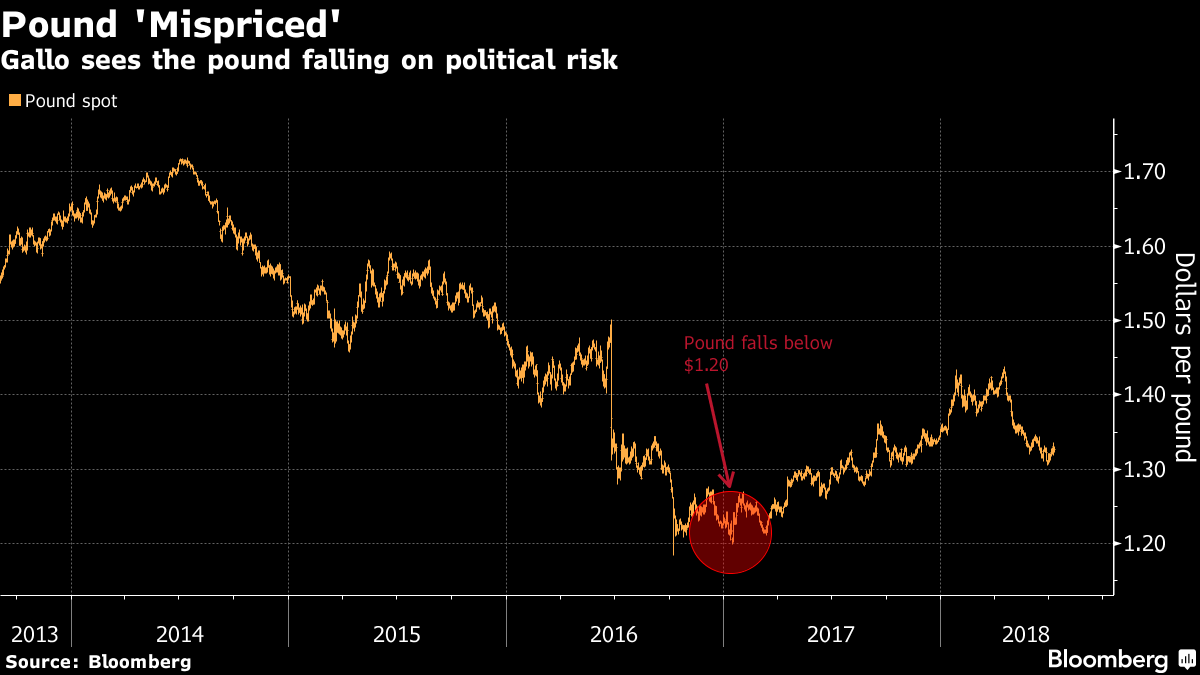

The pound is mispriced and should be almost 10 percent lower for Algebris Investments.

With the currency showing a limited reaction this week to the resignation of two senior U.K. cabinet ministers, the market is too comfortable in the short term with political uncertainty, according to Alberto Gallo, portfolio manager at Algebris. Traders are overestimating the chances for a Bank of England interest-rate increase, he said.

“In this uncertain environment, with potentially a fall in the government, we don’t think the BOE can hike rates,” Gallo said in an interview with Bloomberg Television. “There is a serious risk that the U.K. will have to print its way out of trouble but in doing that, they will issue more debt,” he said, referring to the possibility of greater bond issuance under a hard Brexit scenario or the opposition Labour party coming to power.

The pound, now trading around $1.32, should be much closer to $1.20, he said. It was last at that level in January 2017. Money markets see a 76 percent chance there will be a BOE move in August.

--With assistance from Francine Lacqua and Tom Keene.

To contact the reporter on this story: Ellen Milligan in London at emilligan11@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Neil Chatterjee

©2018 Bloomberg L.P.