What has happened since the industry last gathered for this otherwise annual conference, in 2019?

The biggest changes have been pandemic related with all of the health and safety challenges of COVID for the mines operating during that time.

The initial impact in early 2020 was a sharp fall in the coal price to below $US50 a tonne but obviously since then with the global economic stimulus and the cushioning of what was thought would be a big global downturn, and a lack of new supply into the global coal market, the prices are at record levels and have been sustained for the past six months or so.

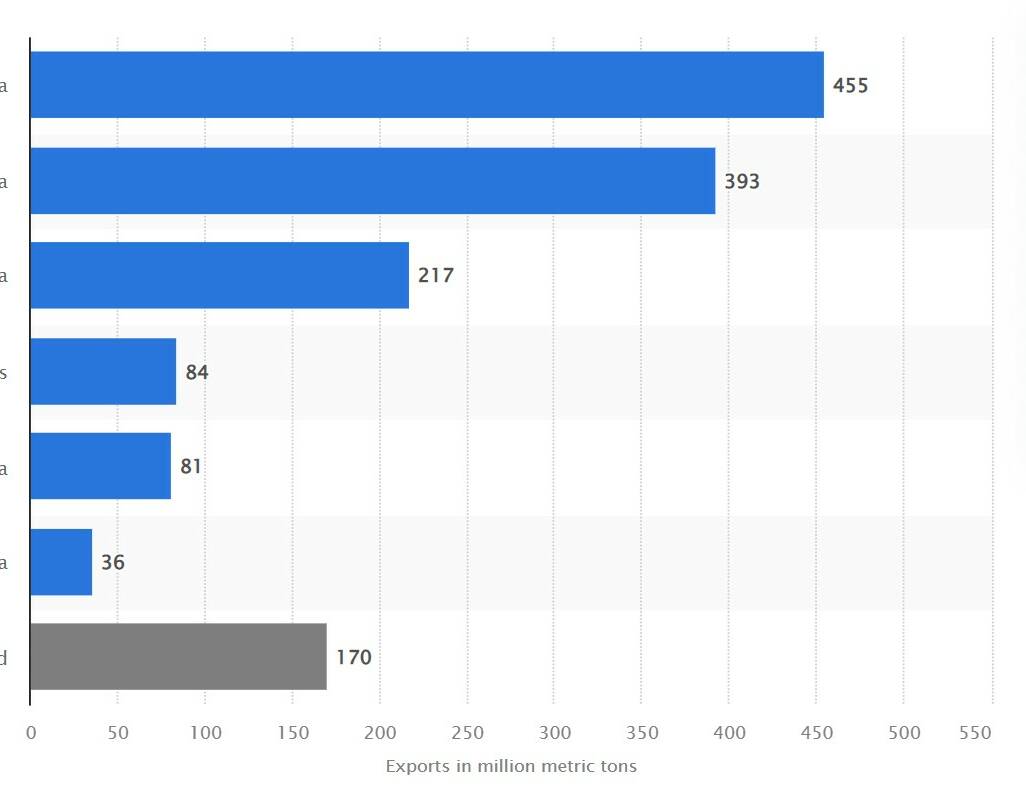

We have also seen changes in the mix of our trading relationships as a major exporter of coal with a fall to the point where there is no Australian coal going to China, whereas previously it had been at about 18 per cent of our export market.

To their credit, there was a pretty nimble and quick response of export producers into other markets so that we have been able to sustain our level of export volume without too much trouble.

Do you see a return of Australian coal exports to China?

