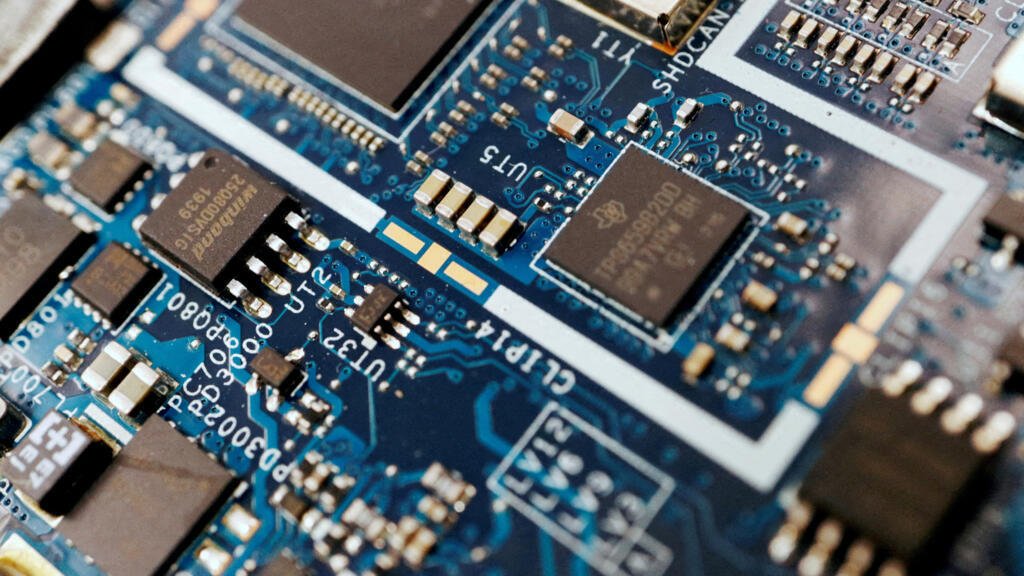

Dutch authorities have, for the first time ever, invoked Cold War-era legislation to take control of a Chinese-owned microchip factory – prompting backlash from China. The move underlines the intensifying competition between the United States, China and Europe for global leadership in semiconductor technology.

On 30 September, the Netherlands invoked the Goods Availability Act to take control of Nexperia, a European subsidiary of the Chinese chip giant Wingtech headquartered in the Dutch city of Nijmegen, citing risks to national and European economic security.

Both Wingtech and China’s leading state-backed semiconductor association say they firmly oppose the move, which was only announced this week.

The Goods Availability Act dates back to 1952, a period of post-World War II reconstruction and rising geopolitical tensions that would culminate in the Cold War. The legislation was designed to give the Dutch government authority to manage national resources and safeguard economic stability in times of crisis.

Until now, the Act had never been used.

In a statement on 12 October, the Dutch Ministry of Economic Affairs cited “serious governance shortcomings” and declared its aim to ensure that goods produced by Nexperia – both finished and semi-finished – remain available during an emergency.

Parent company Wingtech called the move "excessive intervention based on geopolitical bias rather than a fact-based risk assessment".

Wingtech also suggested that Nexperia had suffered an internal coup, with "certain foreign members of its management" attempting to forcibly alter the company’s ownership structure under the guise of complying with Dutch directives.

The China Semiconductor Industry Association said in a statement it opposed "the abuse of the concept of 'national security'", as well as "the imposition of selective and discriminatory restrictions" on Chinese-owned companies overseas.

Nexperia declined to comment when approached by RFI, and the Dutch Ministry of Economy did not provide further details beyond its official statement.

But according to Alexandre Ferreira Gomes, a research fellow with Dutch think tank Clingendael, Dutch authorities are concerned "that some of the technology that is developed by Nexperia is being shared or leaked to Chinese counterparts".

This extends the scope in which governments will, from now on, more clearly interfere in private sector companies that operate in "critical sectors".

INTERVIEW with Alexandre Ferreira Gomes

Microchips on battlefields

There are additional concerns. A 2022 investigation by the UK’s Royal United Services Institute revealed that some of Nexperia’s chips had been used by Moscow in Russian military drones and cruise missiles deployed in the Ukraine conflict, despite sanctions in place after Russia’s invasion. Dutch broadcaster NOS later found recent Nexperia microchips on battlefields in Ukraine.

As a consequence, the UK government forced Nexperia to divest its Newport chip manufacturing facility in November 2022 under the National Security and Investment Act. Nexperia expressed shock at the decision, but sold the facility in 2023 to US-based Vishay Intertechnology.

Nexperia admitted in 2024 it was aware of “incidents where our products have ended up in applications which our chips were not developed or sold for, including in countries where we do not do business”.

While the company said it condemned the Russian invasion and complied with international sanctions, Gomes suggests that Western governments are wary.

“China has been supporting Russia’s war efforts in Ukraine,” he said. “By restricting access of Chinese stakeholders or companies to Nexperia, [governments] also hope to limit the military use of these technologies, particularly by Russia.”

Trade wars

Underlying all this is the fierce competition for microchip supremacy – a complex struggle involving China, the US and Europe.

“There is an increasingly overt conflict between China and the US, with the US imposing export controls on certain technologies that cannot be sold to China,” Gomes explained. “China responds with export controls on key materials, such as gallium and germanium, necessary for chip production.”

The Netherlands has been swept up in these tensions before. In 2018, pressure from Washington led the Dutch government to block sales of high-definition scanners produced by a Dutch-owned company, ASML, that produces printers for semiconductor wafers.

Amsterdam also withheld an export licence for the products on the grounds that they fell into the category of dual-use technologies which can serve both civilian and military purposes, and were therefore subject to special restrictions.

Netherlands lands in crossfire in US-China trade war

Last year, the US Department of Commerce’s Bureau of Industry and Security put Nexperia's parent company Wingtech on a blacklist, claiming that the company was helping China to acquire semiconductor factories in the US and in countries allied with Washington in order to improve its own chip industry.

According to Gomes, it is not clear if the US directly pressured the Netherlands into taking over Nexperia, but “given the perception that the position of Nexperia is sensitive, also in relation to the discussion of Russian military applications”, he says, they may have preempted any US action.

Today, things are changing rapidly, according to the researcher. “Just a few years ago, China was considered an important partner for a country like the Netherlands. Now, they are keen to protect what they have left.”

Beijing views the Dutch government’s move as anti-Chinese, further straining already fragile EU-China relations, which have been in a downward spiral since 2021 following Brussels’ suspension of a major investment deal over human rights concerns.

EU puts massive China investment deal on hold

French alternative

While the Netherlands resorts to emergency legislation, France is opting for a different strategy. According to Gomes, Paris has "traditionally been more attentive to sovereignty issues" and has established several funds and initiatives to invest in high-tech startups.

For example, the French public investment bank BPIFrance "intervenes and acquires companies itself rather than allowing them to be taken over by Chinese or American firms", he says.

These policies align with the European Chips Act, which focuses on collaboration within the EU semiconductor ecosystem and building EU-wide resilience, rather than the more defensive approach taken by the Dutch government.