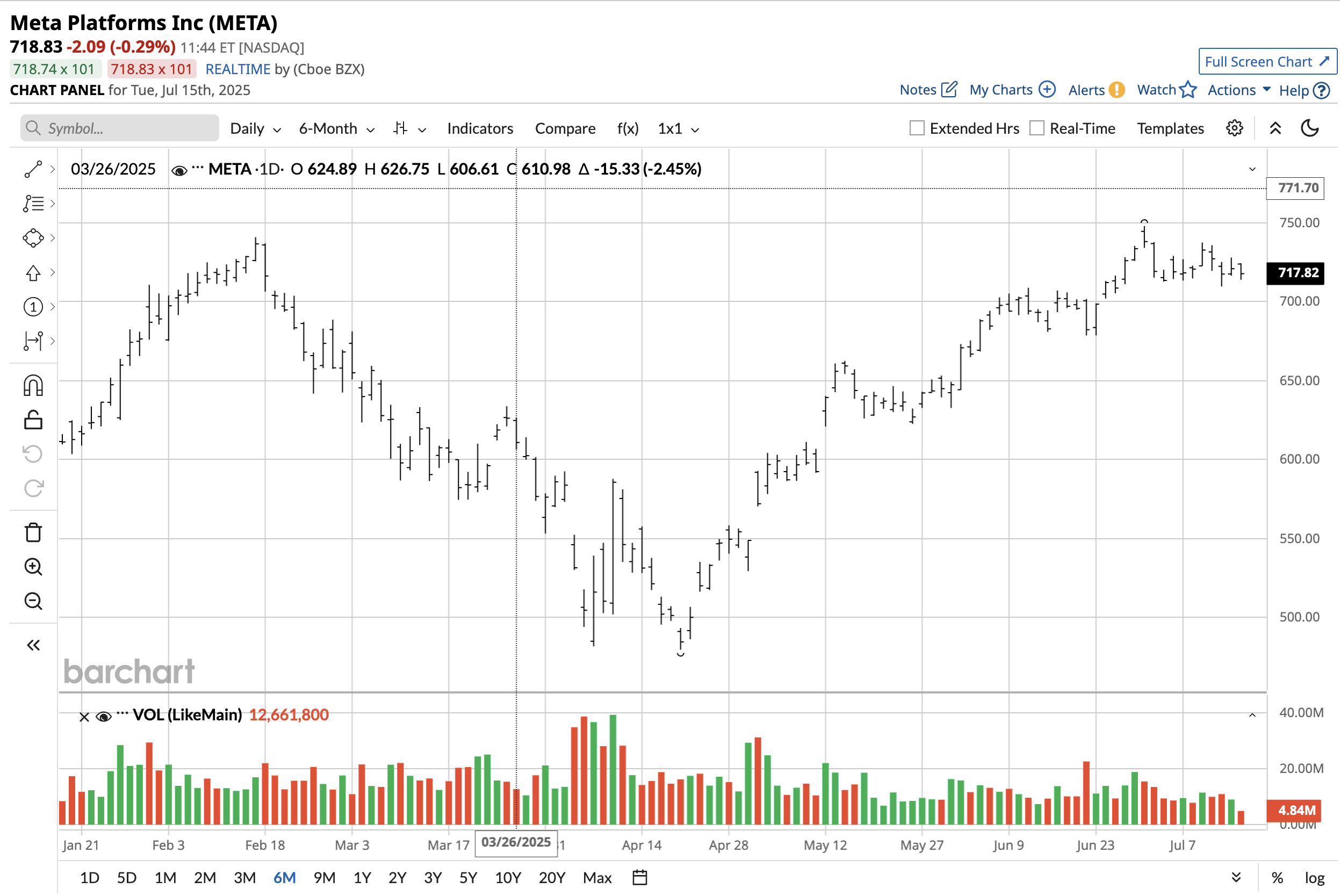

Meta Platforms (META) has seen near-flawless execution in the past three years. After a setback in 2022, the stock bottomed out and has delivered 706% in gains from its trough to today.

Back then, Facebook was losing users, growth was slowing down, and Meta didn’t have a vehicle to direct its cash flow toward to boost its growth. CEO Mark Zuckerberg poured investments into Reality Labs, and that essentially became a money pit.

Artificial intelligence (AI) came just at the right time, and it has rescued Meta Platforms and then some. Many analysts are now in love with the company and its prospects going forward, especially those at Piper Sandler.

Why Piper Sandler Loves Meta

Piper Sandler analysts see META stock as their top large-cap internet pick. Their rationale is due to Meta’s “strong checks & AI investments.” The analysts raised their estimates, pointing out that Meta has “...returned to a beat/raise cadence after 1Q 2025 was the worst our ad buyer has seen since Q4 2022.”

They also believe Reels and Meta’s diversification into other businesses is helping keep up the momentum. Piper now projects Q3 revenue at $47 billion, implying 16% year-over-year growth. This is the same year-over-year sales growth Meta reported in Q1.

