/Micron%20Technology%20Inc_billboard-by%20Poetra_RH%20via%20Shutterstock.jpg)

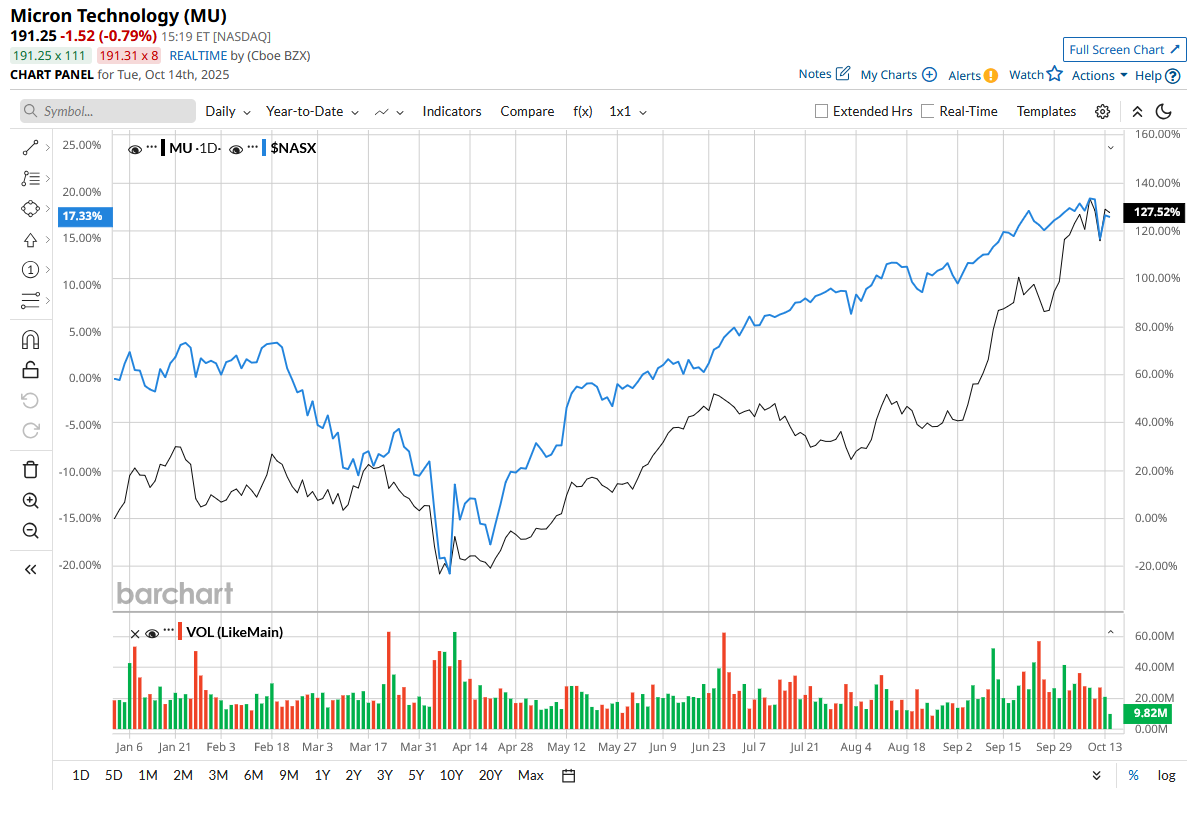

Micron Technology (MU) is a leading semiconductor company that designs and manufactures memory and storage products used in computers, smartphones, data centers, and artificial intelligence (AI) systems. Micron has become a focal point for investors betting on the AI memory wave, pushing its stock up 127% year-to-date (YTD), wildly outperforming the tech-led Nasdaq Composite Index ($NASX) gain of 17.7%.

