With Meta Platforms’ stock down more than 60% on the year and fellow digital ad giant Alphabet having missed estimates yesterday, it’s safe to say expectations are fairly low heading into Meta’s latest earnings report.

Among analysts polled by FactSet, the consensus is for the social-media giant to report third-quarter revenue of $27.44 billion (down 5% annually) and GAAP EPS of $1.90 (down 41%).

Meta typically provides quarterly sales guidance in its earnings report. The company’s revenue consensus for the seasonally big fourth quarter stands at $32.3 billion (down 9% annually).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Meta’s earnings report, along with a conference call with management that’s scheduled for 5 P.M. Eastern Time.

Please refresh your browser for updates.

6:12 PM ET: Meta's call has ended. Shares are down 19.2% after-hours to $104.85 after the company posted mixed Q3 results (revenue beat, EPS missed), guided for Q4 revenue of $30B-$32.5B vs. a $32.3B consensus, and (most importantly) guides for 2023 costs/expenses of $96B-$101B and capex of $34B-$39B, above 2022 guidance ranges of $85B-$87B and $32B-$33B.

On the call, Mark Zuckerberg and other Meta execs repeatedly defended the company's aggressive spending (amid considerable analyst skepticism), arguing large AI and Reality Labs investments will leave Meta on much stronger long-term footing. Zuck also disclosed Instagram now has over 2B MAUs and WhatsApp has over 2B DAUs, and that Reels (though still a $500M headwind to total revenue) is on a $3B/year revenue run rate.

Thanks for joining us.

6:03 PM ET: Last question is about whether Meta is making too many experimental bets.

Wehner insists Meta is only investing in areas where it thinks there's a real payoff. Highlights the success of investments in click-to-WhatsApp ads.

Zuck once more defends the long-term value of the metaverse and AI investments. Li notes the payoff Meta is seeing for its investments in growing Reels engagement/monetization.

5:58 PM ET: A question about ad product investments.

Li reiterates Meta is making investments to drive in-app conversions for ads to improve measurement, and is seeing a payoff for them. Also reiterates Meta is investing in using AI to develop privacy-friendly ways to improve targeting/measurement.

5:55 PM ET: Li says Meta's 2023 spending guidance takes into account a variety of macro scenarios. Also reiterates Meta is focused on being "disciplined" about headcount growth.

Regarding metaverse investments, Zuck argues there are four areas of focus: Social experiences such as Horizon, VR (across both consumer and work headsets), AR (where he insists no one is ahead of Meta yet) and neural interfaces for hardware (where he argues Meta is engaged in groundbreaking work). Says some of these efforts will yield products in the short-term, while others will take 5-to-10 years.

"I think it would be a mistake for us not to focus on any of these areas that I think will be fundamental to the future," he says. "I think it's some of the most historic work we're doing."

5:47 PM ET: A question about how much metaverse investments are driven by a desire to future-proof its platforms from external threats.

Zuck says protecting the company from external threats is a factor behind Meta's investments, but not the only one. Argues Meta also benefits from enabling transactions to happen on its platforms, and that having end-to-end platforms also lets it create user experiences that it otherwise couldn't.

5:42 PM ET: A question about how much the ATT impact has diminished.

Wehner says the diminished impact of ATT on growth in Q3 mostly comes from lapping the 1-year anniversary.

5:40 PM ET: A question about Reels usage retention. And one about long-term capex-intensity.

Wehner reiterates Reels is incremental overall to time spent, and that Meta is working to close the monetization gap between Reels and feed/stories ads. Adds that it will still take time for Reels to become a net positive to revenue.

Regarding capex, Li says Meta will pace future AI-related capex investments based on the returns it sees on current investments. Adds that Meta is also investing in growing its data center footprint and expects this part of capex to become more efficient over time.

Zuck compares the effort to drive Reels usage and improve monetization to Meta's effort to do the same with its stories services a few years ago. Notes stories monetization was more successful than Meta expected.

Also says Reels growth benefits Meta by providing it more data about what content its users are consuming, which it can leverage to improve content personalization.

5:33 PM ET: A question about macro headwinds. And one about how much wiggle room Meta has to trim operating expenses.

Wehner says Meta is seeing large macro headwinds for its ad business, and that cyclicality is a factor. Adds that Meta is seeing progress in dealing with Apple policy changes, and that click-to-message ads are a bright spot for ad sales.

Li says the majority of Meta's 2023 opex growth will come from hiring done in 2022, and that growth will decelerate as Meta passes the 1-year anniversary of these hires.

5:30 PM ET: The Q&A session has begun. First question is about the capex guide, and what kinds of AI investments are driving it. There's also a question about U.S. time spent.

Wehner says Meta is pleased with what it's seeing regarding engagement, and the time spent on Facebook and Instagram are up Y/Y both in the U.S. and globally. He adds that Meta isn't optimizing for increasing time spent.

