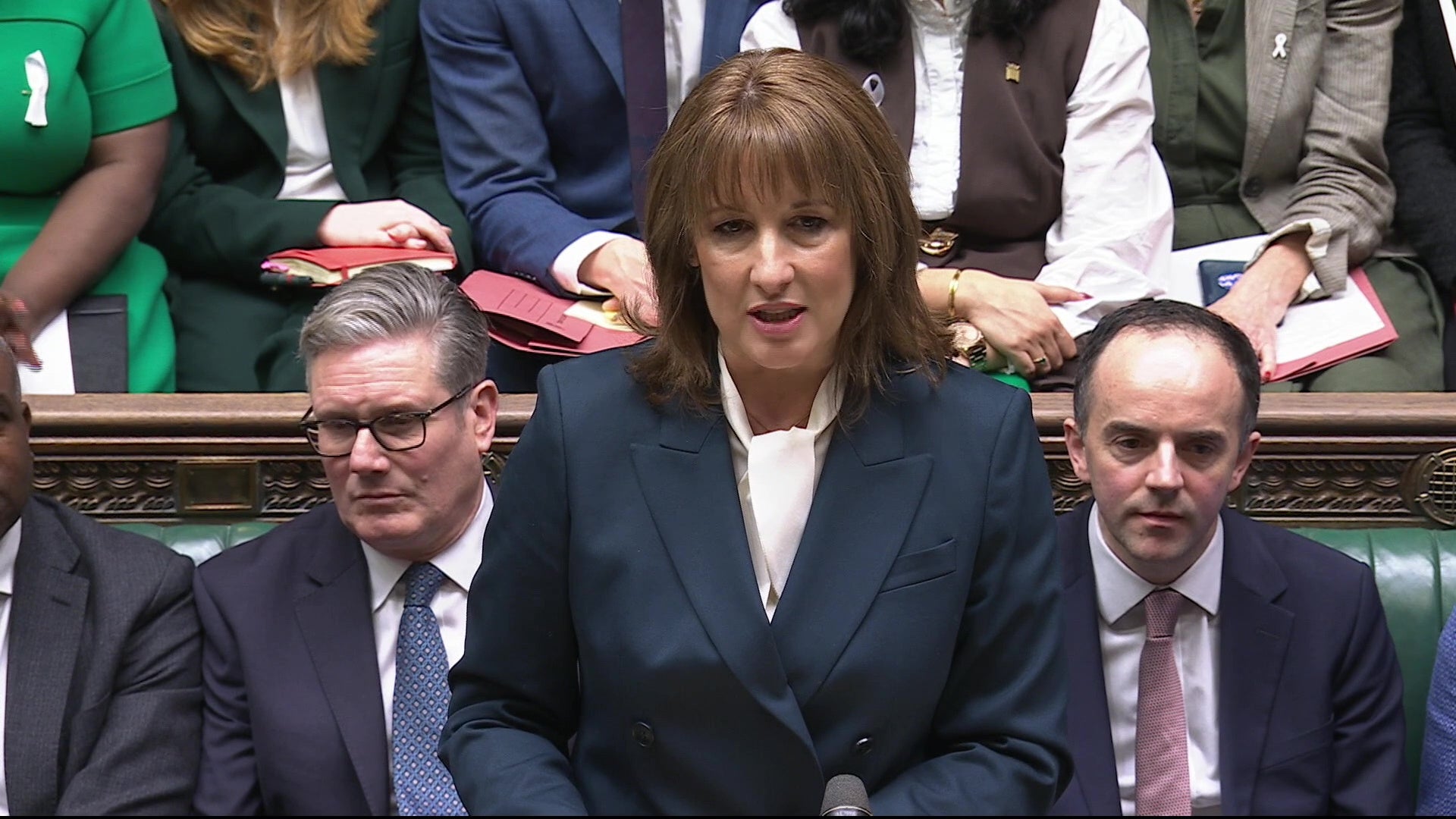

Millions more people will be dragged into paying higher income tax after Rachel Reeves bet her political future on a £26bn tax raid on the middle classes in her make-or-break second Budget.

In what she branded a “Labour values” Budget, the chancellor moved to appease the left in her party with a package of measures that included 43 separate tax rises – according to shadow chancellor Sir Mel Stride – taking the tax burden in the UK to its highest level in history. But she finally brought an end to the much-criticised two-child benefit cap, which campaigners say will help lift thousands of children out of poverty, and announced a £73bn splurge in welfare spending.