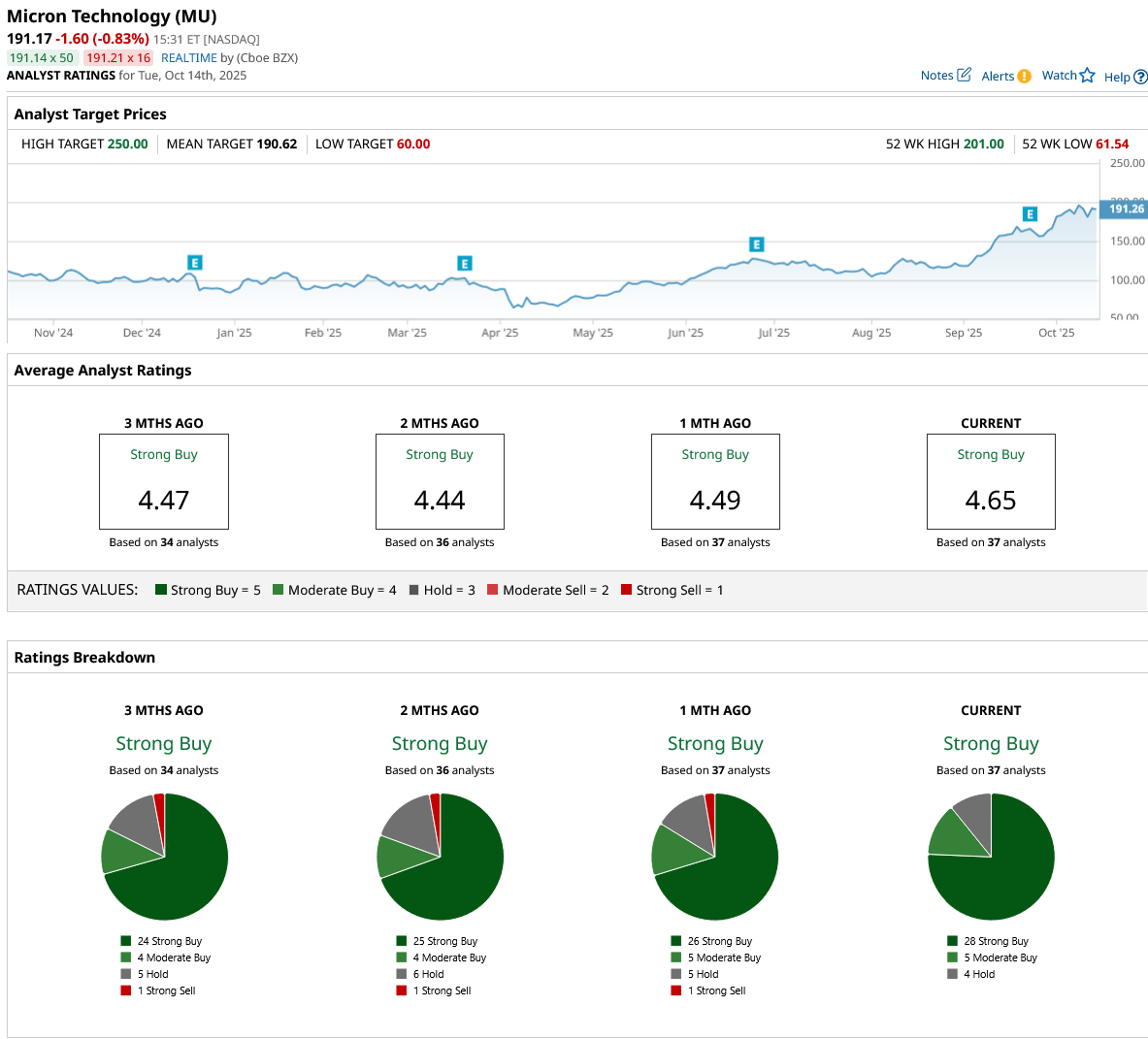

Recently, BNP Paribas Exane upgraded Micron stock to “Outperform” and raised its target price to $270. This new high price estimate implies an upside potential of over 40% from current levels.

