Shares of Meta Platforms Inc. (NASDAQ:META) saw a 7.67% drop during the pre-market trading session on Thursday after the company reported a massive one-time charge in its third-quarter earnings report.

Meta Boosts AI Spending

Meta’s Q3 earnings report, released on Wednesday, revealed diluted earnings per share of $1.05, including a one-time, non-cash income tax charge of $15.93 billion. This figure contrasts with the estimated $6.68.

On an adjusted basis, the earnings per share stood at $7.25. The quarterly revenue of $51.24 billion exceeded the Street estimate of $49.38 billion, marking a 26.25% increase from the same period last year.

Zuckerberg expressed optimism about the company’s future, particularly its Meta Superintelligence Labs and AI glasses. He also outlined the company’s plans for 2026, which include a significant increase in capital expenditures and total expenses. This will be primarily driven by infrastructure costs, including cloud expenses and depreciation. Employee compensation costs, particularly for AI talent, are also expected to contribute to this growth.

See Also: Forget Bulldozers — Caterpillar CEO Says AI Data Centers Are The New Power Move

Expert Calls Market-Reaction ‘Short-Sighted’

Despite the company’s strong financial performance, the stock has been under pressure. According to Wedbush analyst Dan Ives, the market’s reaction is short-sighted, and Meta’s increased CapEx is a positive move.

Furthermore, Zuckerberg addressed investor concerns about the profitability of Meta’s growing wearables business. He stated that while the company earns revenue from device sales, the bigger opportunity lies in services and AI features layered on top. He expressed confidence in the profitability of Meta’s investment in smart glasses and augmented reality devices.

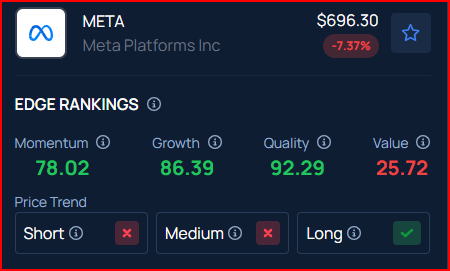

META Price Action: On a year-to-date basis, shares have risen 25.44%. They were trading at $696.30 at last check, as per data on per Benzinga Pro.

Meta holds a momentum rating of 78.02% and a growth rating of 86.39%, according to Benzinga's Proprietary Edge Rankings. The Benzinga Growth metric evaluates a stock’s historical earnings and revenue expansion across multiple timeframes, prioritizing both long-term trends and recent performance. Click here to see how it compares to other leading tech companies.

READ NEXT:

Image via Shutterstock

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.