Following a tumultuous start to 2022 for tech stocks, bulls are hoping Microsoft’s top and bottom-line numbers will give the sector a lift.

Currently, the consensus among analysts polled by FactSet is for the software giant to report December quarter (fiscal second quarter) revenue of $50.71 billion (up 18% annually), GAAP EPS of $2.31 and non-GAAP EPS of $2.32.

Microsoft typically shares quarterly revenue guidance for its three reporting segments on its earnings call. The company’s March quarter revenue consensus stands at $48.11 billion (up 15% annually).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Microsoft’s earnings report, which is due after the bell on Tuesday, along with a call scheduled for 5:30 P.M. Eastern Time. Please refresh your browser for updates.

6:39 PM ET: Microsoft's call has ended. After initially trading lower post-earnings, shares are up 2.5% after-hours to $295.80 thanks to the quarterly sales guidance the company issued on its call.

Microsoft beat FQ2 sales and EPS estimates, while reporting above-consensus sales for its More Personal Computing segment and in-line sales for its Productivity & Business Processes and Intelligent Cloud segments. But on the call, the company issued above-consensus sales guidance for both More Personal Computing and Intelligent Cloud, to go with in-line guidance for Productivity & Business Processes.

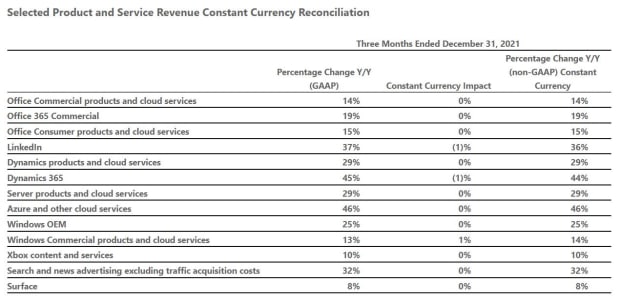

Microsoft also reported stronger-than-expected commercial bookings growth (32% in dollars, 37% in CC), which drove a 31% increase in its commercial contract backlog (RPO). Windows OEM license sales (up 25% Y/Y) were a standout during the quarter, thanks to commercial PC strength. Azure revenue rose 46%, and every other reported business outside of Surface also posted double-digit growth.

Thanks for joining us.

6:32 PM ET: Nadella: The nature of the demand we're seeing will change a bit as we come out of the pandemic. For example, we're now seeing more demand for Power Apps as they can help improve productivity amid labor shortages. But the broader trend of digitization isn't changing. IT spend will keep growing.

6:29 PM ET: A question about the impact of IT security talent shortages.

Nadella: We need more people in IT, and for the skills to be more evenly distributed across organizations. We're trying to bake security into a variety of products to make things easier for companies. We think we have an opportunity to secure the entire "heterogenous digital estate" of our customers.

6:26 PM ET: A question about Office 365 growth.

Hood: We're seeing strong momentum with SMBs as we launch solutions that better address their needs. SMB subscriptions tend to have lower revenue/month, which masks some of the enterprise ARPU growth we're seeing.

6:22 PM ET: Microsoft is now up 2.1% AH. And the Invesco QQQ Trust is roughly flat. What a difference good sales guidance can make.

6:21 PM ET: A question about commercial bookings strength.

Hood: Digitization is driving a lot of opportunities. While quarterly bookings can be volatile, sales execution was very good during the quarter. Demand remains strong across customers/industries.

6:18 PM ET: A question about Microsoft's "metaverse" efforts.

Nadella: We see this as an opportunity both at the platform infrastructure and application levels. The increasing digitization of places/things is an opportunity. Teams will have immersive meetings, first 2D but eventually VR-based as well. Gaming naturally has strong metaverse connections. I think the next wave of the Internet will be a more open world.

Hood: Our investments in this space will go to individual products/teams that can figure out how to best address the opportunity.

6:14 PM ET: Nadella says Microsoft isn't immune to labor market pressures, but will continue hiring talent aggressively.

6:12 PM ET: First question is about the demand environment, and how durable Microsoft sees it for the whole of 2022.

Nadella: We see pretty strong demand signals from businesses. Productivity improvements can keep costs down in an inflationary environment. We're also seeing demand strength in gaming. The economics of gaming franchises is becoming more software-like.

6:10 PM ET: The Q&A session is starting. Microsoft's stock is now up 0.6% AH.

6:10 PM ET: FY22 (ends in June 22) operating margins are now expected to be up slightly Y/Y.

6:09 PM ET: Microsoft's stock has caught a bid thanks to its guidance: Shares are now down just 0.3% AH.

