Meta investors are hoping the social-media giant will post a stronger earnings report than the one shared yesterday by rival Snap.

Among analysts polled by FactSet, the consensus is for Meta to report fourth-quarter revenue of $31.55 billion (down 6.3% annually) and GAAP EPS of $2.26.

Meta typically shares quarterly sales guidance in its reports. The company’s first-quarter revenue consensus stands at $27.18 billion (down 2.6% annually).

Eric Jhonsa, Real Money’s tech columnist, will be live-blogging Meta’s earnings report, along with a call with management that’s scheduled for 5 P.M. Eastern Time.

Please refresh your browser for updates.

6:08 PM ET: Meta's call has ended. Shares are up 19.4% after-hours to $182.75, hitting their highest levels since last summer after Meta topped Q4 sales estimates (EPS officially missed due to restructuring charges, but op. income was above consensus), issued in-line Q1 sales guidance and cut its 2023 cost/expense and capex guidance.

On the call, Mark Zuckerberg stressed that Meta will strive to run itself more efficiently this year, while continuing to make large AR/VR and AI-related investments. He also disclosed Meta's click-to-message ad business is now on a $10B/year run rate, and that he wants the company to be a leader in generative AI.

Thanks for joining us.

6:02 PM ET: A question about the assumptions behind Meta's Q1 sales guide.

Li says the Q1 guide accounts for the macro uncertainty Meta is dealing with, as well as a lower forex headwind and optimism about the returns it's seeing on ad product and AI investments.

5:59 PM ET: A question about click-to-message ad growth, and one about efficiency efforts.

Li says click-to-message ads are driving incremental ad demand, with many advertisers using them exclusively. Adds Meta continues looking for ways to both improve ROI for the ads and grow supply.

Regarding efficiency, Zuck says Meta is in the midst of a "phase change" in terms of how it spends, accepting that some businesses will see rapid growth and that others are more mature. Says he's "fairly optimistic" that there are a lot of things Meta can do to be more efficient that will also help it build faster.

5:54 PM ET: A question about Reality Labs losses, and one about Shop ads.

Li says Meta still expects Reality Labs' losses to grow in 2023, and continues to invest there for the long-term. Regarding Shop ads, Olivan indicates they're growing rapidly off a small base, with a run rate in the hundreds of millions.

5:52 PM ET: A question about the "added signal" Meta is getting from AI-based content recommendations.

Zuck notes Meta is using larger, GPU-based, AI models that are more compute-intensive to drive recommendations, and that the company is seeing a benefit from doing so. Adds that AI-recommended content is growing not just on Reels, but on the main Facebook and Instagram feeds.

5:49 PM ET: A question about the relationship between opex and capex growth going forward. And one about the current health of the digital ad market.

Li reiterates Meta aims to see compounding earnings growth, while continuing to invest in growth initiatives. Regarding the ad market, she says the holiday season's performance was in line with Meta's expectations, and that the environment remains volatile.

5:46 PM ET: A question about whether Meta is still seeing headwinds from Apple policy changes, and one about whether there will be similar headwinds for Android.

Li says Meta is still seeing a headwind in absolute dollars from the Apple changes, but is making progress towards mitigating the impact. Regarding Android, she says it's too early to tell, while adding Google is taking an approach that involves working with the ad industry.

5:44 PM ET: A question about the implications of Meta's revised spending guidance.

Li says the lower spending guide implies lower payroll growth (due to both layoffs and less hiring), lower depreciation expenses (due to increasing the estimated useful life of servers) and a $1B reduction in estimated charges related to closing office facilities.

5:41 PM ET: A question about the impact of Apple policy changes, and one about Reality Labs' long-term spending.

Li says Meta continues making progress in mitigating the impact of policy changes, and is still working to drive more ad conversions on its apps.

Olivan adds AI investments are helping drive conversion growth, as well as help advertisers automate their ad campaigns.

Regarding Reality Labs spend, Zuck says hardware investments currently require more resources than software investments, and that Meta is "constantly adjusting" how it allocates resources to Reality Labs. Also reiterates Meta is generally trying to run more efficiently.

