/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

Microsoft (MSFT) will release its first-quarter earnings for fiscal 2026 on Oct. 29. The tech giant has been consistently delivering solid growth, driven by strong demand for its productivity suite, artificial intelligence (AI) offerings, and cloud solutions. Despite these tailwinds, the stock’s recent price action has been underwhelming. While MSFT shares are up roughly 29% so far this year, they’ve managed just a modest 5.8% gain over the last three months.

The upcoming earnings report is expected to reflect continued strength across Microsoft’s business units, particularly in Azure and its AI-driven offerings. Last quarter, the company’s cloud revenue growth and integration of AI features into its products supported its growth. That momentum is unlikely to fade in Q1. However, the real question is whether investors will see enough in the numbers to push the stock higher.

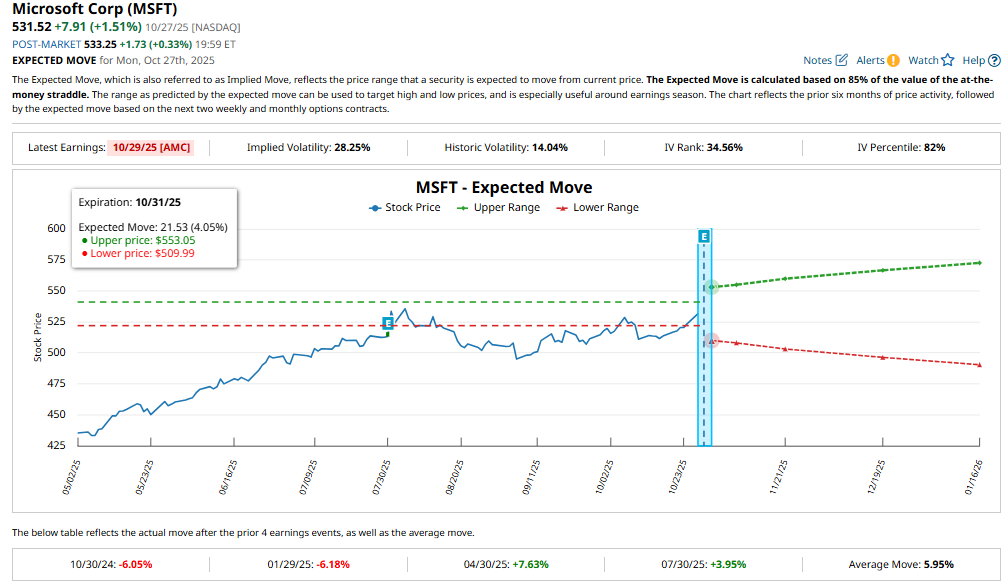

Options market activity ahead of the earnings suggests the market expects a post-earnings move of about 4.1% in either direction for contracts expiring Oct. 31. This anticipated volatility is actually milder than Microsoft’s average swing of nearly 6% following earnings over the past year. Historically, the company’s earnings reactions have been mixed. MSFT stock has climbed after the last two reports, but it has also posted declines in two of the previous four quarters.

In short, Microsoft’s AI and cloud offerings are likely to boost its financials. However, will it be enough to drive its stock price?

Microsoft Q1 Earnings: What to Expect?

The momentum in Microsoft’s business will likely be sustained. The company is building one of the most extensive AI and cloud infrastructures and is operating more than 400 data centers across 70 regions. This global footprint strengthens its leadership in cloud computing and positions it to capture the surging demand for AI-powered enterprise solutions.

Driving its growth is the strength in its commercial cloud business. Azure and Microsoft 365 continue to drive its growth, driven by robust contract renewals and the signing of several high-value deals, some exceeding $100 million. During the last reported quarter, commercial bookings surpassed the $100 billion mark, reflecting the strength of Microsoft’s enterprise relationships and the stickiness of its ecosystem.

A key indicator of Microsoft’s revenue visibility is its commercial remaining performance obligation (RPO), which rose 37% year-over-year to $368 billion. Roughly one-third of this is expected to convert into revenue in fiscal 2026, providing visibility over future growth.

In the Productivity and Business Processes division, the momentum from Microsoft 365’s commercial and consumer segments is expected to continue. The company’s focus on premium tiers is driving higher average revenue per user, while broader enterprise adoption of Microsoft 365 supports sustained seat growth. On the consumer front, earlier price adjustments and steady subscriber gains are expected to further lift cloud revenues, showing Microsoft’s success in monetizing its ecosystem across both business and personal users.

The Intelligent Cloud segment, led by Azure, remains Microsoft’s primary growth engine. Demand from large enterprises for infrastructure and AI capabilities continues to exceed supply, even as Microsoft aggressively expands data center capacity. The company projects Intelligent Cloud revenue between $30.1 billion and $30.4 billion for the quarter, with Azure’s growth expected to be around 37% in constant currency. While some softness in server products could temper results, the broader Intelligent Cloud trajectory remains positive.

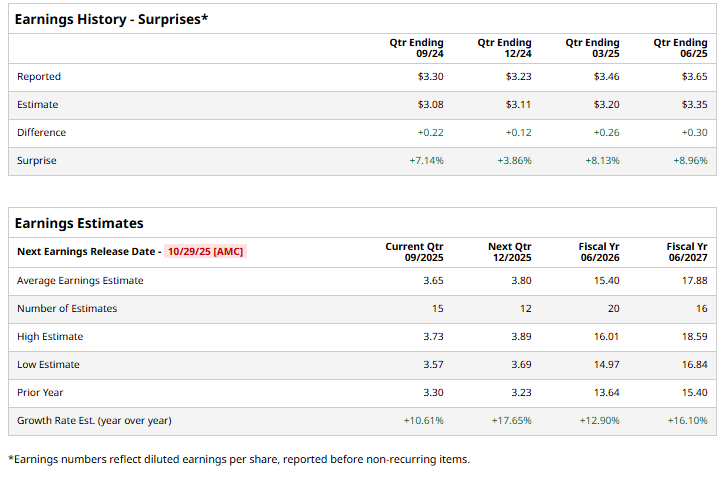

Despite potential weakness in gaming and server products, Microsoft’s overall revenue is projected to rise, reflecting the company’s diversified growth model. On profitability, analysts expect adjusted earnings per share of $3.65, representing a 10.6% year-over-year increase. Importantly, Microsoft has exceeded Wall Street’s earnings expectations for four consecutive quarters, including a 9% upside surprise last time.

Bottom Line: Should You Buy Microsoft Stock Ahead of Earnings?

Microsoft is one of the most fundamentally solid and strategically positioned companies in the tech sector. Its growing share in the cloud computing space, expanding AI capabilities, and large enterprise contracts all point to sustained revenue and profit growth. Moreover, its robust commercial pipeline and consistent track record of outperforming expectations provide confidence in its near-term outlook.

However, investors should temper expectations for a major post-earnings rally. Much of Microsoft’s AI and cloud growth story is already reflected in its valuation, and the options market’s muted volatility expectations suggest traders anticipate a relatively contained reaction. In other words, even if results are strong, the upside could be limited in the short term.

Thus, Microsoft is a buy for long-term investors, supported by durable growth drivers and strong financial visibility. Further, Wall Street analysts are bullish about MSFT stock and maintain a “Strong Buy” consensus rating.

As for short-term traders, the risk-reward balance ahead of earnings may not justify a new position.