/Meta%20by%20creativeneko%20via%20Shutterstock.jpg)

Meta Platforms (META) stock is down from its post-Q2 earnings peak. It could be a buy here for patient investors. This article will explore three ways to play it using put and call options for the value investor.

Meta closed at $754.79 on Friday, August 22, down from a closing high of $790.00 on August 12. Meta's Q2 earnings were released on July 30, when it was at $695.21. But the next day it rose to $773.44. So, since then, META stock has dropped.

I argued in a July 31 Barchart article that META stock might be worth $800.85 per share ("META Stock Soars and Options Volume Explodes - Is META Fully Valued?"). That was based on its free cash flow (FCF) and FCF margins.

This means there is a potential upside of +6.1% (i.e., $800.85/$754.79 = 0.061) for new investors in META stock. That's not much.

But there are ways to play this using options that might make sense for value investors.

This involves shorting out-of-the-money (OTM) puts, and/or a combination of buying longer-dated in-the-money (ITM) calls and shorting near-term OTM calls.

Shorting OTM META Puts

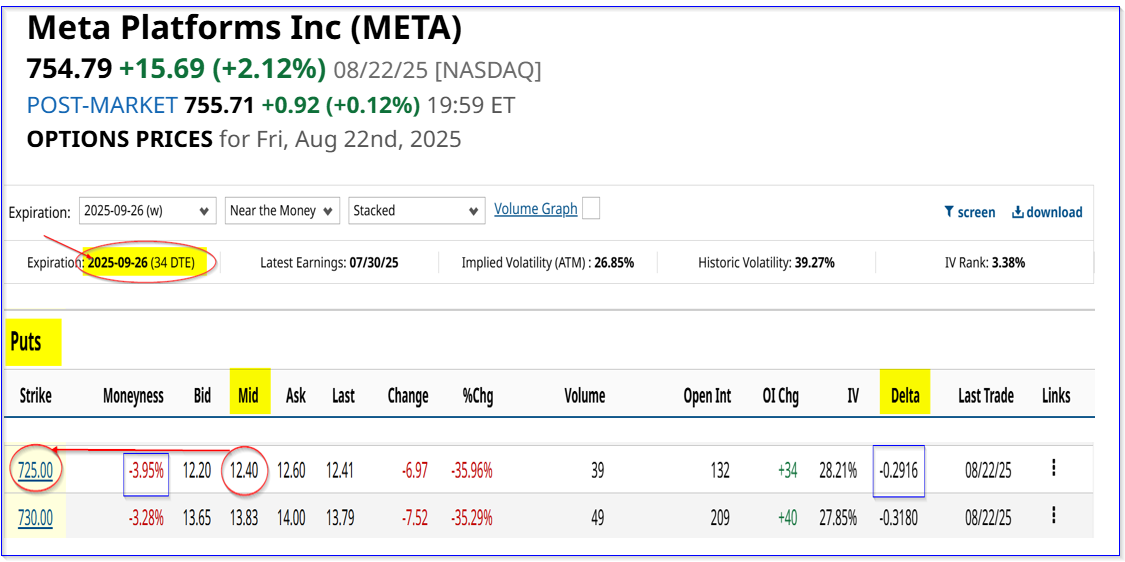

For example, look at the Sept. 26 expiry period, for put contracts expiring about a month from now (33 days to expiry). It shows that the $725.00 strike price put contract, which is almost $30 or about 4% below the closing price (i.e., is out-of-the-money or OTM), has an attractive midpoint premium of $12.40.

That means a short-seller of these puts can make an immediate yield of 1.71% (i.e., $12.40/$725.00).

This is because the investor who secures $72,500 with their brokerage firm (i.e., collateral posted to buy 100 shares at $725.00), is allowed to enter a trade order to “Sell to Open” 1 put contract at $725.00 for expiry on Sept. 26. The account immediately receives $1,240 (i.e., $1,240/$72,500 = 0.0171 = 1.71%).

As long as META stays over $725.00 until Sept. 26, the investor's collateral will not be assigned to buy 100 shares at $725.00. But even if that happens, the investor has a lower breakeven:

$725.00 - $12.40 = $712.60 breakeven point

That price is 5.6% below Friday's close. In other words, it provides a potentially lower buy-in price. Moreover, the upside using our price target is quite attractive:

$800.85 / $712.60 = 1.1238-1 = +12.48% upside

The point is that an investor can repeat this trade each month. For example, over three months, the expected return (ER) is over 5% (i.e., 1.71% x 3 = 5.13%). Again, that assumes the investor can repeat this short-put yield each month for three months.

The only issue is that an investor has to invest $72.5K. Many investors don't have that amount. Another play is to do a “poor-man's covered call” (i.e., a PMCC).

Poor Man's Covered Call (PMCC)

Here is how this works. An investor first buys an in-the-money (ITM) call (i.e., below the trading price) at a future expiry period, for example, expiring three months from now. Then they can sell nearer-term expiry period call options (say, for one-month expiry) at higher strike prices.

That way they have the potential upside from the ITM call option but the outlay is much lower than securing an OTM put play. And they collect covered call income as well.

