MicroCloud Hologram Inc (NASDAQ:HOLO) shares are trending Thursday after the company announced financial results for the first half of 2025, with a turnaround to profitability.

What To Know: The company reported a net profit of RMB 238.1 million ($33.1 million), a stark contrast to the net loss of RMB 121.7 million in the same period of 2024. This was driven by a 726.2% surge in revenue from its holographic solutions.

The company's financial position also strengthened considerably, with current assets increasing 293% year-over-year to RMB 2.912 billion ($406 million). Cash and cash equivalents increased 153% year-over-year to RMB 1.6 billion ($223 million), and shareholders' equity rose 297% to RMB 2.868 billion ($400 million).

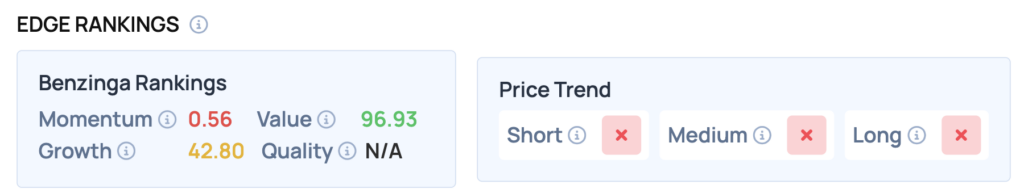

Benzinga Edge Rankings: Benzinga Edge stock rankings give you four critical scores to help you identify the strongest and weakest stocks to buy and sell. The most notable metric is the Value score, which is exceptionally high at 96.93.

Price Action: According to data from Benzinga Pro, HOLO shares are trading lower by 1.11% to $4.46 Thursday morning. The stock has a 52-week high of $375.20 and a 52-week low of $4.16.

Read Also: Bitcoin, Ethereum Brace For US Labor Data As Experts Warn Of Cross-Asset Volatility

How To Buy HOLO Stock

By now you're likely curious about how to participate in the market for MicroCloud Hologram – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock

.png?w=600)