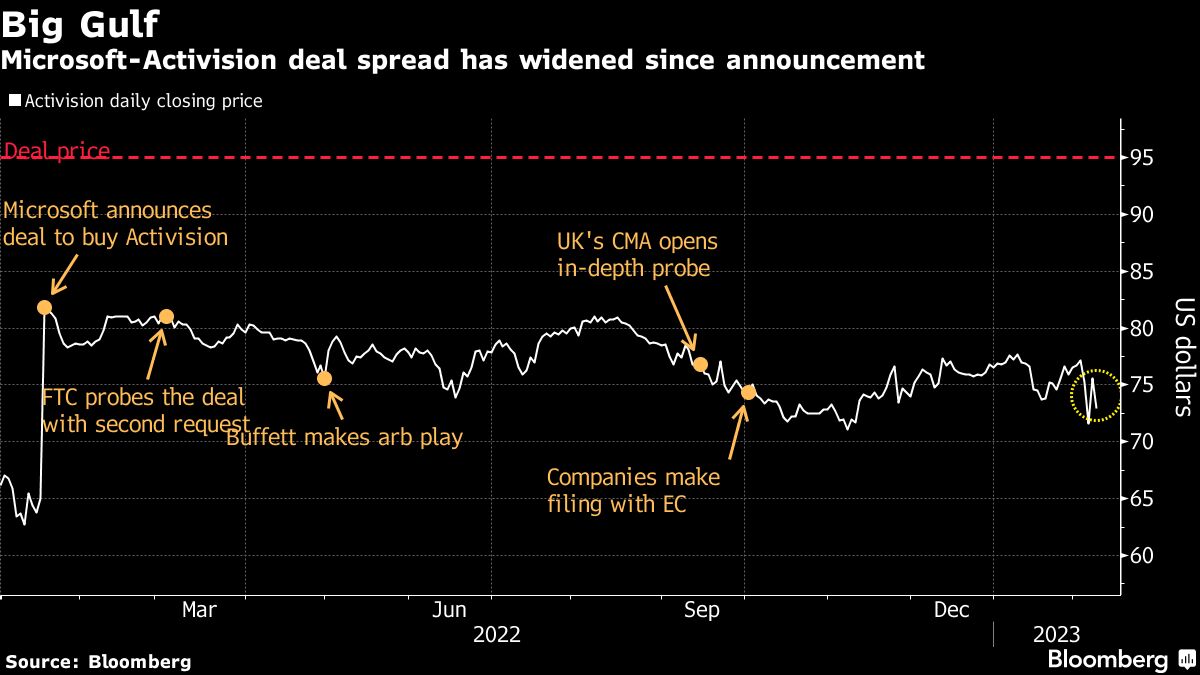

Traders are becoming increasingly unsure whether Microsoft Corp.’s proposed $69 billion takeover of Activision Blizzard Inc. will go through, after Britain’s antitrust watchdog became the latest regulator to challenge the deal.

Activision shares slumped as much as 4.2% on Wednesday and closed down 3.6% at $72.89, putting them more than 23% below Microsoft’s cash offer of $95. The gap between Activision stock price and the takeover bid widened after the UK Competition and Markets Authority voiced its opposition to the tie-up.

At this point, the market sees a 10% to 30% probability of the transaction being completed, said Aaron Glick, a merger arbitrage specialist at Cowen & Co.

That calculation depends on what price investors assume the shares will fall to in an event of deal break. The market had priced in odds of roughly 40% two months ago, when the US Federal Trade Commission was seeking to block the sale.

The deal could harm competition in the UK gaming market and Microsoft will need to offer remedies to receive approval, Britain’s regulator said in provisional filings. The watchdog’s warning comes after the US Federal Trade Commission decided to block the merger in December.

“The provisional findings, taken together with recent media reports, indicates that there is a very low, perhaps negligible, likelihood of the CMA reversing course and approving the transaction with only behavioral remedies,” Glick said.

To be sure, some arbitrage traders still remain bullish on Activision’s standalone prospects if the deal doesn’t go through. Some of that optimism stems from Activision’s earnings that released on Monday, handily beating estimates.

©2023 Bloomberg L.P.