/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

Micron Technology (MU) is reportedly preparing to exit China’s server chip market, marking another chapter in the ongoing U.S.-China tech standoff. According to a Reuters report, the company plans to stop supplying server chips to data centers in China after struggling to recover from Beijing’s 2023 ban on its products in critical infrastructure.

The move stems from a decision by China’s Cyberspace Administration (CAC), which concluded that Micron’s products posed cybersecurity risks. As a result, Chinese operators of critical information infrastructure were barred from purchasing Micron’s chip. This restriction severely affected the company’s presence in the country’s data center and networking markets.

What’s Next for Micron?

China has long been an important region for Micron. In fiscal 2025, the company generated $2.64 billion in revenue from Mainland China (excluding Hong Kong), accounting for about 7.1% of total sales. This figure was down from $3.05 billion the previous year. When including Hong Kong, Micron’s total revenue from the region reached $3.78 billion in fiscal 2025.

While the decision to pull out of China’s server market may sound concerning at first glance, the financial impact on Micron is expected to be limited. Notably, Micron has been benefiting from ongoing spending on artificial intelligence (AI) infrastructure. As data centers expand rapidly to support AI-driven workloads, the need for Micron’s high-performance memory and storage products has surged. However, the Chinese government's ban on its chips for use in critical infrastructure shut the company out of one of the world’s fastest-growing data center markets, creating opportunities for domestic competitors.

Importantly, Micron isn’t abandoning China entirely. The company will continue selling to two major Chinese customers that operate data centers outside of the country, one of which is PC giant Lenovo (LNVGY). It also plans to maintain its presence in the automotive and mobile sectors within China, which remain key growth areas for semiconductor demand.

Is MU Stock a Buy or Sell?

With global AI investments showing no signs of slowing, Micron’s solid presence in memory and storage solutions positions it well to deliver considerable growth. The semiconductor giant’s future revenue will continue to benefit from the expansion of data centers. The acceleration in server unit growth, driven by the rise of AI agents, increasingly complex enterprise computing tasks, and continued growth in traditional server applications in enterprises, will drive demand for Micron’s DRAM products.

Notably, data centers’ requirement for sophisticated and high-value components has driven Micron to enhance both its product mix and profitability. In fiscal 2025, Micron’s data center segment accounted for 56% of total company revenue, with gross margins climbing to 52%.

The company’s High Bandwidth Memory (HBM) business continues to witness solid demand. In the fourth quarter of fiscal 2025, HBM revenue surged to nearly $2 billion, implying an annual run rate approaching $8 billion. The ramp-up of Micron’s HBM3E products supported this growth.

Looking ahead, Micron’s next-generation HBM4 technology is also advancing on schedule and is likely to strengthen Micron’s competitive positioning. Micron’s HBM4E will provide both standard and customizable options. The customizable options are expected to command higher gross margins than standard offerings, cushioning its bottom line.

Micron’s HBM customer base has now expanded to six major partners, with pricing agreements already in place for most of its HBM3E supply through 2026. Discussions are underway to finalize HBM4 supply agreements, which are expected to sell out the company’s full 2026 capacity in the coming months.

Beyond HBM, Micron continues to strengthen its leadership in other memory categories. Its LPDDR5 for servers saw more than 50% sequential growth last quarter, reaching record revenue levels. In partnership with Nvidia (NVDA), Micron has been instrumental in introducing LPDRAM to the data center market and remains the exclusive supplier of LPDRAM for Nvidia’s GB product family. Moreover, its GDDR7 memory products, designed to deliver exceptional speed and power efficiency, position it well to capitalize on demand from future AI-driven systems.

While Micron is experiencing robust AI-driven demand, its current valuation is appealing, making it a buy right now. MU stock trades at a forward price-earnings ratio of 12.1x. At the same time, analysts expect Micron’s earnings per share to soar 106.9% in fiscal 2026, suggesting that the stock is significantly undervalued.

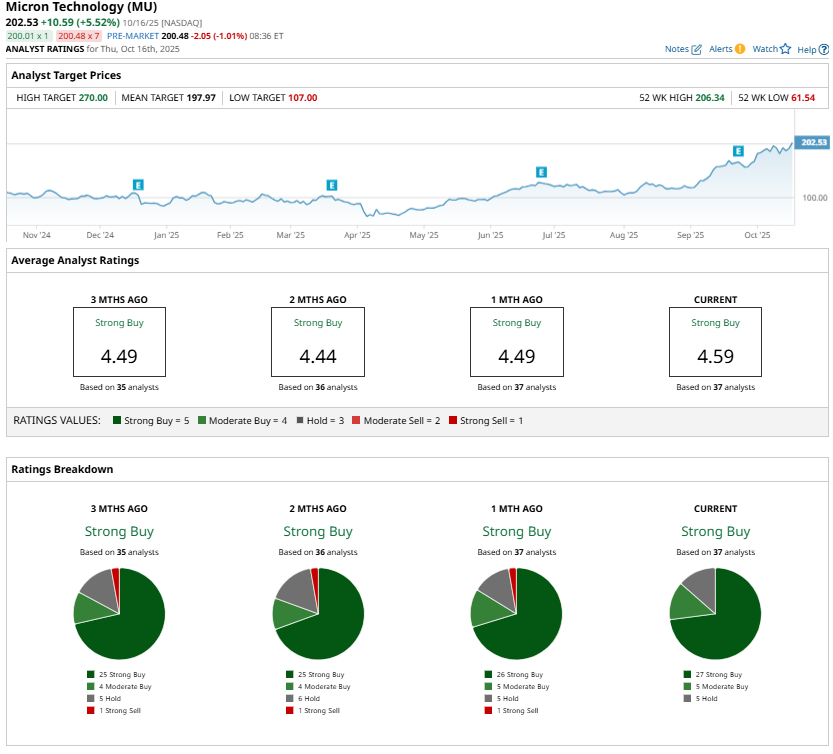

Analysts remain bullish, with a “Strong Buy” consensus rating on Micron stock.