Incoming CFO Susan Li says AI-related capex investments are serving to both grow time spent and improve the quality of Meta's ad products.

5:24 PM ET: Wehner reiterates the spending outlook provided in the Q3 report. Says operating expense growth will decelerate meaningfully in 2023 as headcount is kept flat. However, cost of revenue growth will be high due to depreciation expenses related to high capex.

5:21 PM ET: Regarding the Q4 guide, Wehner says it assumes forex will be a 7-point headwind to revenue growth, up from 6 points in Q3.

5:19 PM ET: Wehner says the Y/Y impact on Apple's ATT changes diminished in Q3, as Meta lapped the 1-year anniversary of the changes. But adds this was offset by weaker ad demand due to macro pressures.

Also says ad spend among smaller advertisers has been "more resilient" than ad spend among large advertisers, and notes Asia-Pac was the region with the fastest revenue growth.

5:17 PM ET: Dave Wehner is now talking. He's recapping Meta's Q3 financials, and promises hiring will "slow dramatically" following Q/Q headcount growth of 3,700 in Q3.

5:14 PM ET: Zuck talks up professional use cases for Meta's recently-launched Quest Pro VR headset. Insists the company's large metaverse investments will be of tremendous long-term importance and ultimately pay off.

5:13 PM ET: For now, Zuck's comments haven't had an effect on Meta's stock: Shares are down 14.5% AH.

5:12 PM ET: Shifting content consumption towards Reels is said to be a $500M revenue headwind for now, as Meta works to improve Reels monetization. Reels is said to be on a $3B/year revenue run rate.

Click-to-WhatsApp ads are now said to be on a $1.5B/year run rate, up 80% Y/Y.

5:10 PM ET: Zuck says there are now more than 140B Reels played across Facebook and Instagram each day (up strongly Q/Q), and asserts Reels is growing time spent on Meta's apps and helping it gain social media engagement share.

5:08 PM ET: Zuck defends Meta's large Reality Labs investments. Also says he expects capex to decline as a % of revenue over the long-term.

5:07 PM ET: Zuck says Meta's revenue trends are behind where he thinks they should be, while adding he expects a return to healthier revenue growth in 2023.

5:06 PM ET: Mark Zuckerberg is talking. He asserts Meta's product trends look better than what recent commentary suggests, and that engagement trends are strong.

Instagram is said to now have over 2B MAUs, and WhatsApp is said to have over 2B DAUs.

5:04 PM ET: Meta's call is starting. This will be the company's first call without Sheryl Sandberg, who recently stepped down as COO.

It will also be the last call during which Dave Wehner acts as CFO. Wehner will move over to the role of chief strategy officer on Nov. 1.

5:00 PM ET: Meta's quarterly free cash flow over the last two years. As the numbers show, aggressive hiring/capex and top-line pressures have combined to take a pretty big toll on FCF.

4:51 PM ET: Meta's headcount at the end of Q3 (which is forecast to be roughly similar to its headcount at the end of 2023) stood at 87,314. That's up 5% Q/Q and 28% Y/Y.

4:46 PM ET: In spite of all the demand headwinds it's seeing, Meta's ad impressions rose 17% Y/Y, a slight improvement from Q2's 15%.

However, average price per ad (hurt by Apple policy changes that hurt targeting/measurement, as well as the fact that Reels monetization is in its early stages) fell 18%, worse than Q2's 14% decline.

4:43 PM ET: As a reminder, Meta's earnings call starts at 5PM ET. I'll be covering it.

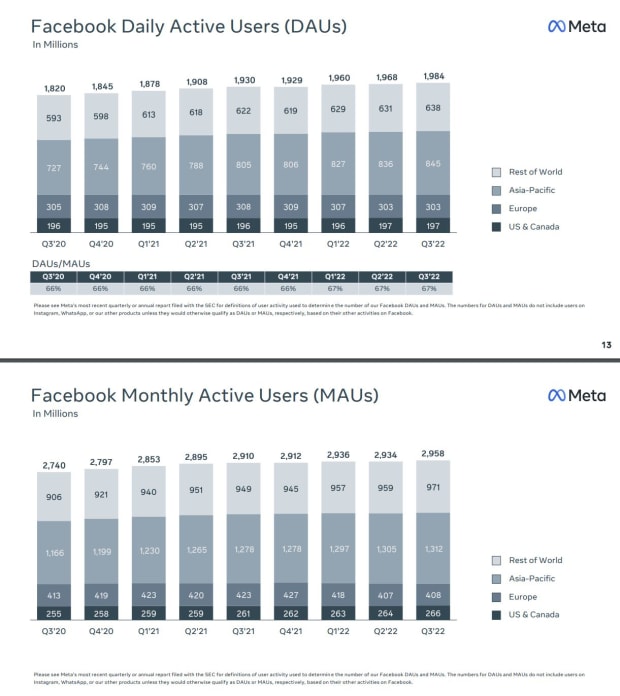

4:42 PM ET: Facebook/Messenger daily active users rose 1% Q/Q and 3% Y/Y to 1.98B. Facebook/Messenger monthly active users rose rose 1% Q/Q and 2% Y/Y to 2.96B.

