Tech bull Daniel Ives has predicted that Microsoft Corp. (NASDAQ:MSFT) is on the path to becoming a $5 trillion company in the next 18 months after he raised the stock’s price target to $600 apiece.

What Happened: After bumping his price target on MSFT, citing a "massive adoption wave" of artificial intelligence-driven Azure services, on Wednesday, Dan Ives told CNBC that he expects Microsoft to become a $5 trillion company over the next 18 months.

“We are trying to understand the trajectory of the AI stack, commercial cloud, which is trending anywhere from 5% to 7% ahead of expectations, and I think the most important thing is, this could be an incremental $25 billion that the street is not factoring into next year’s number,” he said.

Adding, “That’s why I believe, not just $4 trillion, potentially, we are looking at a $5 trillion market cap in the next 18 months.”

He also hailed MSFT’s Chairman and CEO, Satya Nadella, saying that “if you look at what Nadella is doing, Nadella understands the cloud side better than any of the competitors.”

“I think what’s happened now, as we go into the software phase of AI, is that’s where Nadella and Redmond are playing chess, and others are playing checkers,” Ives said.

See Also: Microsoft Stock Poised For 23% Rally As AI Monetization Gains Steam, Dan Ives Says

Why It Matters: Ives said that his price target bump to $600 apiece was “conservative,” as the timeline was just for 18 months.

Ives explained that for every $100 that an MSFT customer spends, there is an incremental $50 of AI spend on the table.

“So, essentially, what you’re creating is almost another sort of mini Microsoft within Redmond. And I think no one understands what’s happening better than Jensen Huang from Nvidia,” he said.

Price Action: MSFT shares were up 0.047% in after-hours on Wednesday and ended 0.44% higher at $492.27 apiece. It has risen by 17.60% on a year-to-date basis and 8.87% over the past year.

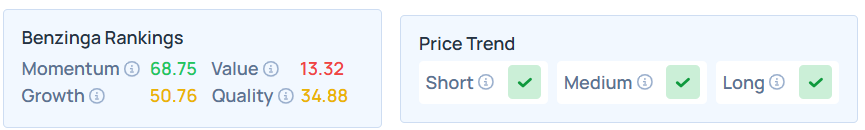

Benzinga Edge Stock Rankings shows that MSFT had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid; however, its value ranking was poor at the 13.32nd percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Wednesday. The SPY was up 0.056% at $607.12, while the QQQ rose 0.26% to $541.16, according to Benzinga Pro data.

Read Next:

Photo courtesy: Tada Images / Shutterstock.coma