/Moderna%20Inc%20meds-by%20Ascannio%20via%20Shutterstock.jpg)

Valued at $10.7 billion by market cap, Moderna, Inc. (MRNA) is a biotechnology company specializing in the development and commercialization of messenger RNA (mRNA) therapeutics and vaccines. The Cambridge, Massachusetts-based company is best known for its COVID-19 vaccine (mRNA-1273, branded as Spikevax), which was one of the first mRNA vaccines authorized for emergency use globally.

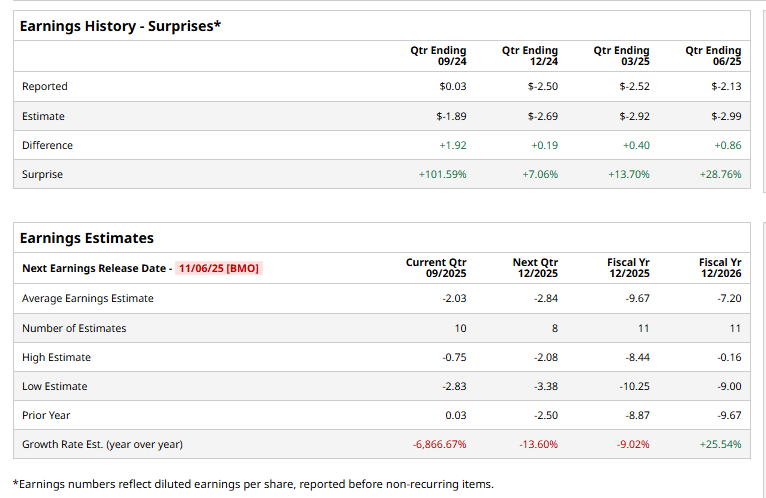

The healthcare major is expected to announce its third-quarter results on Thursday, Nov. 6. Ahead of the event, analysts expect Moderna to deliver a loss of $2.03 per share, down significantly from the profit of $0.03 per share reported in the year-ago quarter. On a positive note, the company has surpassed the Street’s bottom-line estimates in each of the past four quarters.

For fiscal year 2025, analysts expect the company to report a loss of $9.67 per share, 9% below the $8.87 per share loss in 2024.

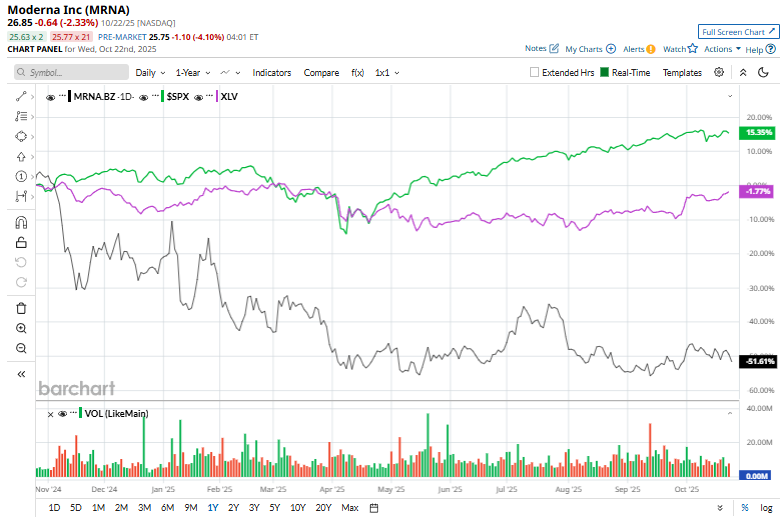

MRNA stock has plummeted 49.7% over the past 52 weeks, significantly lagging behind the S&P 500 Index’s ($SPX) 14.5% gains and the Health Care Select Sector SPDR Fund’s (XLV) 3.4% decline during the same time frame.

On Oct. 13, shares of Moderna rose marginally after the company reported encouraging early results for its investigational cancer therapy, mRNA-4359, in combination with Merck’s Keytruda. Phase I/II data presented at the European Society for Medical Oncology Congress showed a 24% objective response rate in melanoma patients, rising to 67% among those with PD-L1–positive tumors, and a 60% disease control rate overall.

The stock has a consensus “Hold” rating overall. Of the 24 analysts covering the stock, opinions include three “Strong Buys,” 17 “Holds,” one “Moderate Sell,” and three “Strong Sells.” Its mean price target of $42.45 implies an upswing potential of 58.1% from the prevailing price levels.