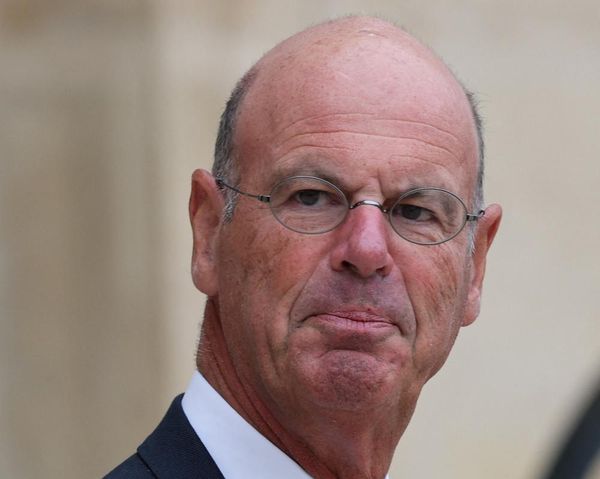

Michael Mahoney's grandfather was a cardiac surgeon — so his first career plan was to become a doctor. Then he got a C+ in organic chemistry, an infamously challenging course for medical majors. Mahoney didn't give up — he adjusted to where his skills matched.

Mahoney, now CEO of top medical device firm Boston Scientific, switched to a finance major at the University of Iowa. And he ultimately earned an MBA at Wake Forest University in 1989. His hope? Help medical companies get healthy.

His early career as a medical technology leader at major companies caught attention. In 2011, Boston Scientific recruited him to potentially become CEO. But the company was suffering from the fallout of a major failed merger. Why would he even consider such a risky move?

"I knew right away that I wanted the job and I asked a friend at a consulting firm to do some due diligence," Mahoney told IBD. "He recommended against it, but it's very rare that one gets a job offer that could be life-changing and I was very attracted to the brand, the challenge of turning it around, and the potential to grow it globally. Starting as president gave me an opportunity to study the company from within for a year, which turned out to be an enormous advantage when I became CEO."

Mahoney became CEO in November 2012. At that time, when annual revenue was $7.3 billion and the company lost $4 billion. It would be an understatement to call this a turnaround: For the year ending December 2024 revenue was $16.7 billion, with net income of $1.9 billion. First-quarter 2025 results included net sales of $4.7 billion, up 20.9% over the prior year.

And the stock price is up roughly 1,900% under Mahoney's leadership. The S&P 500 in that time is only up 306%.

Learn Leadership Lessons Early Like Michael Mahoney

Now 59, Mahoney's first job was selling cash registers door-to-door. It was good training for the first job he held after he graduated from college: selling nuclear cardio cameras for General Electric in the Carolinas. He advanced to executive roles at GE, including managing units in diagnostic imaging, cardiology and health care information technology.

"I learned from the leaders at GE, especially Jeffrey Immelt, its future CEO, who was demanding and set ambitious targets for his management team, but was always brimming with encouragement and energy to a collective goal," Mahoney said. "His influence inspired a winning spirit about not being satisfied with the status quo, a core value I brought to Boston Scientific."

The dot-com boom prompted GE in 1999 to tap Mahoney to be CEO of an IT startup, Global HealthcareExchange. His job? Study ways to improve the supply chain. "I learned to embrace the startup mentality of wearing many hats, moving quickly, and taking risks, and it gave me the confidence to make an enormous career jump," he said.

In 2005, Mahoney joined Johnson & Johnson. He started as chairman of its orthopedic and neurosciences franchise and later became worldwide chairman of Medical Device & Diagnostics from 2009 to 2011. He oversaw 50,000 employees and seven franchises. "That's where I learned portfolio management and the importance of globalization to drive growth," he said.

Change The Company Culture

"At J&J I saw the importance of a corporate culture in a diversified company," Mahoney said. "One of the first things I noticed at Boston Scientific was the tentative and risk-averse culture, likely a product of the company not having created winning targets. The company focused on lower-growth markets, like cardiac rhythm management and stents, which now make up less than 20% of the company. Generally, employees didn't have a winning mentality and did not embrace a truly global mindset."

He realized that part of the company's problem was that it was far too bureaucratic. So as president he began streamlining the layers and recruiting new leaders. He empowered managers to make quick decisions and take smart risks with a simplified and accelerated approval process.

"I'm a strong believer in decentralization and the importance of values-based leadership," he said. "We prioritized hiring and developing great teams globally, then empowering them to make things happen in their markets. Pretty soon we were no longer wholly reliant on the performance of a single country or region. Part of the magic of the company is that every business unit or region doesn't have to do the same thing. Each global business president is accountable for sales, operating income, resource allocation and portfolio prioritization, but the company centralizes where it makes sense, like operations, quality, supply chain and IT."

Mahoney oversees 53,000 employees helping physicians diagnose and treat 44 million patients a year in over 100 countries from Brazil and Vietnam to Poland and South Africa. Glassdoor gives Boston Scientific high ratings for its ability to attract and retain talent. It was ranked No. 43 in the list of Best Places to Work in 2024 with 4.4 stars, just above Visa. "Our culture encourages employees to challenge the status quo without fear of being reprimanded," Mahoney noted.

Mahoney: How To Succeed At Mergers And Acquisitions

One major factor in Boston Scientific's growth has been Mahoney's overseeing of more than 50 mergers and acquisitions. Before he became CEO, the company focused just on making big acquisitions, mostly in cardiology. But like with most M&A across industries, the deals often did not pay off.

He tasked the leaders of all eight divisions to grow faster than their market competitors. The key has been setting aside an average of 10% of sales to invest in research and development (higher than most competitors) and devoting much of their profits to new deals that would help their customers. Physicians and hospitals are under tremendous pressure to drive economic value and bring health care costs down, while addressing unmet needs.

Go For Life-Changing Products

"Mergers and acquisitions are inherently risky because you make decisions with imperfect and often complex information, so it isn't possible to get things right all the time," he explained. "M&A deals often emphasize breadth, but we think depth — category leadership — is just as relevant and helping us grow faster than our underlying markets and most peers. Going deep in the markets we serve is a recurring strategic theme in all our deals. We aren't afraid of taking big swings because when they work out, they can be life-changing for millions of people."

He cites the acquisition of Farapulse, the company behind a device to improve heartbeat rhythm, as a good example. It was originally a seed-stage $500,000 venture investment in 2013. And it became an acquisition in 2021 after meaningful clinical data on electrophysiology was gathered and U.S. approval was in sight. Today it is Boston Scientific's fastest-growing single product, with over $1 billion in sales in 2024, "a trajectory rarely seen in medical devices," Mahoney said.

Drive Growth Through Innovation Everywhere, Mahoney Says

The company currently has more than 40 active companies in its venture capital portfolio, one of the largest in the medical technology industry. Mahoney sees that M&A and creative research and development across the company will pay off and help patients. He's targeting unmet needs in the areas of complex cardiovascular, respiratory, digestive, oncological, neurological, and urological diseases and conditions.

Analysts forecast Boston Scientific to keep up its winning ways. They're calling for 16.3% adjusted EPS growth for 2025 and 12.6% for 2026. "Risks seem modest and considered in the outlook, with revenue exposure to products manufactured in Canada, Mexico, and China described as modest," Wolfe Research wrote.

Mike Mahoney's Keys

- Chairman and CEO of Boston Scientific since November 2012.

- Overcame: A company culture that did not foster innovation and billions of dollars of losses.

- Lesson: "We empower employees to make decisions more quickly, often out of their comfort zone, so they see more opportunities and sometimes we're wrong and we just learn something."