Microsoft Corp. (NASDAQ:MSFT) Chairman and CEO Satya Nadella has revealed that the true bottleneck for the burgeoning AI industry isn’t a shortage of advanced GPUs, but rather the fundamental physical infrastructure required to power them.

Check out MSFT’s stock price here.

Nadella Exposes AI’s Hidden Crisis After $35 Billion Anthropic Deal

This insight comes amidst a massive new strategic partnership with AI startup Anthropic, valued at approximately $35 billion. The deal sees Microsoft investing $5 billion into Anthropic, a prominent competitor to OpenAI. Whereas Anthropic is committing to spending $30 billion on Microsoft Azure compute capacity.

However, despite this monumental demand, Nadella’s comments suggest Microsoft’s challenge lies not in attracting customers, but in scaling the physical “token factories” – his term for the data centers that process AI computations.

“We are supply-constrained on powered shells,” Nadella stated in a Nov. 18 podcast with Cheeky Pint, offering a stark contrast to the dotcom-era bust.

The “powered shell” refers to a data center building that has been fully connected to the power grid, complete with massive electrical and cooling infrastructure, ready for server racks.

Why AI Infrastructure Boom Is ‘Different’ From Dotcom Bubble

He emphasized that, unlike the dotcom bubble, where “dark fiber” sat unused, today’s demand for AI compute is immediate and overwhelming.

“I don't have a utilization problem,” Nadella explained, highlighting that existing capacity is fully subscribed. “My problem is, I got to bring more supply.”

AI Not About Smart Algorithms, But Who Can Plug Them In

Securing land, obtaining permits, and integrating with power grids for gigawatt-scale operations is a lengthy, complex, multi-year process.

Nadella underscored this challenge, stating, “If I don't have enough shells that are powered that I can then roll in my racks and then make them operational,” the advanced chips cannot be deployed.

As Nadella articulated, the opportunity in AI is “simply too big to approach any other way,” underscoring his belief that a platform should be open to all, even rivals.

The Anthropic partnership, following significant investments in OpenAI, exemplifies this “non-zero-sum” philosophy, ensuring that Azure remains the foundational “AI server” regardless of which frontier model ultimately dominates.

Microsoft Outperforms Nasdaq In 2025

Shares of MSFT have risen 17.97% year-to-date, whereas the Nasdaq Composite and Nasdaq 100 indices have returned 16.35% and 16.82%, respectively.

On Tuesday, the shares closed 2.70% lower at $493.79 apiece and dropped by 0.35% in premarket on Wednesday. The stock has gained 18.19% over the year.

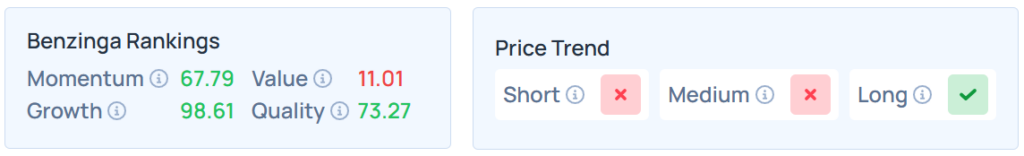

It maintains a weaker price trend over the short and medium terms but a strong trend in the long term, with a strong quality ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

The futures of the S&P 500, Nasdaq 100, and Dow Jones indices were mixed on Wednesday, after closing lower for the second consecutive day this week on Tuesday.

Read Next:

- Jeff Bezos Touts Data Centers In Space As Samsung And OpenAI Plan Floating Data Centers In The Ocean

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image via Shutterstock