/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

Microsoft (MSFT) will announce its fourth quarter fiscal 2025 earnings on July 30. Investors have been bullish ahead of the results, driving the stock to a record high of $518.29 on July 25. So far in 2025, shares are up a robust 21.5%, powered by strong demand for Microsoft’s cloud and artificial intelligence (AI) offerings.

This recent rally has pushed Microsoft’s valuation higher. However, analysts remain confident there’s still room for upside, especially as global demand for cloud services and generative AI solutions continues to accelerate.

Recent quarterly results from Alphabet (GOOGL), which reported robust growth in its own cloud and AI solutions, have only added to the positive sentiment surrounding Microsoft. Like Alphabet, Microsoft is deeply embedded in the AI and enterprise cloud landscape, and it’s benefiting from similar tailwinds.

For instance, Microsoft Cloud brought in more than $42 billion in revenue in Q3, a 22% increase. This reflected strong and growing demand for its solutions. Furthermore, Microsoft’s AI portfolio is also gaining traction, with its AI-related revenue climbing steadily.

The company has also been aggressively expanding its infrastructure to meet this rising demand. Its ongoing investments in data center capacity are designed to keep pace with the AI boom and ensure it can support future growth.

In short, Microsoft’s leadership in both AI and cloud will continue to pay dividends in Q4, driving its financials.

With strong tailwinds behind it, Microsoft could once again deliver solid quarterly revenue and earnings.

Microsoft Q4 Earnings: Cloud and AI Set to Lead Growth

Microsoft is poised to report another strong quarter, with its fourth-quarter financials expected to reflect continued momentum mainly driven by its cloud and AI offerings.

In the Productivity and Business Processes segment, Microsoft anticipates revenue between $32.05 billion and $32.35 billion, representing double-digit growth. This growth is expected to be supported by steady demand for Microsoft 365 (M365) Commercial cloud services. Revenue in this category is projected to rise around 14%, with average revenue per user benefiting from greater adoption of premium offerings such as E5 and AI-enhanced M365 Copilot. Additionally, small and medium-sized businesses continue to drive the expansion of Microsoft’s customer base.

M365 Commercial product revenues, which include more traditional software purchases like Office and Windows on-premises components, are expected to see moderate mid-single-digit growth. M365 Consumer cloud, however, is likely to grow in the mid-teens, aided by the price increase introduced in January.

LinkedIn is poised to deliver high single-digit growth, buoyed by increasing member engagement and platform expansion. Meanwhile, Dynamics 365 is expected to see revenue grow in the mid to high teens, with strong demand across all workloads.

The Intelligent Cloud segment, a significant growth engine for Microsoft, is projected to generate revenue between $28.75 billion and $29.05 billion, up 20% to 22% in constant currency. Much of this will be fueled by strong demand for Azure, with revenue in the cloud platform anticipated to rise 34% to 35%. Azure’s non-AI services are growing steadily, but AI services are expanding even faster.

Conversely, the on-premises server business is expected to decline in the mid-single digits as more customers shift to cloud-based solutions. Enterprise and partner services should grow in the mid to high single digits, driven by steady demand for support services.

In the More Personal Computing segment, revenue is forecasted between $12.35 and $12.85 billion. Windows OEM and Devices revenue are likely to decline, reflecting ongoing normalization in inventory and weak device demand. Still, Search and news advertising is a bright spot, with revenue growth expected in the mid to high teens, supported by gains across Edge and Bing.

Gaming revenue should rise modestly, with Xbox content and services growing in the high single digits thanks to first-party titles.

Despite pressure on margins due to AI infrastructure investment, Microsoft’s earnings are expected to remain strong. Analysts project EPS of $3.35, up 13.6% year-over-year. Given Microsoft’s consistent track record of exceeding expectations, Q4 may once again deliver upside for investors.

What Is the Potential Upside for Microsoft Stock?

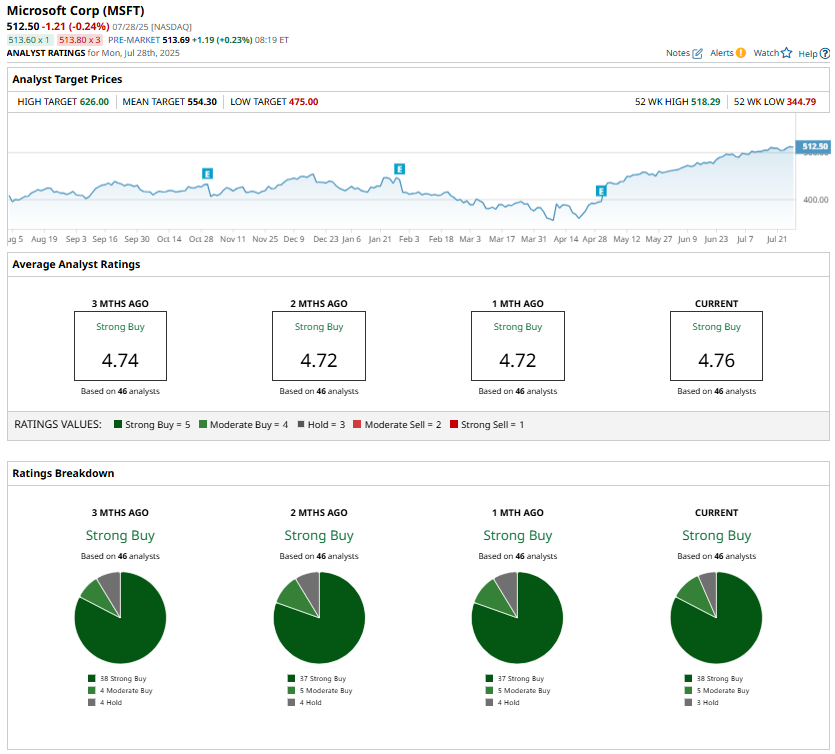

With its strong positioning in cloud computing and AI, Microsoft is well-positioned to deliver another impressive quarter. Wall Street is bullish about MSFT stock ahead of Q4 earnings with a consensus rating of “Strong Buy.”

One of the highest price targets on the Street is $626, suggesting MSFT stock could climb about 22% from its current price.