6:08 PM ET: FQ3 segment revenue guidance:

Productivity & Business Processes (Office, Dynamics, LinkedIn) - $15.6B-$15.85B (consensus is $15.76B)

Intelligent Cloud (Azure and server software) - $18.75-$19B (consensus is $18.56B)

More Personal Computing (Windows, gaming, Surface, ads) - $14.15B-$14.45B (consensus is $13.65B)

6:05 PM ET: Bookings growth is expected to be healthy, but affected by a tough comp and a relatively small contract expiry base. Capex will be down slightly Q/Q.

6:03 PM ET: Regarding guidance, Hood says the outlook doesn't factor in the Nuance acquisition, which is expected to close this quarter.

She also says forex will be a 2-point headwind to revenue growth and also depress cost/expense growth by 1 point.

6:02 PM ET: Hood notes Xbox hardware revenue (+4% Y/Y) benefited from better-than-expected supply.

6:00 PM ET: Hood: More Personal Computing revenue benefited from better-than-expected Windows OEM, Surface and search ad revenue.

5:59 PM ET: Both the Productivity & Business Processes and Intelligent Cloud segments saw 1-point forex headwinds relative to expectations. Their sales would've been slightly above consensus otherwise.

5:58 PM ET: Power Apps revenue (counted within Dynamics revenue) rose 161% Y/Y.

5:57 PM ET: Hood: Office 365 commercial paid seat growth (16%) benefited from strong demand among SMBs and frontline workers.

5:55 PM ET: Hood: Opex grew less than expected due to spending shifting to future quarter. Headcount rose 16% Y/Y.

5:54 PM ET: Hood says commercial bookings (+32% Y/Y in dollars, +37% in constant currency) were well ahead of expectations.

5:53 PM ET: Hood notes the dollar's strengthening during the quarter was a 1-point headwind to growth relative to expectations.

5:52 PM ET: CFO Amy Hood is now talking.

5:52 PM ET: Nadella reiterates that Game Pass now has more than 25M subs. Declares Activision will help consumers game wherever/however they want and help shape the future of gaming.

5:50 PM ET: Nadella: More than 1B consumer and commercial users now use Microsoft accounts to log in. And more than 700K customers now use our advanced security solutions.

5:48 PM ET: Onto Windows (a clear strong point in FQ2). Nadella asserts "a PC renaissance" is afoot, and that Windows took share during the quarter. Says there are now 1.4B+ devices running Windows 10 or 11, and that Windows 11 users engage with the Windows app store at 3x the rate of Windows 10 users.

5:45 PM ET: Nadella adds the number of Teams Rooms devices more than doubled Y/Y, and that Teams Phone is also seeing strong growth.

5:43 PM ET: Nadella: LinkedIn has become mission-critical in this job market. Confirmed hires were up 110% Y/Y. Strong growth also seen for LinkedIn's services marketplace for freelancers.

Nadella also discloses Teams has surpassed 270M MAUs (up from 250M as of July).

5:40 PM ET: Nadella asserts Dynamics continues taking share. Its revenue growth numbers back this up.

5:38 PM ET: He's now talking about developer solutions. Declares every DevSecOps workflow will eventually start with GitHub's offerings for the space.

5:36 PM ET: Nadella moves on to Microsoft's data stack. Highlights customer engagements and says volumes/transactions for the Cosmos DB cloud database solutions rose over 100% Y/Y.

5:35 PM ET: Nadella is talking about Azure. Declares Microsoft has more data center regions than any other cloud provider. Notes the customer base for the Azure Arc hybrid/multi-cloud solution has tripled Y/Y.

5:33 PM ET: Satya Nadella is now talking.

5:32 PM ET: Microsoft is going over its safe-harbor statement.

5:31 PM ET: The call is starting.

5:27 PM ET: Hi, I'm back to cover Microsoft's FQ2 call, which should start in a few minutes. Here's the webcast link, for those looking to tune in.

5:01 PM ET: I'm taking a short break, but will be back to cover Microsoft's call, which kicks off at 5:30 ET. Shares are down 4.9% AH to $274.07 after Microsoft topped FQ2 estimates on the back of better-than-expected numbers for its More Personal Computing segment, while reporting roughly in-line sales for its Productivity & Business Processes and Intelligent Cloud segments.

4:59 PM ET: Naturally, Microsoft's sales guidance for its 3 reporting segments will get a lot of attention at a moment like this. The guidance is typically shared on the call by CFO Amy Hood towards the end of her prepared remarks.

4:55 PM ET: Microsoft's report is having some spillover effects for a market that's been in a pretty risk-averse mood lately. Various enterprise software stocks are lower (for example, Salesforce is down 2% and Snowflake is down 3.7%), and the Invesco QQQ Trust is down 1.7%.