5:35 PM ET: A question about balancing short-form video growth and monetization, and one about what talks about advertisers have been like regarding short-form.

Zuck says building and monetizing a new product are two separate challenges, and that Meta has historically sought to initially focus on creating a popular product before working on monetizing it, and that this approach has served it well. Adds Meta is now "at a pretty good scale" for Reels.

COO Javier Olivan adds that more than 40% of advertisers are now using Reels, and highlights some advertiser success stories. Li reiterates Meta is still on track to make Reels revenue-neutral by around year's end.

5:30 PM ET: First question is about generative AI use cases. There's also a question about long-term capex-intensity.

Zuck says Meta has "a bunch of different workstreams" across its platforms that could make use of generative AI. Says Meta will learn over time what works and what doesn't, while admitting the infrastructure costs for supporting generative AI workloads is high.

Regarding capex, Li says Meta's new data-center architecture will be cheaper and faster to build, and offer more flexibility. Says Meta aims to bring capex down as a % of revenue, while cautioning near-term capex growth will be driven by AI-related needs.

5:25 PM ET: The Q&A session is starting.

5:23 PM ET: Li goes over recent cost-cutting efforts, which encompass layoffs, cutting non-essential projects, consolidating office facilities and migrating to a more cost-efficient data center architecture.

5:21 PM ET: Li says AI-based content recommendations are helping grow engagement, and that efforts (in response to Apple policy changes) to improve ad performance and measurement are paying off.

She adds more than half of all click-to-message ad buyers are exclusively using the ad format.

5:17 PM ET: Li says Q4 revenue remained under pressure by weak ad demand, which was impacted by macro headwinds. Growth remained negative for e-commerce and CPG ads, though the pace of decline for e-commerce has slowed. Travel and healthcare ads were growth areas.

Ad revenue growth was strongest in the Rest of World region. North America was flat, while Europe and Asia-Pac declined. Asia-Pac and Rest of World drove ad impression growth.

5:13 PM ET: Li is recapping Meta's Q4 financials. Notes lower marketing and legal expenses partly offset higher spending in other areas.

5:12 PM ET: CFO Susan Li is now talking.

5:11 PM ET: Zuck takes some time to talk up Meta's AR/VR efforts. Asserts the launch of a new consumer headset later this year will set a new standard for consumer experiences.

5:09 PM ET: In the wake of ChatGPT's arrival, Zuck calls generative AI an exciting new area, and says he aims for Meta to be a leader in the space.

5:08 PM ET: Click-to-message ads are said to now be on a $10B/year run rate.

5:07 PM ET: Zuck reiterates Facebook and Instagram are seeing shifts in user activity towards the viewing of AI-recommended content. Also says Reels plays have more than doubled over the last year, with Reels sharing having more than doubled over the last 6 months.

Adds that Reels monetization still trails that of more established ad products. But says Reels is on track to be revenue-neutral by year's end.

5:05 PM ET: He adds Meta will be more proactive about cutting non-essential projects, but that a lot of its efficiency efforts will be related to core initiatives.

5:04 PM ET: Zuck asserts Meta's product trends were better in Q4 than what a lot of commentary suggested. Also reiterates 2023 will be a "year of efficiency" for his firm.

5:03 PM ET: Mark Zuckerberg is talking.

5:02 PM ET: The call is starting. Meta is up 18.3% AH heading into it.

4:55 PM ET: Meta's call should start in a few minutes (I'll be covering it). Here's the webcast link, for those looking to tune in.

4:50 PM ET: As the company apparently gets set to buy back more stock, Meta ended 2022 with $40.7B in cash/equivalents and $9.9B in debt.

4:47 PM ET: With higher capex and headcount weighing, free cash flow fell 58% Y/Y in Q4 to $5.29B. For the whole of 2022, FCF fell 52% to $18.44B.

