Jim Chanos Slams Michael Saylor For Spewing ‘Financial Gibberish’ As He Hints At Selling Bitcoin Or BTC Options To Fund MSTR Dividends

Famed short-seller Jim Chanos publicly criticized Strategy Inc.‘s (NASDAQ:MSTR) Executive Chairman Michael Saylor, labeling his latest financial strategy as “financial gibberish.”

The critique came after reports that Saylor is open to selling Bitcoin (CRYPTO: BTC) or its options to fund dividend payments for securities the company issued to acquire the cryptocurrency in the first place.

Check out MSTR’s stock price here.

Saylor’s ‘Worst-Case Scenario’ Plan

The controversy began after Saylor, speaking at the Bitcoin Treasury Unconference in New York City, suggested a “worst-case scenario” plan.

In a Q&A session, he indicated that his firm, formerly known as MicroStrategy, could sell calls or warrants on its Bitcoin holdings, or even liquidate some of the underlying asset itself, to cover dividend obligations.

Following his remarks, MicroStrategy’s stock saw a nearly 6% jump on Thursday, indicating a positive, if complex, reception from the market.

Jim Chanos Slams Michael Saylor For ‘Financial Gibberish’

Chanos, known for his skeptical eye on corporate accounting and financial structures, took to X to voice his disbelief.

“More financial gibberish from Saylor,” he posted. “So $MSTR may sell options on Bitcoin (or sell Bitcoin itself) to finance the dividends on securities he issued to buy Bitcoin?! Lol, ok. (Who falls for this stuff?).”

Chanos’s comment highlights what he perceives as a circular and unsustainable financial maneuver.

MSTR’s Bitcoin Treasury

Strategy has built a massive corporate treasury of over 600,000 BTC, largely financed through debt and equity offerings.

As of Sept. 15, it has acquired an additional 525 bitcoins between Sept. 8 and Sept. 14, 2025. This latest purchase was made for approximately $60.2 million, at an average price of $114,562 per coin, inclusive of fees.

The acquisition, funded through the company’s At-The-Market (ATM) offerings, increased Strategy’s total bitcoin treasury to 638,985 BTC. The aggregate purchase price for its entire holdings now stands at $47.23 billion, reflecting an overall average purchase price of $73,913 per bitcoin.

According to Chanos, the idea of selling the core asset to pay yields on the very instruments used to buy it struck the veteran investor as fundamentally flawed.

While supporters applaud Saylor’s conviction and view the company as a proxy for Bitcoin investment, critics like Chanos raise concerns about the financial risks and sustainability of leveraging the company’s balance sheet so heavily on a single, volatile asset.

Price Action

The stock rose 5.89% on Thursday and 0.51% in after-hours. It was up 16.37% year-to-date and 141.34% over the year.

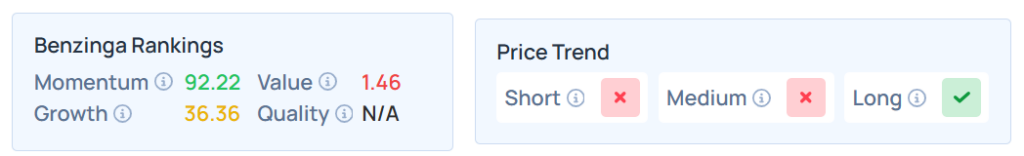

Benzinga’s Edge Stock Rankings indicate that MSTR maintains a weaker price trend in the short and medium terms but a stronger trend in the long term. However, the stock’s value ranking is relatively poor. Additional performance details are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, rose on Thursday. The SPY was up 0.47% at $662.26, while the QQQ advanced 0.90% to $595.32, according to Benzinga Pro data.

On Friday, the futures of the Dow Jones, S&P 500, and Nasdaq 100 indices were higher.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock