/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

Shares of Micron Technology (MU) have gained considerably in value, rising about 97% year-to-date. This significant growth in MU stock is powered by solid demand for its cutting-edge memory chips and storage solutions.

Notably, Micron has been one of the top beneficiaries of artificial intelligence (AI) in the semiconductor industry. The rapid expansion of data centers, alongside a recovery in consumer markets like PCs and smartphones, has driven demand for Micron’s products.

Thanks to the AI-driven tailwinds, Micron delivered strong sales and profitability in fiscal 2025.

In fiscal 2025, Micron posted revenue of $37.4 billion, up nearly 49% from the prior year, marking an all-time high. The company’s profitability has improved sharply, with gross margins expanding 17 percentage points to reach 41%. The ramp of high-value data center products and strong DRAM pricing across multiple end markets supported its growth.

High-bandwidth memory (HBM), high-capacity DIMMs, and low-power server DRAM collectively generated $10 billion in revenue in fiscal 2025, a more than five times increase from the prior year. This jump reflects the surging demand for advanced technologies to power AI workloads. On top of that, the company’s data center SSD business also recorded record revenue and market share, further strengthening Micron’s position in the digital infrastructure buildout.

Despite the rally, Micron’s valuation does not look stretched. Tight DRAM supply and accelerating AI-related demand continue to create favorable pricing dynamics, which should further bolster Micron’s margins and share price. The strength in HBM puts Micron in a lucrative position as AI workloads increasingly require faster and denser memory. Meanwhile, the NAND business is benefiting from an improved mix of data center demand and healthier industry conditions, creating another avenue for profitability. Let’s take a closer look.

Micron: End Market Demand to Support Growth

Micron’s end market demand remains solid, which will drive its financials and share price. In data centers, growth will stem from both AI and traditional servers. The company’s management sees acceleration in server unit growth this year. At the same time, the traditional server market remains strong. This positive outlook is driven by the rise of AI agents and the increasing complexity of enterprise workloads. AI server growth, in particular, continues to be very strong, which is increasing demand for Micron’s DRAM products.

Data centers are also driving demand for Micron’s high-value products, improving its product mix and profitability. In fiscal 2025, Micron’s data center business accounted for 56% of total revenue, with gross margins of 52%. Its HBM products continue to see massive demand and its revenue hit nearly $2 billion in Q4 of fiscal 2025, suggesting an annual rate of about $8 billion, driven by the ramp-up of its HBM3E products.

Looking ahead, Micron’s HBM market share is expected to grow. It now serves six customers and has pricing agreements for most of its HBM3E supply in 2026. It is also negotiating HBM4 orders and expects to finalize contracts for the rest of its 2026 supply soon. Micron’s LPDDR5 for servers grew over 50% last quarter, reaching record revenue.

On the storage side, AI workloads are spurring demand for both high-performance NAND and high-capacity SSDs. Micron is gaining share with its technology leadership and a stronger product portfolio and is positioned to benefit from tightening HDD supply and a healthier storage market.

In the PC market, the broader adoption of AI-enabled PCs is supporting a more favorable demand outlook. Healthy growth in PC unit shipments will continue to bolster demand for Micron’s products. On the mobile front, the rise of AI-ready smartphones is serving as a key catalyst for increased DRAM content. Meanwhile, the automotive market has emerged as increasingly memory and storage-intensive, driven by advanced driver-assistance systems (ADAS) and AI-enhanced in-cabin experiences, further supporting Micron’s growth trajectory.

Micron Stock Appears Compelling on Valuation

Micron is experiencing robust AI-driven demand for its products and is expected to deliver strong growth in fiscal 2026 and beyond. Moreover, its valuation remains highly attractive. MU stock trades at a forward price-earnings ratio of 12.8x, which is too cheap to ignore considering its expanding margins and significant earnings growth potential.

Wall Street is projecting that Micron’s earnings per share (EPS) could surge nearly 67% in fiscal 2026, indicating that MU stock is undervalued and has significant upside potential.

Here’s Why to Hold Micron Stock

With strong AI-driven demand across multiple end markets and an attractive valuation, the rally in Micron stock is far from over. For current shareholders, this presents a strong case to maintain their positions, while new investors may find the stock appealing given its favorable price relative to its growth potential.

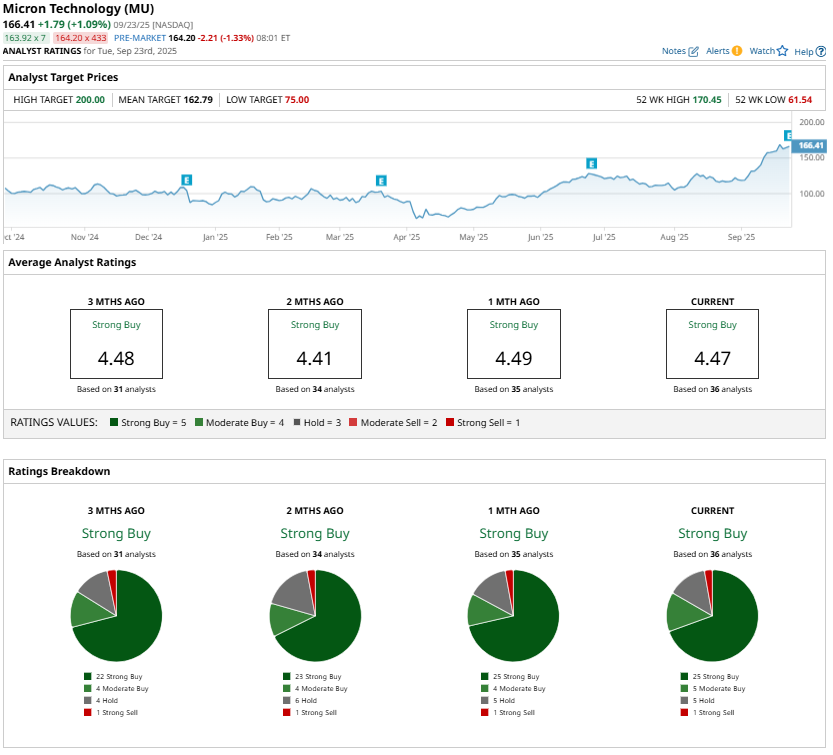

Analysts continue to endorse MU stock with a “Strong Buy” consensus rating, reflecting confidence in Micron’s growth potential.