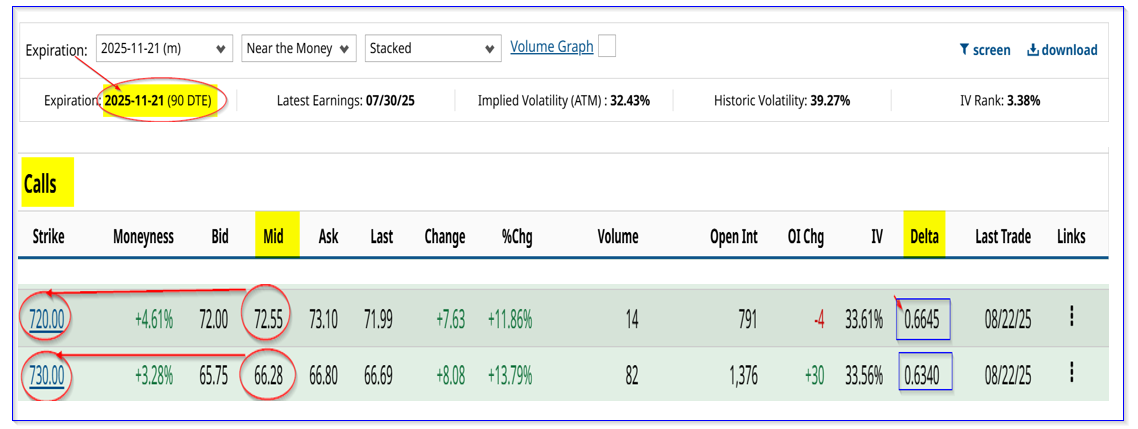

For example, look at the Nov. 21, 2025, expiry call option period, which expires 90 days from now (i.e., 3 months away).

The $720.00 call option midpoint premium would cost a buyer $72.55 (i.e., $7,255 per contract) and the $730 call costs $66.28 (i.e., $6,628). This means the outlay is about 10% of the short-put play above.

It also means that, using an average of these two calls, an investor could set a buy-in of $725 (i.e., 1 call at $720 for $7,255 and 1 call at $730 for $6,628, i.e., a total investment of $12,916:

$12,916 / 200 = $64.58 average cost

This for an average $725.00 call strike price using these two ITM call contracts in the next 3 months.

In other words, the breakeven point is:

$64.58 + $725.00 = $789.58 breakeven

That is only +4.60% higher than today's price (i.e., $789.58/$754.79). But, if META rises to the $800.78 target price, the upside is much better than owning shares:

$800.85-$725.00 avg strike = $75.85 intrinsic value per ITM call

$75.85-$64.58 avg. cost = $11.27 upside

$11.27 upside / $64.58 avg. cost = 0.1745 = +17.45% potential upside

That +17.5% upside ITM call buy play contrasts with the +6.1% upside owning META shares (at the target price), and the +12.48% breakeven upside with the short-put play (assuming META stock falls first to $725.00 and an assignment is made at $725.00).

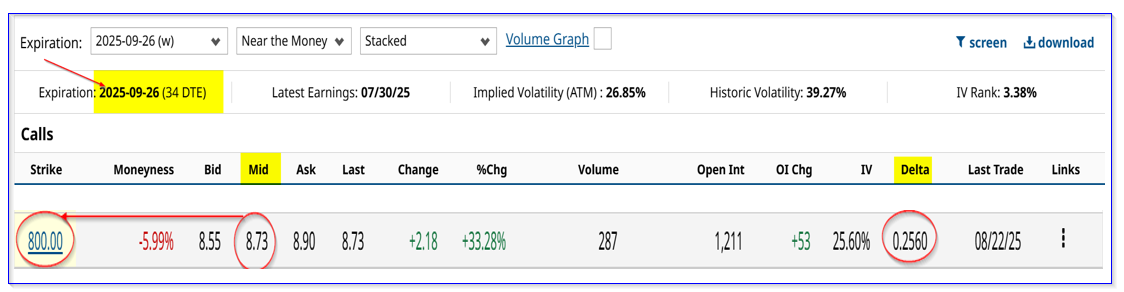

Moreover, the ITM call buyer can now also sell short covered calls and make more income. For example, the Sept. 26 option period shows this. Look at the 1-month call options at $800.00 (the target price):

It shows that the midpoint premium that can be received is $8.73. That provides the ITM covered call player an immediate yield of 1.106%:

$8.73/$789.58 breakeven point = 0.01106 = 1.106% for one month

Moreover, the investor's total return would be higher if the stock rises to $800:

$800-$789.58 = $10.42 +48.73 = $19.15

$19.15 / $64.58 average cost = 0.2965 = +29.65% potential upside

And don't forget the investor can potentially repeat this trade three times over the next 90 days as they are already long the Nov. 11 expiry ITM call options.

So, as a result, an investor only has to outlay 10% or so of what it costs to buy 100 shares of META and/or short 1 OTM put option, and make a better potential upside. That is why this is called a “poor man's covered call” or PMCC.

There are substantial risks associated with OTM and ITM calls and puts. Investor can study the Barchart Option Education Center to better understand these risks.