Michael Burry, the legendary investor famous for predicting the 2008 housing crisis, has taken a new position in UnitedHealth Group (UNH) through his Scion Asset Management, according to 13F filings for the second quarter.

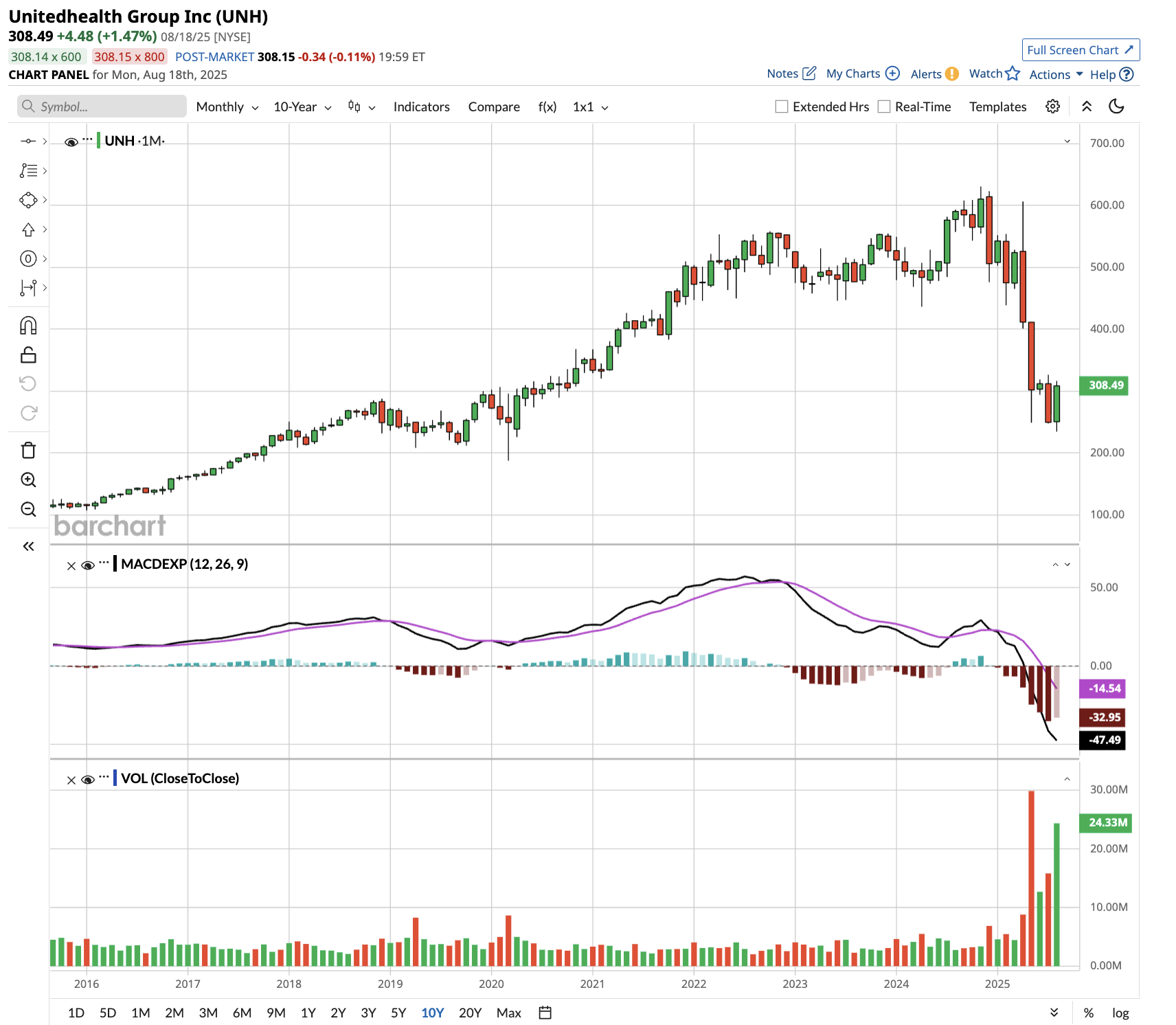

UnitedHealth stock has been battered in 2025, falling nearly 60% from all-time highs through last Thursday before surging 12% on Friday, Aug. 15 following Warren Buffett’s surprise disclosure of a $1.6 billion stake. The healthcare giant has faced intense scrutiny as the poster child for America’s rising healthcare costs.

The nation’s largest private health insurer is navigating multiple headwinds. CEO Andrew Witty stepped down in May after the company pulled its annual earnings outlook. A Justice Department investigation into Medicare billing practices has added regulatory pressure, while the company’s revised 2025 outlook fell well short of Wall Street expectations.

Burry’s investment suggests he sees opportunity amid the turmoil. This adds on to Buffett’s investment, which analysts say “represents a big vote of confidence” and could provide a “trading floor” for the managed care sector.

With UnitedHealth trading at deeply discounted levels despite its market-leading position, contrarian investors like Burry may be betting the current challenges are temporary while the long-term healthcare demand thesis remains intact.

