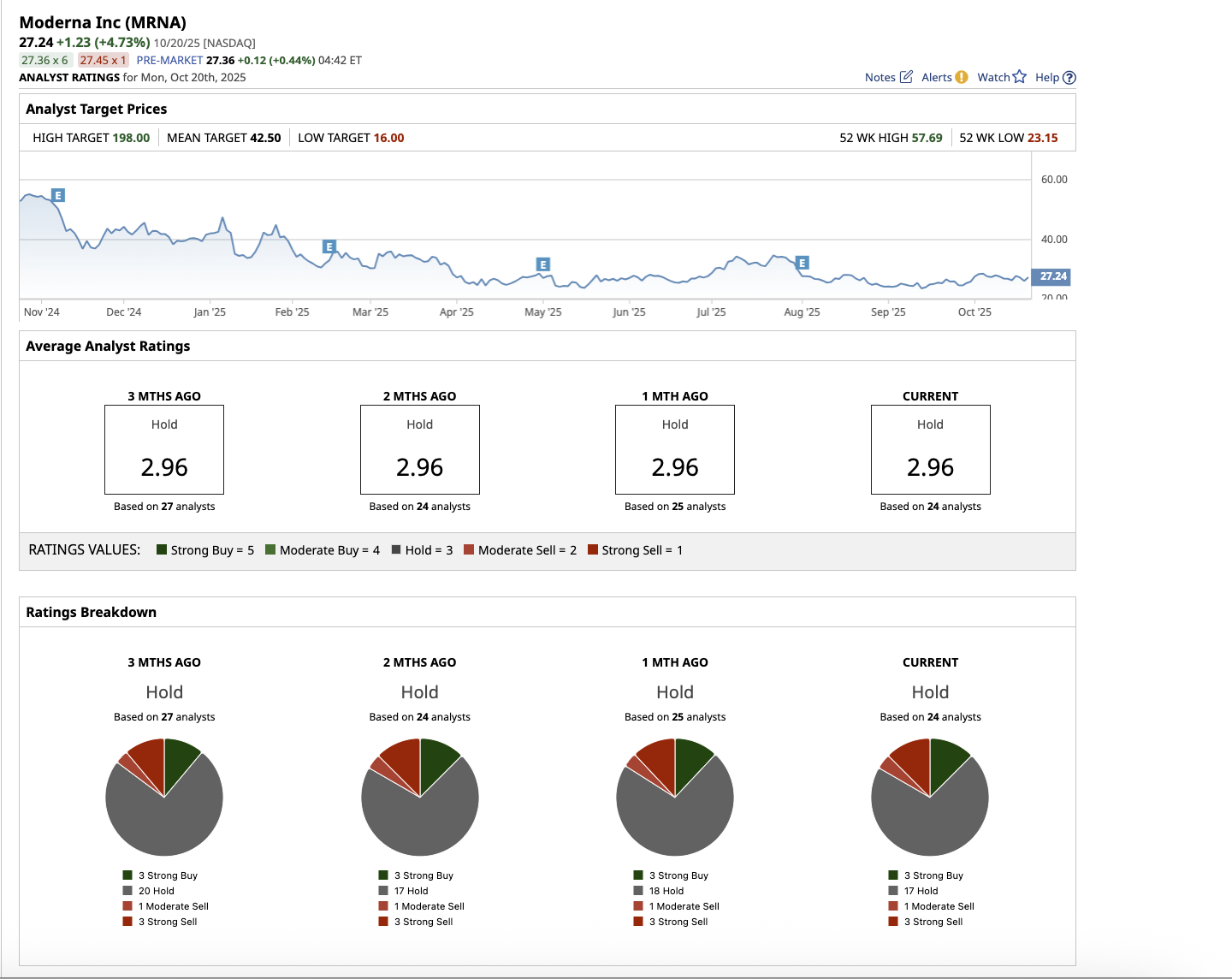

Is Moderna a Buy, Hold, or Sell on Wall Street?

On Wall Street, the consensus for Moderna stock is a “Hold.” Of the 24 analysts covering the stock, three rate it a “Strong Buy,” 17 rate it a “Hold,” one says it is a “Moderate Sell,” and three rate it a “Strong Sell.” The average target price of $42.50 implies the stock can rally 56% from current levels. The high price estimate of $198 suggests the stock can rally by around 627% over the next 12 months.