4:53 PM ET: Microsoft's company-wide gross margin was flat Y/Y at 67%. The GM for "Microsoft Cloud" (it covers Azure, Office 365 Commercial and Dynamics 365, among other things) fell by 1 point to 70%, though Microsoft it would've been up 3 points if not for an accounting change.

4:49 PM ET: Microsoft ended December with $125B in cash/short-term investments and $53B in debt. Needless to say, the company will have no trouble financing its $68.7B, all-cash deal to buy Activision if regulators sign off on it.

4:45 PM ET: Like some other tech giants, Microsoft continues hiring aggressively: Operating expenses rose 14% Y/Y to $12.5B, after growing 11% in FQ1.

On a GAAP basis, R&D spend totaled $5.8B, sales/marketing spend $5.4B and G&A spend $1.4B.

4:42 PM ET: Operating cash flow rose 16% Y/Y to $14.5B, while free cash flow rose 3% to $8.6B.

Microsoft notes FCF was pressured some by capex, which rose by $1.4B Y/Y to $6.8B.

4:40 PM ET: Ahead of the Activision Blizzard deal, Microsoft remained an active buyer of its own stock: Buybacks totaled $6.2B in FQ2, matching FQ1's figure.

4:38 PM ET: Momentum remained solid for LinkedIn and for Dynamics business apps: Their revenue respectively rose 37% and 29% Y/Y. LinkedIn growth was slightly above guidance, and Dynamics growth slightly below.

4:34 PM ET: Microsoft continues trading lower AH: Shares are currently down 4.5%.

4:33 PM ET: Xbox content/services revenue rose 10% Y/Y, an improvement from FQ1's 2% and slightly above guidance. Microsoft notes it was dealing with tough gaming comps, and that first-party title and Xbox Game Pass growth offset lower third-party title revenue.

Xbox hardware sales, which remain very supply-constrained, rose 4%.

4:30 PM ET: Office continues chugging along, with Office commercial revenue (the lion's share of Office revenue) up 14% and Office consumer revenue rising 15%.

Office 365 commercial seats rose 16% Y/Y and Microsoft 365 consumer subs rose by 2.3M Q/Q and 8.9M Y/Y to 56.4M.

4:27 PM ET: The Windows OEM strength might have some positive read-through for other firms with significant PC exposure. Intel reports tomorrow and AMD reports on 2/1.

4:23 PM ET: Windows OEM revenue (saw growth accelerate to 25% from FQ1's 12%, topping guidance for low-to-mid-teens growth) is one clear standout. Microsoft notes Windows OEM growth saw (as expected) a 6-point benefit from Windows 11 revenue deferral, but also says it benefited from strong PC demand -- particularly in the commercial segment, where its average revenue/license is higher.

4:19 PM ET: Microsoft's sales growth across major businesses. Every business except for Surface posted double-digit Y/Y growth.

4:16 PM ET: One bright spot: Commercial bookings (can fluctuate from quarter to quarter due to contract timings) were up 32% Y/Y, after having grown 11% in the September quarter. Microsoft attributes this to an increase in large/long-term Azure contract signings and strong sales execution.

The bookings growth helped Microsoft's remaining performance obligation (RPO - covers future revenue under contract) rise 7% Q/Q and 31% Y/Y to $147B. Y/Y growth improved from FQ1's 28%.

4:12 PM ET: "Azure and other cloud services" revenue rose 46% Y/Y. That compares with 50% September quarter growth.

4:10 PM ET: The fact that sales for Microsoft's two most profitable reporting segments were only in-line might have something to do with the stock's initial AH drop. More Personal Computing, which covers Windows, gaming, Surface and Bing/ad sales, drove virtually the entire revenue beat.

4:07 PM ET: Revenue by business segment:

Productivity & Business Processes - $15.9B (in-line)

Intelligent Cloud - $18.3B (in-line)

More Personal Computing - $17.5B (above a $16.6B consensus)

4:04 PM ET: Shares are down 3.9% after hours to $273.45.

4:03 PM ET: Results are out. Revenue of $51.73B beats a $50.71B consensus. EPS of $2.48 beats a $2.32 consensus.

4:00 PM ET: Microsoft closed down 2.7%. The FQ2 report should be out any minute.

3:56 PM ET: Microsoft's stock is down 2.6% today heading into its report, amid a 2.3% drop for the Nasdaq. Shares are now down 13% on the month, but still up 27% over the last 12 months.

3:54 PM: The FactSet consensus is for Microsoft to report FQ2 revenue of $50.71B and non-GAAP EPS of $2.32. Quarterly guidance for revenue and various businesses is expected to be shared on the earnings call.

3:51 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Microsoft's earnings report and call.