Is UNH Stock a Good Buy Right Now?

UnitedHealth Group’s Q2 earnings call revealed near-term pressures, but also highlighted compelling reasons why the healthcare giant could emerge stronger for long-term investors.

UnitedHealth’s medical costs have been rising faster than expected. The company initially estimated costs to go up about 7.5% this year, but they’re actually rising even more.

For 2026, UnitedHealth is being much more conservative and assuming medical costs will rise by nearly 10%. The company is responding by:

- Raising prices - Charging higher premiums to customers to cover the increased medical costs.

- Cutting benefits - Reducing what services insurance plans will cover or making customers pay more out of pocket.

- Using narrower networks - Limiting which doctors and hospitals customers can use (typically to cheaper, more efficient providers).

These changes take time to work through the system. Most of UnitedHealth’s contracts renew on Jan. 1, so the 2026 changes will start helping their profits next year, with full benefits showing up by 2027.

CEO Stephen Hemsley has initiated comprehensive operational reforms, including monthly business reviews, enhanced forecasting processes, and significant management changes across Optum. Moreover, UNH is investing heavily in AI capabilities and modernizing its technology stack, which should drive long-term efficiency gains.

Despite execution challenges, OptumHealth’s value-based care model continues to demonstrate superior outcomes with 20% fewer hospitalizations and 11% fewer ER visits versus. Mature patient cohorts (2021 and prior) are achieving 8%-plus margins, proving the model’s viability once properly executed.

UNH stock remains the dominant player in multiple healthcare segments with unmatched scale advantages. Its integrated model combining insurance, pharmacy benefits, and care delivery creates defensive moats that competitors struggle to replicate.

What Is the Target Price for UNH Stock?

Analysts tracking UNH stock forecast adjusted net income to expand from an estimated $16.24 per share in 2025 to $32.22 per share in 2029. Today, UNH stock trades at a forward price-earnings multiple of 19x, which is in line with the 10-year average. If it trades at a similar multiple, the healthcare stock should trade around $608 in early 2029, indicating an upside potential of over 100% from current levels.

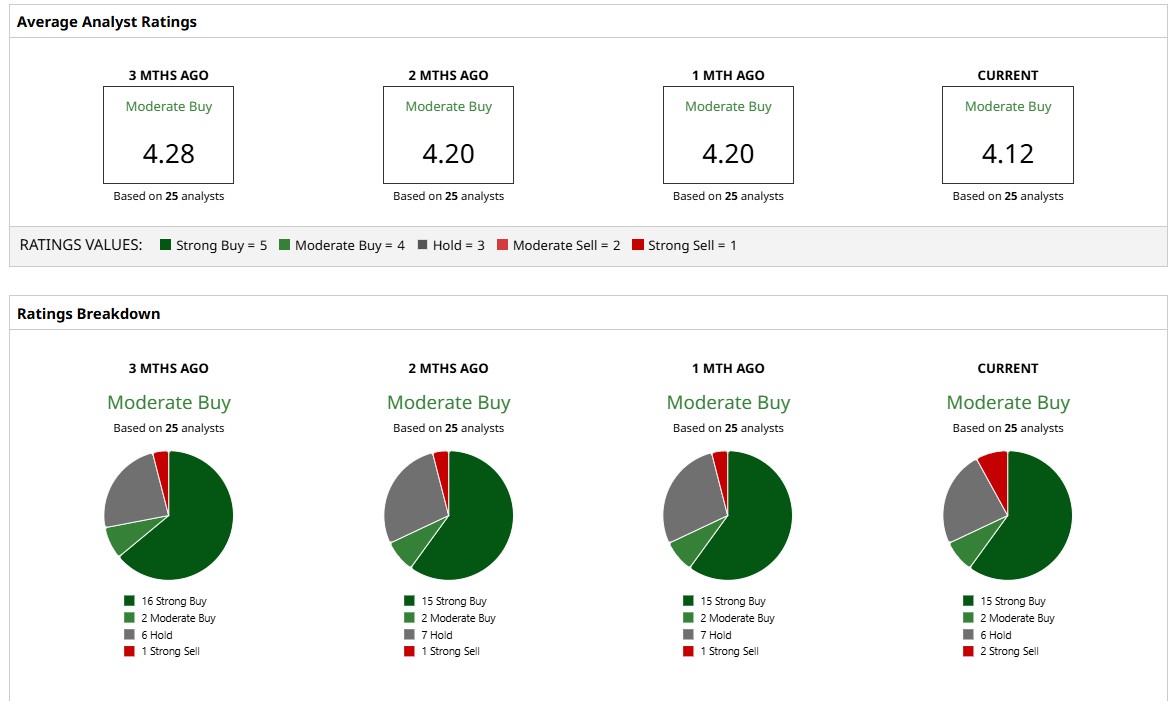

Out of the 25 analysts covering UNH stock, 15 recommend “Strong Buy,” two recommend “Moderate Buy,” six recommend “Hold,” and two recommend “Strong Sell.” The average UNH stock price target is $306.62, roughly in line with the current trading price.