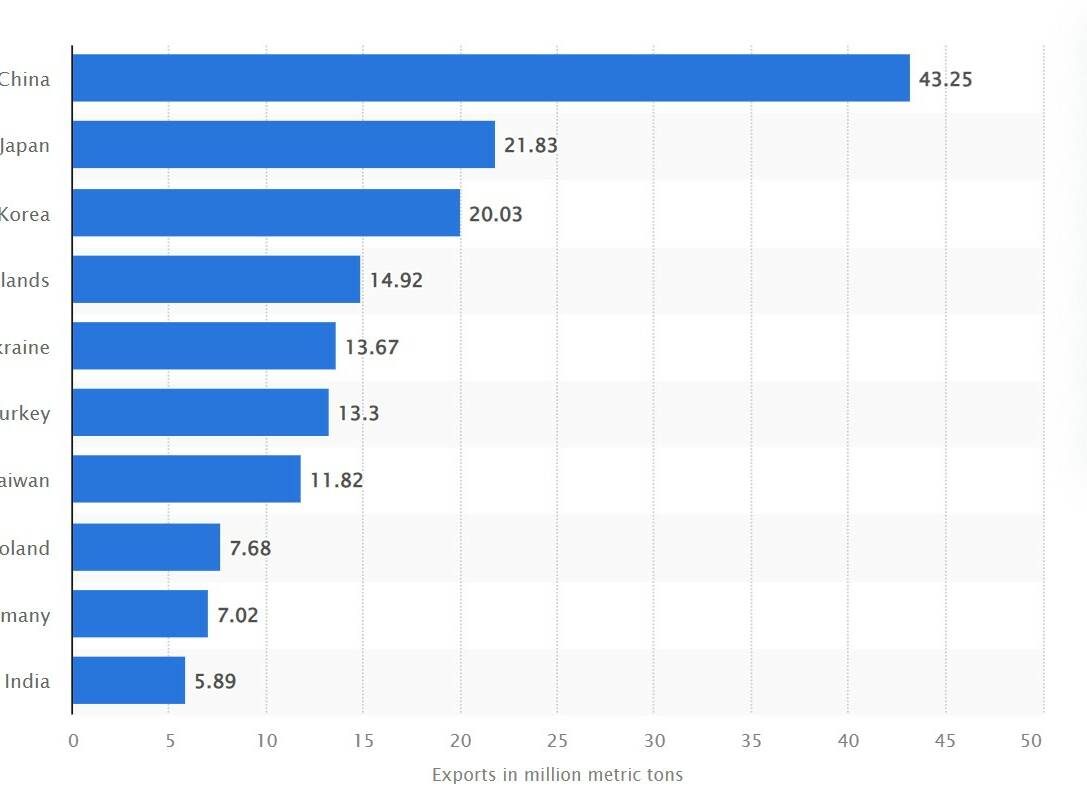

If there was to be a return to exporting into China - and the industry would welcome that - I think the big challenge is going to be finding the coal.

Because of the switch by exporters into other markets, coal that would otherwise have gone to China has gone elsewhere and with a lack of significant new supply coming into the market it's going to be a challenge for China to win that back.

They may have missed the boat, in other words?

It's quite possible that literally that may be the case.

And all the coal that was either at Chinese bans or en route when the ban began in late 2020 has now been freed up?

Yes.

In tonnage terms, China could be self-reliant, yet it generally imports about 10 per cent of its needs. Why?

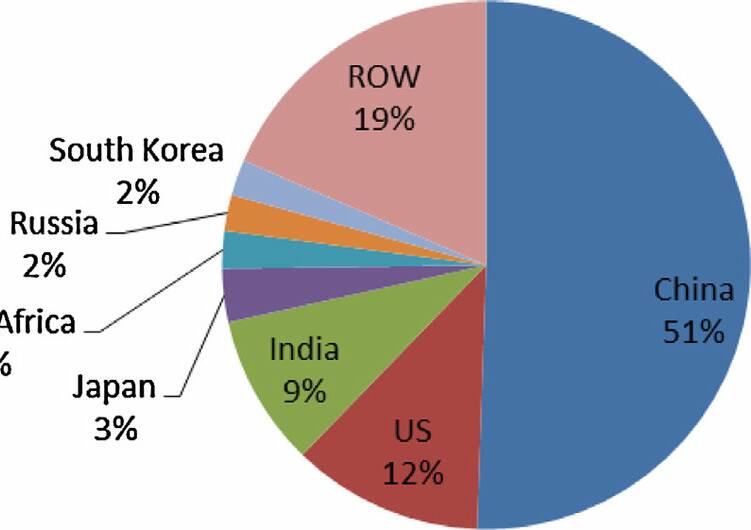

It's a quality thing. China produces about half the world's coal and uses half the world's coal and about 10 per cent of its imported. Historically they've imported coal to bring up the overall quality of the domestic product in both thermal and coking coal. Depending on price points that's how its been used in the past.

Different power stations have different specifications but they generally run better with higher quality coal. China is still building power stations and they need more high quality coal to blend in with the lower quality.

Notwithstanding the high price of coal right now, there are cost issues relating to transport; from the western part of China to the coast, compared with the cost of bringing coal from Newcastle.

We're competitive on those costs?

Potentially, yes.

Thermal coal is selling for an unprecedented $US400 a tonne. How long do you think this run will go for?

The best indication we have is looking at the futures prices are, the spot prices for the future and over the next few years we still expect to see prices for the next few years of above $US250.

Given the apparent shortage of coal and continued need for it during the transition, do you see new mines opening in NSW, or major brownfields extensions?