They put the price target at $808, implying 15% upside from the current price.

AI Is Moving the Needle

The principal factor reinforcing analyst conviction here is how Meta has used AI to supercharge its business. Its ads are now much more efficient, along with the core social media algorithm.

The top line is also picking up speed, since Meta now has a bona fide flywheel. It can use the cash from its Family of Apps segment to fund billions in AI and data center spending. Analysts expect $64 billion to $72 billion in AI-related capex for all of 2025.

On Monday this week, Mark Zuckerberg said that Meta Platforms will spend “hundreds of billions of dollars” to build massive AI data centers for “superintelligence.” Zuckerberg said that Meta already has the capital from its business to fund these data centers.

The first multi-gigawatt data center is expected to come online in 2026, followed by another one in the next few years.

What Other Analysts Think

The analyst community is still not a monolith, and they have differing views here, though the vast majority of them are bullish.

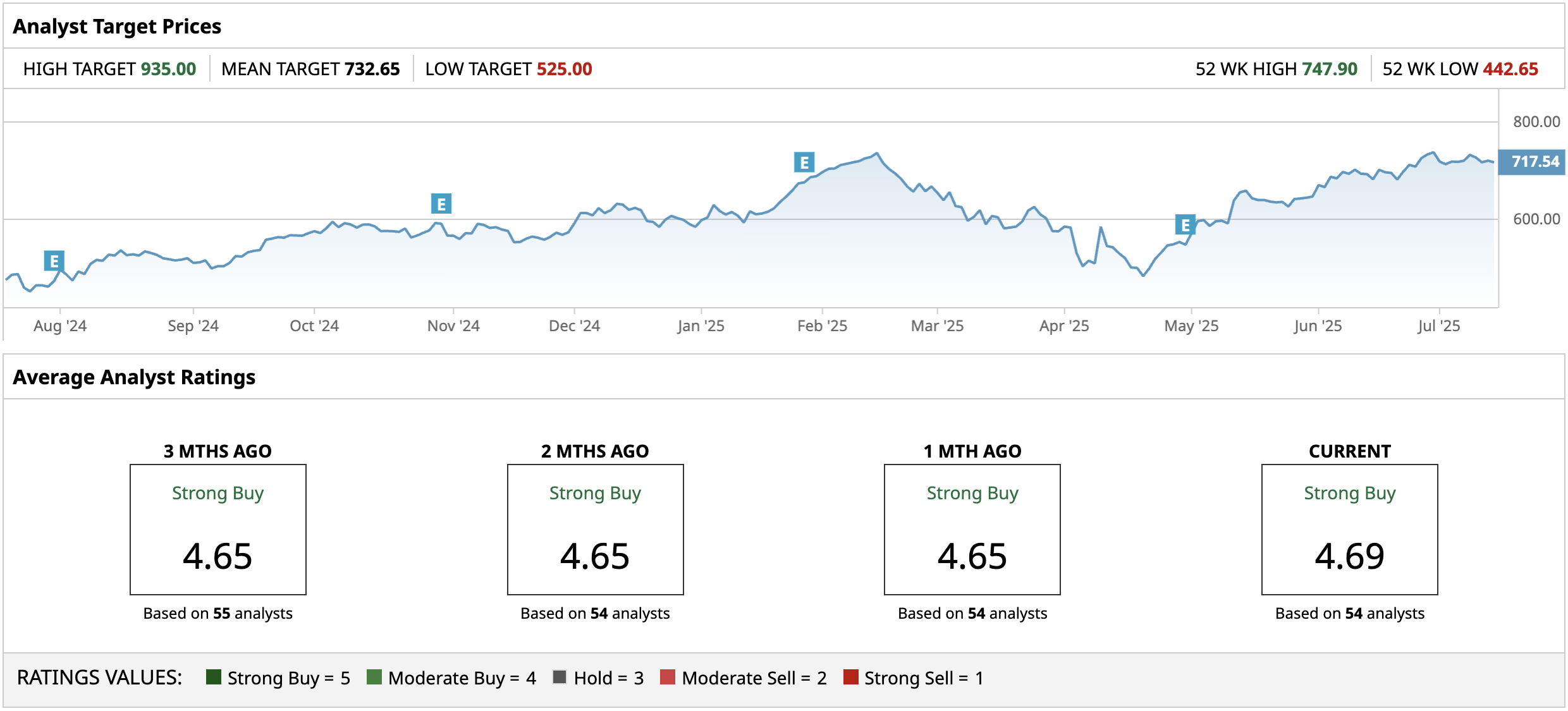

Out of 54 analysts, 45 tag META stock as a “Strong Buy,” with three tagging it as a “Moderate Buy.” Five see META stock as a “Hold,” leaving only one “Sell” rating. The lowest price target at the moment is $525, and the highest price target is $935.