Meta Platforms Inc. (NASDAQ:META) has decided to share the burden of its skyrocketing AI infrastructure costs by selling $2 billion in data center assets, as the company braces for capital expenditures that could exceed $100 billion in the coming years.

Meta Eyes Outside Capital For AI Infrastructure Push

In a quarterly filing disclosed Thursday, Meta said it approved a plan in June to sell certain data center assets, reclassifying $2.04 billion worth of land and construction-in-progress as "held-for-sale," reported Reuters.

These assets are expected to be contributed to a third party within 12 months as part of a co-development strategy for future data centers.

The move signals a shift in Meta's traditional approach of self-funding its infrastructure buildout. "We're exploring ways to work with financial partners to co-develop data centers," Meta CFO Susan Li said on the company's earnings call Wednesday.

While Meta still intends to internally finance a large portion of its investments, Li noted that select projects "could attract significant external financing" and offer flexibility if infrastructure requirements change.

See Also: Palo Alto Networks Stock Is Falling Today: What’s Going On?

Zuckerberg’s AI Supercluster Ambition Drives Spending

CEO Mark Zuckerberg has previously outlined his vision to build AI-focused data center "superclusters," describing one as covering "a significant part of the footprint of Manhattan." These clusters are designed to power advanced AI applications, including generative AI and superintelligence.

To support this vision, Meta raised the lower end of its 2025 capital expenditures forecast by $2 billion, bringing the range to between $66 billion and $72 billion.

Meta reported second-quarter revenue of $47.52 billion, beating analyst estimates of $44.58 billion, aided by AI-enhanced ad targeting.

Meta's total "held-for-sale" assets stood at $3.26 billion as of June 30, according to the filing.

Meta Joins Microsoft, Google In AI Arms Race

Meta's move mirrors a broader trend among tech giants adjusting their financing strategies to meet the demands of AI. Alphabet Inc. (NASDAQ:GOOG) (NASDAQ:GOOGL) has raised its 2025 capex outlook to roughly $85 billion, while Microsoft Corporation (NASDAQ:MSFT) plans to spend $30 billion in the current quarter, driven by Azure cloud demand.

Price Action: Meta shares have gained 25.16% year-to-date and are up 57.65% over the past 12 months, according to Benzinga Pro.

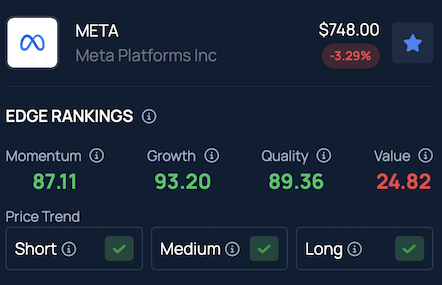

Benzinga's Edge Stock Rankings show that META continues to demonstrate strong upward momentum across short, medium and long-term periods. More detailed performance data is available here.

Read Next:

Photo Courtesy: Skorzewiak on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.