Part of the reason those prices are at those levels is the war in Ukraine. Russia was a big exporter of coal into Europe, even though coal was being phased out of Europe, they were relying on Russian gas to do that.

The global supply and demand situation with coal speaking generally is usually pretty finely balanced so when you get these demand impacts it can have a sharp effect on price and we've seen that in the past with weather effects and that sort of thing, including those months when the NCIG terminal lost a coal loader to storm damage in November 2020.

It's having an impact in a bigger way here because Russia coal exports into Europe, and the absence of it, is enough to have an impact on the global seaborne demand in a tight market when there is no real new supply coming through.

The current prices are extremely high, but long term they are probably not sustainable.

The situation in Europe is putting upward pressure on coal prices and it caused the pace of Europe's transition away from coal to be slowed, and probably delayed their progress on that for several years.

A resolution of the war in Ukraine would potentially see a return to the path they were on over time but it's pretty clear, generally, there's an expectation that coal prices will be elevated for some time to come, which makes managing issues relating to transition pathways a bit easier.

What do you see with future baseload power, given it is now accepted we need to build a grid two to three times the capacity of our usual daily demand to make it work?

I just can't see a scenario where our current coal-fired power stations are allowed to close prematurely despite the wishes of some for them to be shut immediately because I don't think any responsible government is going to allow that to happen.

I still expect Liddell is likely to shut on the announced time frame, because that has already been extended, I don't personally believe Eraring will cease operations in 2025, brought forward from the original date of 2032 - potentially seven years earlier and only three years away - because I cannot see a scenario where there is sufficient replacement capacity in the grid in its current form to cover the demand that is going to be there.

It's a storage issue?

It's a storage and transmission issue. I think 2032 is possible because if there is sufficient investment in the NSW government renewable energy zones, and if there is sufficient investment in the transmission mechanism to get that renewable energy from the various to the homes and businesses at sufficient scale, then it's possible there can be an orderly transition away from coal-fired power stations over time but also there is a technology gap in the necessary storage to provide sufficient backup.

It's one thing to have three times the amount of energy generated that you need because its renewable because its wind and solar (and, therefore, intermittent), but you need to be able to store it.

Generally the accepted approach is that if you have a market that needs, say, 10,000 megawatts (Note: roughly NSW average demand) you've got to be able to generate 30,000 megawatts and store it.

If governments try and force the pace of this too quickly they will put affordability and reliability at risk and public support for the emissions reduction measures will fade as well they have to do this in a measured and considered way.

So if prices rise too high and blackouts happen then we will lose the public will for the transition?

Absolutely. There is no question that would happen.

Does the Minerals Council have a voice at the table in making these transition decisions?

We talk to government about these things and there is an understanding generally that the NSW energy market is changing we've been part of that discussion for many years.

But only a small amount of the coal mined in NSW goes into NSW power stations. It's an important issue for Centennial Coal - a company with a substantial domestic contract book - and its employees, but it's not going to make or break the future of the NSW coalmining sector.

The discussions I have to highlight the things we have been talking about.

The risks of doing this too quickly, the risk to those mines that supply domestic coal and changes to the publicly agreed timetable for the retirement of those power stations and generally the need for adequate replacement baseload capacity for the transition journey that the government wants to take.

We are also involved in the non-coal sector with the so-called 'green metals', there are lots of opportunities there, with something like 13 new projects in the planning pipeline right now.

When I started 10 years ago, 20 per cent of our membership was non-coal. Now it's over a third, because of this.

In the NSW planning system its much the same trend. Previously, about 20 per cent of projects were non coal its now well over a third and 13 or so metals projects including 10 for brand new mines and the potential for 8000 new mining jobs.

Cobalt projects, nickel projects, silver projects, gold, copper, zirconium, there's an iron ore project looking west of Broken Hill and we see significant opportunities for growth.

The general approach of the government at federal and state levels is support for coalmining as long as there is a market for it.

The minerals market is geopolitical. There are limited resources for a lot of these things, some controlled by China, a lot in Africa and we have an abundance of them here in NSW.

The NSW government recently released a critical minerals strategy that highlights this and we are talking with them about a $130 million Critical Minerals and High-tech Metals Activation Fund announced at this year's state budget.

As to its structure, as far as I know the mechanisms are still being worked through.

(Note: The Regional NSW website describes the fund as a five-year program granting directly to projects, with consultation starting this month and expressions of interest for first-round funding to be invited later this year.)

RELATED READING: The Herald's full Power and the Passion energy transition file