During Micron Technology Inc.’s (NASDAQ:MU) third quarter results, the company’s CEO, Sanjay Mehrotra, warned investors that not all of the AI-fueled demand surge may be sustainable.

What Happened: On Wednesday, during the company’s third quarter earnings call, while highlighting its soaring data center revenues, Mehrotra flagged potential short-term distortions tied to global trade tensions that investors need to be prepared for.

He said, “There may have been some tariff-related pull-ins by certain customers,” referring to the likelihood of some customers pulling forward their memory and storage orders ahead of time, to get ahead of potential trade and tariff-related disruptions.

While this raises questions regarding demand visibility in the quarters ahead, Micron says that it is well prepared to “adjust to any unforeseen demand changes that may occur due to macro conditions or the evolving tariff-related situation.”

Mehrotra emphasized that the tariff-related impact was “relatively modest,” but he does, however, acknowledge that the environment has gotten a lot more challenging since the “Liberation Day” tariffs were announced.

Why It Matters: This was an eventful earnings call, with the company announcing $200 billion in fresh investments in the U.S. over the next 20 years, across manufacturing and R&D.

Analysts continue to maintain a strong bullish outlook on the stock, with the high end of its price target at $250, representing a 96.8% upside from current levels.

During its third quarter results on Wednesday, Micron reported $9.3 billion in revenue, ahead of consensus estimates at $8.87 billion. It posted a profit of $1.91 per share, again beating estimates at $1.60, driven by strong demand for its memory products for AI use-cases.

Price Action: Micron’s shares were down 0.52% on Wednesday, trading at $127.25, but are up 1.71% after hours, following its earnings announcement.

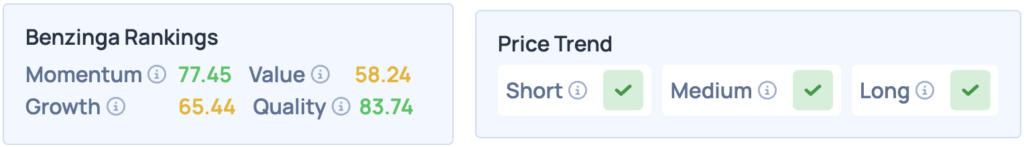

According to Benzinga’s Edge Stock Rankings, the stock scores well on Momentum and Quality, while featuring a strong price trend in the short, medium and long terms. Click here for deeper insights into the stock.

Read More:

Photo courtesy: Shutterstock