Michael Burry, the investor who famously called the 2008 financial crisis, has quietly added an unusual pick to his portfolio that has nothing to do with tech or healthcare. Scion Asset Management disclosed a new position in SLM Corporation (SLM), better known as Sallie Mae, the student loan giant that has been flying under the radar while most investors chase AI stocks.

The timing is notable given the ongoing debates around student debt relief and higher education costs in America. Sallie Mae specializes in private student loans and has been navigating a complex landscape of regulatory changes and shifting borrower demographics.

While Burry made headlines for his bearish bets against Nvidia (NVDA) and Palantir (PLTR), this bullish position in the student loan sector suggests he sees value where others might overlook it.

Is Sallie Mae Stock a Good Buy Right Now?

Sallie Mae reported solid third-quarter results, highlighting the company's resilience in a challenging economic environment. In the September quarter, the nation's largest private student lender reported diluted earnings of $0.63 per share, with loan originations climbing 6.4% to $2.9 billion.

The credit quality of new loans continued to strengthen, with the cosigner rate reaching 95% compared to 92% a year earlier, and average FICO scores at approval increasing to 756 from 754. This reflects the company's disciplined underwriting standards that management has refined over recent years to optimize portfolio performance.

Net charge-offs improved to 1.95% of loans in repayment, down 13 basis points year-over-year (YoY), which suggests that borrowers are capable of meeting their obligations despite broader economic headwinds.

Management successfully executed a $1.9 billion loan sale during the quarter, generating $136 million in gains, while continuing its aggressive capital return strategy. It repurchased 5.6 million shares at an average price of $29.45, bringing total share reduction since 2020 to 55% at an average cost of just $16.75 per share.

Looking ahead, Sallie Mae is poised to benefit from recent federal student loan reforms that will be phased in over the coming years. The company estimates these changes could add $4.5 billion to $5 billion in annual originations once fully implemented, representing substantial growth on top of the current $14 billion private student loan market. The expansion will come primarily from graduate and parent borrowers who previously relied on federal PLUS loans.

The company is also exploring innovative funding partnerships in the private credit space to create more capital-efficient revenue streams. Management expects to announce a groundbreaking partnership soon that would allow Sallie Mae to originate loans without relying entirely on its bank balance sheet, unlocking fee-based income opportunities while managing regulatory capital requirements.

While early-stage delinquencies ticked up modestly due to deliberate changes in loan modification eligibility criteria, late-stage delinquencies and roll rates remain stable. The company maintains its long-term net charge-off guidance in the range of high 1% to low 2%.

What Is the SLM Stock Price Target?

Analysts tracking SLM stock forecast revenue to increase from $1.48 billion in 2024 to $1.71 billion in 2027. In this period, adjusted earnings are forecast to expand from $2.68 to $4.12.

A widening earnings base will allow the lending company to increase its annual dividend per share from $0.46 in 2024 to $0.62 in 2027, enhancing the effective yield to more than 2%. If Sallie Mae stock is priced at 10 times forward earnings, it should gain 50% over the next four years.

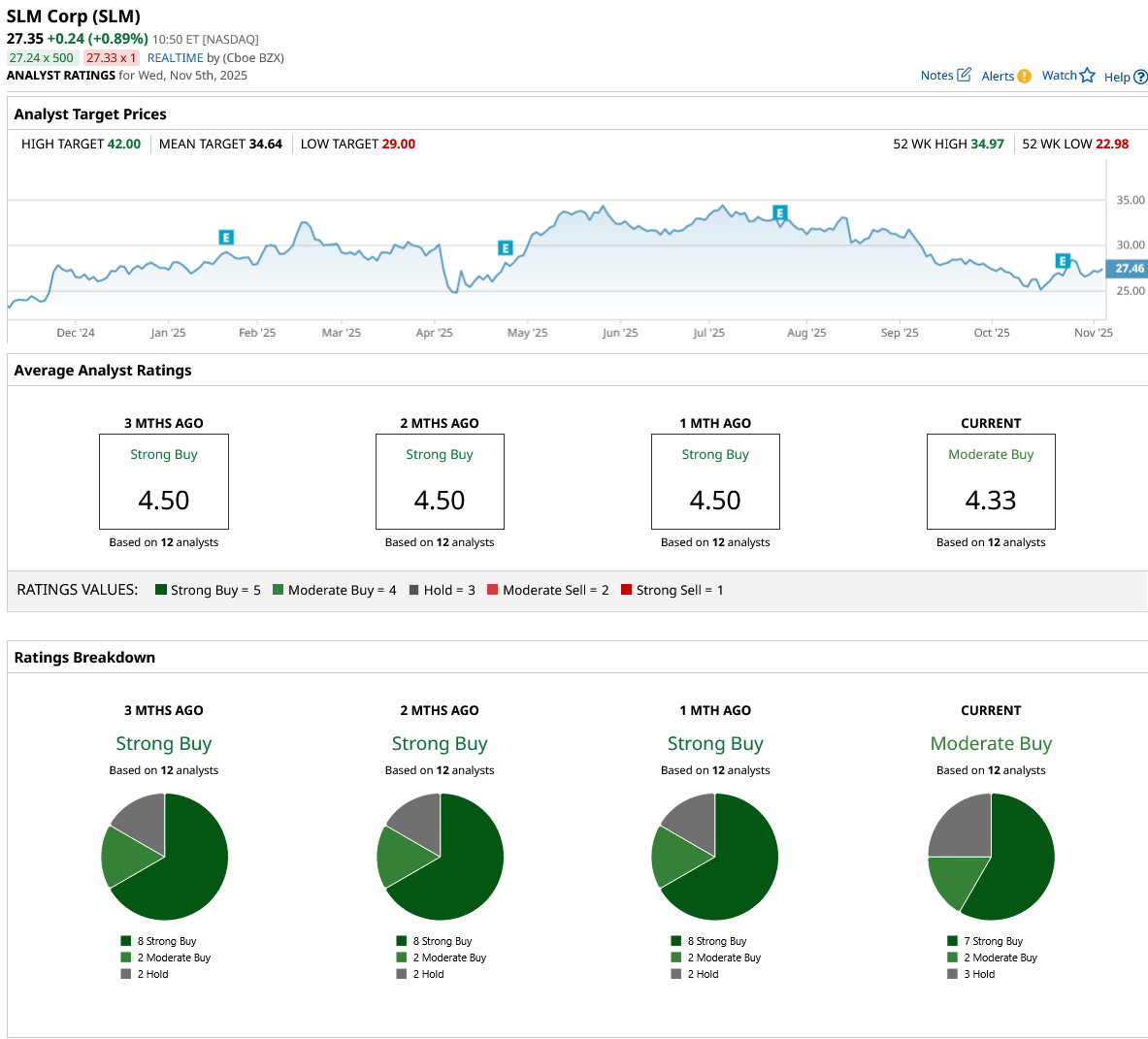

Out of the 12 analysts covering SLM stock, seven recommend “Strong Buy,” two recommend “Moderate Buy,” and three recommend “Hold.” The average SLM stock price target is $34.64, above the current price of $27.35.