Both numbers are roughly in-line with consensus, with active users mostly holding steady Q/Q in North America and Europe (responsible for the lion's share of Meta's revenue).

4:36 PM ET: Notably, whereas the tech sector in general sold off yesterday afternoon following Microsoft and Alphabet's reports, the shares of fellow tech giants are largely unchanged following Meta's report.

In addition, some chip and hardware firms are getting a lift from Meta's capex guidance. Arista Networks is up 6.5% AH, Nvidia is up 4%, AMD is up 2.2% and Marvell is up 3.2%.

4:33 PM ET: $6.55B was spent on stock buybacks in Q3 (at levels higher than what Meta's currently trades at), up from $5.08B in Q2.

With Meta issuing debt to help finance its buybacks, the company ended Q3 with $41.8B in cash and $9.9B in debt.

4:29 PM ET: Meta's Family of Apps segment (it covers Facebook/Instagram/Messenger/WhatsApp) posted GAAP op. income of $9.34B, down 29% Y/Y.

The Reality Labs segment (covers AR/VR efforts) posted a $3.67B GAAP op. loss, up from $2.63B a year ago.

Notably, Meta forecasts Reality Labs' op. losses "will grow significantly" in 2023. Beyond 2023, Meta says it expects to "pace Reality Labs investments such that we can achieve our goal of growing overall company operating income in the long run."

4:24 PM ET: Meta is now down 11% AH to $115.52. Shares have made new 52-week lows and are at levels last seen in 2016.

4:22 PM ET: Total revenue declined 4% Y/Y, with forex acting as a 6-point headwind to growth.

Ad revenue (pressured by macro headwinds, Apple policy changes, and for now shifting content consumption towards Reels) fell 4% to $27.24B.

Reality Labs revenue (mostly VR headset-related) fell 49% to $285M. All other revenue rose 9% to $192M.

4:17 PM ET: Daily active people for Meta's app family totaled 2.93B in September, up 2% Q/Q and 4% Y/Y.

Monthly active people totaled 3.71B, also up 2% Q/Q and 4% Y/Y.

4:14 PM ET: Meta: "We are holding some teams flat in terms of headcount, shrinking others and investing headcount growth only in our highest priorities. As a result, we expect headcount at the end of 2023 will be approximately in-line with third quarter 2022 levels.

We have increased scrutiny on all areas of operating expenses. However, these moves follow a substantial investment cycle so they will take time to play out in terms of our overall expense trajectory. Some steps, like the ongoing rationalization of our office footprint, will lead to incremental costs in the near term. This should set us up well for future years, when we expect to return to higher rates of revenue growth."

Not quite what markets wanted to hear amid growing investor calls to aggressively cut spending.

4:12 PM ET: Likewise, Meta is guiding for 2023 capex of $34B-$39B. That's above a 2022 capex guidance range of $32B-$33B (narrowed from a prior $30B-$34B).

Shares are now down 6.8% AH.

4:11 PM ET: Meta's spending guidance is likely weighing on the stock. The company just slightly trimmed its 2022 cost/expense guidance to $85B-$87B from $85B-$88B. And more importantly, Meta is guiding for costs/expenses to rise to $96B-$101B in 2023.

4:07 PM ET: Meta's stock has quickly reversed course: Shares are now down 5.3% AH.

4:06 PM ET: Results are out. Q3 revenue of $27.71B beats a $27.44B consensus. GAAP EPS of $1.64 misses a $1.90 consensus.

Meta guides for Q4 revenue of $30B-$32.5B vs. a $32.3B consensus.

Shares are up 5.8% after-hours.

4:01 PM ET: Meta closed down 5.6%. The Q3 report should be out shortly.

3:57 PM ET: Along with its sales/earnings, Meta's full-year spending guidance will get attention, as will any comments it shares about planned spending cuts. Recently, investment firm Altimeter Capital sent an open letter to Mark Zuckerberg calling for him to (among other things) cut Meta's headcount by at least 20%.

3:53 PM ET: Thanks in part to Alphabet's Q3 miss, Meta's stock is down 5.9% today going into earnings. Shares are down 62% YTD and at levels first reached in 2016.

3:52 PM ET: The FactSet consensus is for Meta to report Q3 revenue of $27.44B and GAAP EPS of $1.90. The Q4 revenue consensus stands at $32.3B.

From the looks of things, investor expectations are often below these numbers, particularly following Snap and Alphabet's Q3 reports.

3:46 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Meta's earnings report and call.