Let’s find out what could propel MU stock close to $270.

A Strong End to Fiscal 2025

Micron’s core business is to manufacture memory and storage products used in computers, servers, and AI systems to store data while programs operate. These include dynamic random-access memory (DRAM), NAND flash memory, high-bandwidth memory (HBM), and low-power DRAM (LPDRAM). Micron creates the memory backbone of modern computing, powering everything from AI supercomputers and cloud data centers to smartphones and automobiles, which explains why the company's products are in such high demand.

In the most recent fourth quarter of fiscal 2025, total revenue climbed by 46.7% year-on-year (YoY) to $11.3 billion. Adjusted net income increased by 156.7% to $3.03 per share. Adjusted gross margin increased to 45.7% from 36.1% in the prior year quarter. Micron ended fiscal 2025 on a high note, thanks to increasing AI-driven demand, tightening DRAM supply, and record profitability. Revenue surged by 49% to $37.4 billion in the fiscal year, while adjusted earnings increased by a stunning 537%.

During the Q4 earnings call, management stated that the rapid increase in AI-driven data center spending has irreversibly changed Micron's revenue mix. Products tied directly to AI applications, particularly HBM, high-capacity DIMMs, and low-power DRAM (LP) for data centers, accounted for roughly $10 billion of Micron’s fiscal 2025 revenue.

Micron Is Well Positioned for AI-Era Growth

Micron is also streamlining its product mix to focus on higher-margin opportunities. Management confirmed that the company's decision to exit the managed NAND business will free up capacity in the data center segment, where demand visibility and profitability are significantly higher.

Micron also estimates net capital spending to increase from $13.8 billion in 2025 to around $18 billion in 2026, with the majority of that going into DRAM building and equipment. This adjustment is consistent with Micron's confidence in the DRAM cycle. While NAND is increasingly becoming scarce, DRAM demand from AI servers, GPUs, and high-performance computing applications continues to outstrip supply. Management also stated that large hyperscalers installing AI servers are experiencing hard disk drive shortages and are increasingly relying on NAND-based solid-state drives (SSDs) to meet data center demand. Micron anticipates this structural transition will accelerate through calendar year 2026. Additionally, HBM also remains a major growth pillar for Micron. The company expects the HBM segment to deliver higher returns over the long term.

Analysts expect fiscal 2026 revenue to increase by 44.1% to $53.8 billion, with earnings growth of 102%. Trading at 11.5x forward earnings, MU stock is still a reasonable buy compared to peers such as Nvidia (NVDA) or Advanced Micro Devices (AMD) in the semiconductor industry.

What Are Other Analysts Saying About MU Stock?

Owing to its dramatic surge this year, MU stock has surpassed its average target price of $190.62. Aside from BNP Paribas Exane, UBS also raised MU's stock target price to $225 from $195 and assigned it a “Buy” rating.

Many other firms, such as Morgan Stanley, Robert W. Baird, and Itaú Unibanco, also raised the target price for MU, which ranges between $220 and $250.

Morgan Stanley believes that improving demand patterns in DRAM and NAND, together with strong server and storage requirements, are causing supply worries that could endure until 2026. The firm also stated that this progress should alleviate concerns about Micron's position in high-bandwidth memory for AI, resulting in many upward profit revisions in the future.

Overall, Micron has earned a “Strong Buy” in the analyst community. Out of the 37 analysts covering MU stock, 28 rate it a “Strong Buy,” five rate it a “Moderate Buy,” and four recommend a “Hold.”

Overall, DRAM is still in short supply, NAND is rebounding, and HBM is emerging as one of Micron's most strategic segments. With hyperscalers ramping up AI server deployments and Micron's combination of supply discipline and technological leadership, the company appears poised to benefit from the next wave of semiconductor growth. This could propel MU stock to reach the high price estimate of $270 soon.