The decision to freeze tax thresholds in this Budget from 2028/29 onwards, to help fill a £20bn black hole in public finances, will raise £8bn in 2029-30 and drag one in four workers into the highest tax band. A further 780,000 people will pay tax for the first time.

In a wide-ranging Budget, the chancellor announced a raft of measures, including:

But the plans were not enough to generate the economic boost the chancellor had hoped for, with the Office for Budget Responsibility (OBR) watchdog downgrading her economic growth projections by 0.3 per cent and saying none of her measures helped improve the figure.

Speaking at a press conference at a hospital in London after the Budget, Ms Reeves insisted that the plans would build “our economic resilience for the future”.

She said: “I have asked everyone to contribute – yes, for the security of our country and the brightness of its future. But I have kept that contribution as low as possible by reforming our tax system, making it fairer and stronger for the future.”

Later, she added: “I do recognise I am asking ordinary people to pay a little more, but I am asking those with the broadest shoulders to pay more. I acknowledge this has a cost to working people.

“If you are asking if this was a Budget I wanted to deliver today, I would have rather the circumstances were different.”

The chancellor’s second Budget has been lampooned as “the most chaotic in living memory” for the number of leaks and U-turns which preceded it. But she was further embarrassed when the OBR accidentally published its verdict on her plans minutes before she even got to her feet to announce them. It apologised for the leak and launched an inquiry.

At the top of the announcements was the decision to freeze income tax thresholds again until 2031, meaning that by then, 920,000 more people will be paying the 40p higher rate.

The chancellor admitted that this breached the election manifesto promise of not raising income tax, but insisted “everyone must pay their part”. But even the trade union Unison, which funds the Labour Party, warned that freezing thresholds was “the opposite of putting money in working people’s pockets”.

Along with the income tax move, the chancellor also hit middle-class voters with a new limit of £12,000 a year on tax-free cash ISA savings, a landlord tax of an extra 2 per cent from rental earnings, and pension contributions made under salary sacrifice schemes of more than £2,000 per year will now be hit with national insurance contributions from 2029. There was also a mansion tax of £2,500 on properties worth £2m or more and £7,500 on properties worth more than £5m.

But she was loudly cheered when she announced the scrapping of the two-child benefit cap at an annual cost of £3.6bn, a move which she had initially resisted but was demanded by Labour MPs and child poverty campaigners, including the former prime minister Gordon Brown.

She agreed to hit gambling companies with a higher tax to help pay for it, raising the levy on remote gaming from 21 per cent to 40 per cent, and on online betting from 15 per cent to 25 per cent.

Ms Reeves also abandoned welfare cuts and allowed the bill to rise by £73bn to more than £400bn by 2030 after the humiliation of the U-turn on attempted benefits cuts before the summer.

And drivers of electric vehicles will have to pay 3p per mile in a new tax, which could include miles driven abroad because it will be calculated on MOT data.

Conservative Party leader Kemi Badenoch said the Budget was a “total humiliation” for Ms Reeves and called for her to resign. She claimed the Budget was “littered with broken promises” and “really should be her last”, adding that Ms Reeves has lost credibility and trust with the public.

She said: “It’s a total humiliation. Last year she put up taxes by £40bn, the biggest tax raid in British history. She promised that she wouldn't be back for more. She swore it was a one-off. She told everyone that from now on it would be stability, and she would pay for everything with growth. Today, she has broken every single one of those promises. If she had any decency, she would resign.”

Meanwhile, the Reform UK leader, Nigel Farage, predicted the chancellor’s pensions raid could collapse the private pension market. “It is an assault on aspiration and an assault on saving,” he said.

In its initial Budget reaction, the Institute for Fiscal Studies said the chancellor had “found a way to cobble together a sizeable package without increasing the main rates of national insurance contributions, VAT or income tax”. But business warned over her failure to improve economic growth. Tina McKenzie, policy chair of the Federation of Small Businesses, said: “This tax-raising Budget shows the peril of a continuing economic doom loop – we must not be in the same place again next year, with more tax hikes to balance the books due to a lack of economic growth. The tax burden at a record high is the cost of failure to get growth and trim spending.”