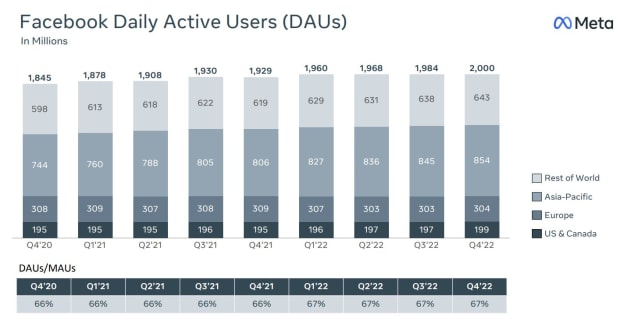

4:45 PM ET: Facebook/Messenger DAUs by region. Aside from Europe, which saw 1M increases in both periods, strong sequential growth was recorded in every region in Q4 2022 than was recorded in Q4 2021.

4:40 PM ET: Meta's ad impressions were up 23% Y/Y in Q4, an improvement from Q3's 17% growth. On the flip side, price per ad fell 22%, a greater decline than Q3's 18%.

The growth of Reels video viewing has been both a tailwind for ad impressions and (with the platform still in the early stages of monetization) a headwind for price per ad. Apple's user-tracking policy changes have also been a pricing headwind.

4:33 PM ET: Meta's Family of Apps segment posted revenue of $31.44B (-4%) and GAAP op. income of $10.68B (down from $15.89B a year ago, partly due to $3.76B worth of restructuring charges).

The Reality Labs segment posted revenue of $727M (-17%) and a $4.28B op. loss (up from $3.3B a year ago, partly due to $440M worth of charges).

Needless to say, Reality Labs' ongoing losses are a big reason markets have been eager to see signs of greater spending discipline.

4:28 PM ET: Revenue fell 4% Y/Y in Q4, as did ad revenue, with forex acting as a 6-point headwind to growth. With the dollar recently softening, Meta expects forex to be just a 2-point growth headwind in Q1.

4:23 PM ET: Meta is now up 18% AH. Its report is also giving a boost to some online ad and social media peers: Alphabet is up 3.6%, Pinterest is up 4.1% and Amazon is up 1.9%. Snap is up 1.5% after dropping 10.3% post-earnings today.

4:20 PM ET: Facebook/Messenger monthly active users totaled 2.96B (+2% Y/Y) and daily active users totaled 2B (+4%).

App family MAUs totaled 3.74B (+4%), and DAUs totaled 2.96B (+5%). A higher DAU/MAU ratio points to improving engagement.

4:16 PM ET: Worth noting: While EPS missed estimates due to restructuring charges, Q4 operating income totaled $10.6B excluding the charges. That's well above a $7.6B consensus, albeit below year-ago op. income of $12.6B.

4:13 PM ET: Shares are now up 14.9% AH to $175.98. They're at their highest levels since last August.

4:12 PM ET: $40B has been added to Meta's buyback authorization, on top of the $10.87B that was remaining at the end of Q4.

4:11 PM ET: Boosting EPS: $6.91B was spent on stock buybacks in Q4, up slightly from $6.55B in Q3. $27.93B was spent over the whole of 2022.

4:09 PM ET: Also, 2023 capex guidance has been lowered to $30B-$33B from $34B-$37B. This compares with 2022 capex of $32B.

4:08 PM ET: Meta guides for Q1 revenue of $26B-$28.5B vs. a $27.18B consensus.

Notably, 2023 GAAP cost/expense guidance has been lowered to $89B-$95B from $94B-$100B.

4:06 PM ET: Results are out. Q4 revenue of $32.17B beats a $31.55B consensus. GAAP EPS of $1.76 (includes $4.2B worth of restructuring charges) misses a $2.26 consensus.

Shares are up 11.9% AH.

4:00 PM ET: Meta's stock closed up 2.8%. The Q4 report should be out shortly.

3:58 PM ET: The Q1 guide will get close attention, as will any additional changes made to Meta's 2023 spending guidance. In November, Meta (in tandem with its layoff announcement) slightly cut its 2023 expense guidance to $94B-$100B from $96B-$101B.

3:55 PM ET: The FactSet consensus is for Meta to report revenue of $31.55B and EPS of $2.26 for its seasonally big fourth quarter.

3:53 PM ET: Hi, this is Eric Jhonsa. I'll be live-blogging Meta's earnings report and call.

.png?w=600)