/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

What if every NFL coach, player, and executive had real-time artificial intelligence (AI) at their fingertips by next season? That’s the reality as Microsoft (MSFT) launches a multi-year partnership to bring Copilot, its advanced AI assistant, directly to the sidelines of all 32 NFL teams.

In the wake of this game-changing announcement, MSFT stock continues its winning streak, up 18.92% year-to-date (YTD) and recently hitting a record $555.48. This far surpasses the broader Nasdaq 100 Technology 11% return over the same period.

This breakthrough isn’t just another Silicon Valley headline, as it marks a shift in how technology giants, sports, and business intersect, putting Microsoft’s AI prowess on a very public stage. Analysts’ confidence is clear, as Citi now projects MSFT could climb as high as $680 in 2025, as Wall Street bets on the company’s AI-driven transformation.

The NFL move arrives amid an unprecedented surge in AI adoption. Global AI markets are projected to grow to $94.30 billion by 2030 at a compound annual growth rate (CAGR) of 38.9%, with enterprise AI deployments driving the growth. It is a sign that artificial intelligence is quickly becoming indispensable in both boardrooms and locker rooms.

One question stands out, though. Could this high-profile deal spark the next wave of growth for MSFT stock, or is the best yet to come? Let’s find out.

Microsoft’s Latest Scoreboard Check

Microsoft, the $3.76 trillion technology powerhouse that has become synonymous with enterprise computing, cloud innovation, and digital transformation, keeps posting standout financials that set the industry pace. The company pays out an annual dividend of $2.49, with a yield of 0.49%.

MSFT’s share price performance stands tall, up 18.92% YTD, rising 21.22% over the last 52 weeks, and priced at $500.43. Trading at a price-to-earnings (P/E) ratio of 37.19x (trailing) and 33.06x (forward) against sector medians of 22.29x and 23.01x, with a price/earnings to growth (PEG) ratio of 2.22x versus the sector’s 1.83x, Microsoft commands a premium.

July 30, 2025, marked another high-water mark as Microsoft released its fourth quarter and full fiscal year earnings. The numbers reinforce why the company commands such confidence. For the quarter ended June 30, 2025, revenue landed at $76.4 billion, up 18% from last year, with operating income soaring 23% to $34.3 billion, and net income jumping 24% to $27.2 billion.

Diluted earnings per share hit $3.65, a 24% lift year-over-year (YoY). Zooming in, Intelligent Cloud revenue hit $29.9 billion, a 26% leap, while Productivity and Business Processes raked in $33.1 billion, up 16%.

For the full fiscal year ended June 30, 2025, the company reported $281.7 billion in revenue, a 15% gain, alongside 17% higher operating income at $128.5 billion and a 16% advance in net income to $101.8 billion. Diluted earnings per share also grew 16% to $13.64. It’s no surprise that CEO and chairman Satya Nadella declared, “Cloud and AI are the driving force of business transformation across every industry and sector.”

Microsoft’s AI Growth

Microsoft’s AI ambitions just moved from slide decks to center stage. The company is expanding its multiyear strategic partnership with the NFL. This is a deal that will bring Microsoft Copilot, its AI-powered productivity assistant, directly to all 32 NFL teams.

Critically, more than 2,500 Surface Copilot+ PCs are being deployed across NFL operations, giving coaches, players, and staff real-time access to advanced AI on both game days and behind the scenes. This integration signals a massive real-world test for Copilot and underscores Microsoft's aim to turn the NFL into a showcase for enterprise-grade AI.

But there’s far more riding on this deal. Microsoft has forecast a record $30 billion in capital expenditures for the current fiscal first quarter, a move directly linked to booming sales in its Azure cloud business and the surging demand for AI infrastructure across industries.

With Azure’s growth outpacing expectations and AI workloads ramping up, this wave of spending will fund next-gen datacenters, high-performance GPUs, and the orchestration of cloud-based AI solutions that serve everything from Copilot to custom enterprise applications.

There’s a cultural dimension to this buildout as well. Microsoft and Thrive Global announced a partnership to weave wellbeing more deeply into employees’ routines by placing the company’s full suite of wellbeing tools and benefits directly inside Microsoft Teams. That matters because Copilot’s promise is more about sustainable productivity at scale. By elevating access to wellbeing resources in the same platform where work happens, Microsoft is reinforcing the human infrastructure that’s needed to maintain high performance as AI features become ubiquitous across the stack.

What the Analysts Are Pricing In

The enthusiasm among analysts for Microsoft’s outlook is noticeable. Looking ahead, average earnings estimates for the September 2025 quarter stand at $3.64 per share, rising to $15.33 for the fiscal year ending June 2026.

That’s a healthy bump from prior-year tallies of $3.30 and $13.64, respectively, translating to expected YoY growth rates of 10.3% for the current quarter and 12.39% for the full year. While the next earnings release date is yet to be set, this stream of consistent estimate upgrades has formed a rising tide of confidence that’s hard to ignore.

