Javier Milei‘s unexpected landslide in Argentina's midterm elections is electrifying the country’s assets, with stocks and bonds surging in a show of confidence rarely seen among emerging market investors.

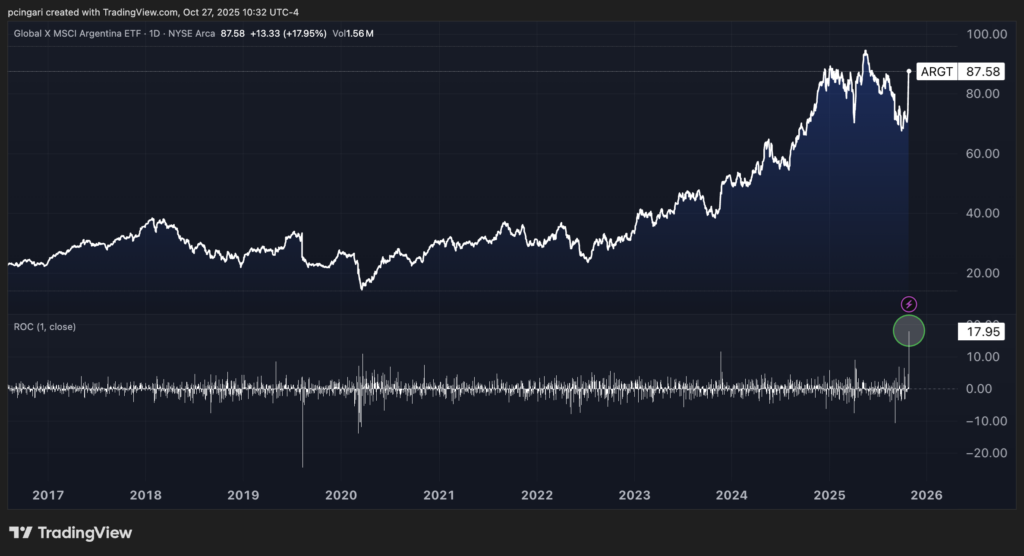

The Global X MSCI Argentina ETF (NYSE:ARGT), the only U.S.-listed ETF focused solely on Argentine equities, rallied over 18% Monday morning, on track for its largest daily gain ever. At the same time, dollar-denominated Argentine bonds jumped 10 to 15 cents, reflecting a sharp compression in political risk after the vote.

The market's euphoria reflects the scale of Milei's political breakthrough, as his libertarian coalition La Libertad Avanza secured 41% of the national vote and is set to nearly triple its congressional representation—jumping from 37 to 101 deputies and from 6 to 20 senators.

With this surge, Milei now holds the legislative firepower to accelerate his sweeping libertarian reforms, from slashing government spending to overhauling Argentina's tax system.

Chart: Argentina’s Equity ETF Jumps After Milei’s Midterm Election Victory

The Virtuous Cycle Can Resume

"The result brings back the prospect that Argentina might regain market access," said Adrián Yarde Buller, chief economist at Facimex Valores, in comments published by local newspaper La Nación.

"With political uncertainty behind us, we could see a significant drop in country risk and a jump in both dollar- and peso-denominated bonds."

Yarde Buller added that Argentina may once again be viewed as investable, as Milei's strengthened mandate opens the door to "a reinforced version of the virtuous cycle that characterized his program earlier this year."

Wall Street Cheers, Washington Doubles Down

The vote also drew praise from Washington. Treasury Secretary Scott Bessent called Milei's renewed mandate a "clear example" that U.S. policy in the region is working.

"Argentina is a vital ally in Latin America," Bessent said in a statement on X, adding that economic freedom would attract fresh private sector investment and jobs.

In the days before the vote, the Trump administration greenlit a $40 billion bailout deal with Argentina. The package includes a $20 billion currency swap with the U.S. Treasury to help stabilize the peso, plus another $20 billion in combined funds from sovereign wealth funds and private banks.

The swap was finalized on Oct. 20.

Milei responded to Secretary Bessent's message on X, calling the midterm outcome "a triumph of the Argentine people’s unyielding spirit for freedom, prosperity, and the defeat of the socialist scourge that has plagued our nation for far too long."

He praised the Trump administration's economic vision, saying it aligns with his own push for liberty, and added that the U.S.-Argentina alliance under Trump's leadership would unlock "unprecedented investment, innovation, and growth."

"Together, we will build a future where chainsaws cut through bureaucracy, not dreams," Milei wrote, referencing his signature metaphor for slashing state spending.

Milei also expressed gratitude to President Donald Trump in a post on X, thanking him for his support and affirming their shared commitment to defending Western values and economic freedom.

5 Argentine Stocks That Exploded Over 35%

The biggest impact of Milei's election victory was felt in U.S.-traded Argentine stocks (ADRs). The following five names saw explosive rallies Monday morning, all gaining more than 34%:

- Grupo Supervielle S.A. (NYSE:SUPV) surged 44.87%

- Banco BBVA Argentina S.A. (NYSE:BBAR) jumped 37.50%

- Empresa Distribuidora y Comercializadora Norte (NYSE:EDN) climbed 35.56%

- Central Puerto S.A. (NYSE:CEPU) rose 35.03%

- Grupo Financiero Galicia S.A. (NASDAQ:GGAL) advanced 34.85%

Now read:

Photo: Shutterstock