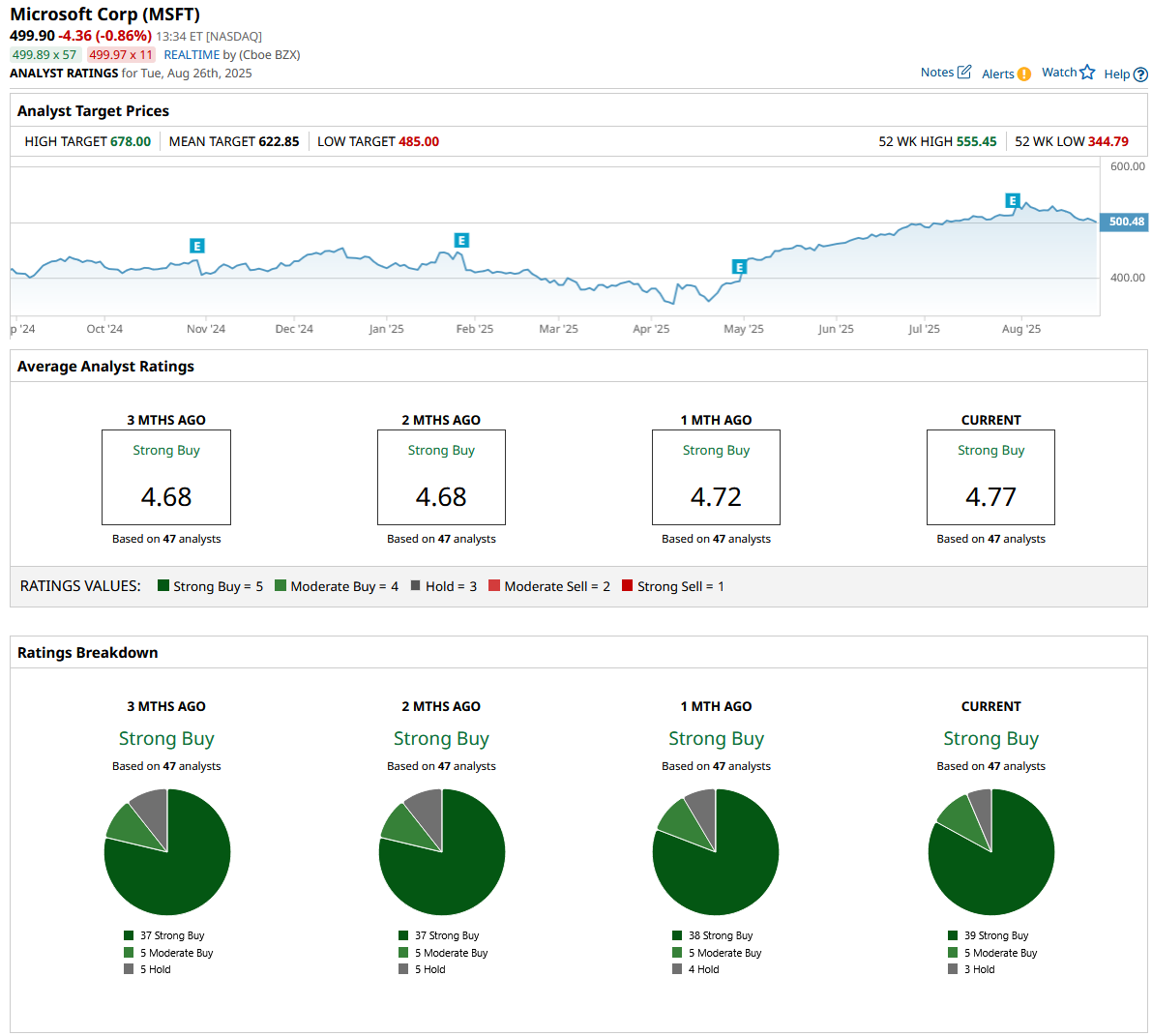

Across the board, sentiment is about as bullish as it gets, with all 47 analysts polled settling on a consensus “Strong Buy” rating for MSFT. The average price target sits at $622.85, which sets the implied upside at an impressive 23.5%.

The case is built on robust fundamentals, ever-expanding cloud revenues, and tangible AI monetization opportunities.

Citi, for instance, just hiked its target to a high of $680, reiterating its “Buy” stance and spotlighting Microsoft’s standout Q4 results, Azure’s accelerating growth, and strategic wins in the AI space as key levers for further gains.

UBS is equally constructive, adjusting its price target from $600 to $650 while maintaining a “Buy” call after strong quarterly momentum. They specifically pointed to Azure’s 39% growth, substantial backlog, and healthy margins.

Conclusion

So, is Microsoft’s new AI play in the NFL a game-changer for MSFT stock? With robust earnings, rock-solid analyst enthusiasm, and bold moves in both sports and cloud, the odds are stacked in Microsoft’s favor. Unless the tech tide turns dramatically, shares look set to keep trending higher, especially as real-world AI wins like this one keep the spotlight firmly on Microsoft’s potential. All signs right now point to more upside ahead.